The Fate of Banks 50 Years After Nationalisation

Image Courtesy: Scroll.in

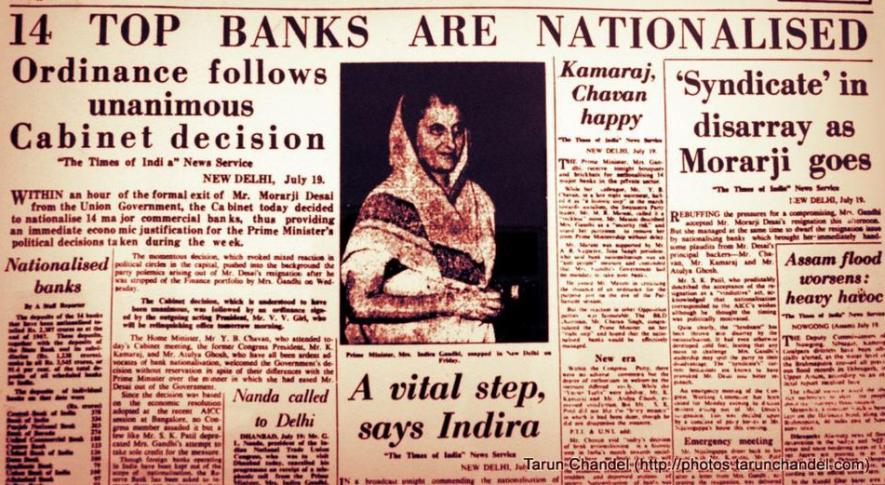

Fifty years ago, on July 19, 1969, as many as 14 large private banks had been nationalised. Ironically, the Golden Jubilee of that event, which had been a significant step in the process of building up a new financial architecture for the country, is being celebrated today by trade unions in the banking sector but not by the government of the day.

The argument that had been given for bank nationalisation had been simple: since credit represents command over capital, how this command is distributed across sectors, across social groups and across regions, determines the trajectory of social development. If the distribution of bank credit has such powerful social consequences, then this distribution must be socially controlled, for which the banks must be owned by the State on behalf of society.

In fact, bank nationalisation had been preceded by a brief period when there was an attempt at social control without State ownership; its failure prompted nationalisation as the only feasible means of effecting social control.

To be sure, notwithstanding all the promises, bank nationalisation did not actually mean a democratisation of the access to credit; how could it in an economy pursuing the capitalist path of development? What it did, however, apart from bringing about a massive expansion of banking facilities across the country, was to broaden the base of capitalist development, by making loans available to the agricultural sector that had been systematically denied institutional credit till then; and this made possible the so-called Green Revolution. It also made finance subservient to the needs of production, rather than being employed for speculation and corporate takeover strategies as earlier.

From the very beginning, however, bank nationalisation had faced stiff opposition from big capital, since it had taken away control over the financial sector from its hands. This opposition intensified immensely after “economic liberalisation” was introduced. International finance capital, which now became a dominant force and with which the domestic corporate-financial oligarchy became integrated, was keen to have the entire world as its arena of unhindered operation; the idea of a major country like India having a financial structure that did not just elude its control but was actually largely State-owned, was anathema for it.

The insulation of the Indian financial system from global finance, which State ownership entailed, was resoundingly demonstrated when the financial crisis of 2008 struck. For the entire Indian banking system, foreign assets accounted for only 7% of total assets, and these too were mainly held by private sector banks, like the ICICI bank. The nationalised banks held hardly any foreign assets, let alone toxic assets, because of which the financial crisis left them completely untouched. But this very insulation was what irked international finance capital.

The US administration put enormous pressure on India to privatise the banking system, and at the very least to privatise the State Bank of India (SBI) as a “signal” of its intent. Lawrence Summers and Timothy Geithner, US treasury secretaries, respectively, under presidents Bill Clinton and Barack Obama, would visit India and insist upon the privatisation of SBI. The Indian government, however, could not muster enough courage to do so, since bank nationalisation had caught the imagination of the people.

Then a new offensive was launched, namely that nationalised banks were not profitable enough, that they compared poorly in terms of profitability with private sector banks. This was a complete red herring: banks had been nationalised to serve a social purpose, not for making maximum profits. The criterion for judging them was how far they had served this social purpose, not how much profits they made; and yet this argument was put forward, quite shamelessly, by individuals and “slot machine” committees (which give the government the report it wants) to discredit nationalised banks and gradually prepare the public for their eventual privatisation.

Finally, there was the argument about nationalised banks being saddled with a larger proportion of “non-performing assets” which, it was claimed, indicated their “irresponsible” lending practices. As a matter of fact, nationalised banks’ NPAs arise not because of their “irresponsibility” but because of changed government policies, in the context of which playing the role they are called upon to play, saddles them with NPAs (non-performing assets or bad loans). There are three obvious changes in government policy that has meant that nationalised banks have been left holding the can.

The first relates to the fiscal squeeze that the government has brought upon itself, by limiting the size of the fiscal deficit through the Fiscal Responsibility and Budget Management Act on the one hand, and by handing out large tax concessions to the private corporate sector, on the other. This has meant, in effect, that large infrastructure projects, which require lumpy investment, which have long gestation periods and, therefore, involve high risks, are now left to be implemented by the private corporate sector, rather than the public sector as earlier.

The second relates to the end of specialised financial institutions that had earlier provided long-term loans for such projects. Under the earlier regime, banks gave largely short-term credit while a whole range of financial institutions, like the IDBI, IFCI, SFCs, ICICI, were specially set up to provide medium and long-term loans for investment. These specialised financial institutions have now dwindled in significance; some of them like the IDBI and ICICI have even converted themselves into banks.

As a result, banks now have to provide not just short-term credit but also medium and long-term loans. Since banks depend upon deposits for their resources, which can be withdrawn at any time, they are in effect “borrowing short to lend long”, a sure-shot recipe for financial stress, especially when it is remembered that many of the projects in the infrastructure sector for which they lend are highly risky projects.

Nationalised banks could just walk away from financing such projects, as many private banks do; but being nationalised banks, they feel obliged to pay heed to government directives to finance such projects. And, of course, since these projects are now being undertaken by the private sector, the scope for “willful default”, where the capitalists involved simply walk away with the funds instead of putting them into the project, is great, which exposes banks to further stress. Ironically the same government which directs banks to give loans to these private projects, then makes a song and dance about the NPAs, and wants to privatise these banks because of such NPAs.

The third change in policy relates to the great reduction that has taken place in the profitability of the agricultural sector. Even though the definition of “priority sector” within which agriculture falls, has been widened to a ludicrous extent, nationalised banks still give loans for agriculture, while foreign banks and private Indian banks have, by and large, withdrawn from giving such loans. Many private banks give loans to middlemen who then use these very funds to give loans to peasants, becoming in effect a new class of private moneylenders. In fact, the ICICI Bank flatly refused to give loans directly to peasants, preferring instead to deal with them through middlemen called “facilitators”.

The fact that loans to agriculture have to be periodically written off, is not because peasants have developed “bad habits”, as many bourgeois commentators pontificating against loan write-offs allege, but because agriculture has ceased to be a profitable activity. The stressed assets of nationalised banks arising from this source, therefore, are attributable not to any “irresponsibility” on their part, but precisely to their “responsibility” in giving loans to agriculture in a context where government policy has undermined agricultural profitability.

To say all this is not to paint nationalised banks in rosy colours; it is just to underscore the fact that government policy has moved away from what it had been when banks were nationalised. Indeed, the phenomenon of nationalised banks sits somewhat uncomfortably in a world dominated by international finance capital. The travails of nationalised banks arise for this reason, namely that the ethos of neoliberalism undermines their functioning. But reversing nationalisation would simply carry forward the dominance of international finance capital. It would further undermine national sovereignty, and further accentuate the process of primitive accumulation of capital at the expense of petty production and peasant agriculture.

In all the discussion about the fate of nationalised banks, however, one important fact has been totally ignored, namely that these banks are not government-owned but State-owned. The government, as merely the executive wing of the State, cannot decide entirely on its own what should be the fate of these banks. But this is precisely what it has tended to do, for instance, in allowing private equity into these banks and then raising the share of such equity. An announcement is simply made in the budget about disinvestment and when the budget gets passed this also gets ipso facto ratified. This must stop.

When banks were nationalised in 1969, not only did Parliament approve the decision, but even the judiciary had to give its assent, since nationalisation was challenged in the Supreme Court.

Nationalisation, in short, had the approval of all the organs of the State. It is necessary to insist that any interference with the ownership structure of the nationalised banks, including reducing equity even in the range above 51%, should have specific parliamentary sanction.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.