FDI in Coal: Look Who’s Coming to the Party

With the Narendra Modi government announcing that 100% foreign direct investment (FDI) will be allowed into the country’s coal mining sector, it is very likely that world’s biggest mining conglomerates will eagerly step in. India has an estimated 319 billion tonnes of cumulative coal reserves, mainly in Jharkhand, West Bengal, Chhattisgarh, Odisha and Madhya Pradesh, with more in Telangana, Andhra Pradesh, Maharashtra, and smaller deposits in several other states, including the North-East.

At present, about 92% of the mining is done by the public sector behemoth Coal India Limited (CIL) and the smaller public sector undertaking, Singareni Collieries Company Limited (SCCL). In 2018-19, India produced about 730.54 million tonnes (MT), according to provisional figures of the coal ministry, of which 606.89 MT was produced by CIL and about 64.4 MT by SCCL.

On the face of it, there appears to be no need for the government to invite foreign companies to exploit India’s coal deposits. The public sector undertakings are doing well, their production is growing, they have paid almost Rs.1.27 lakh crore as dividends and reserves to the government in the past decade, in addition to various taxes and royalties amounting to Rs.44,000 crore last year. They are also a source of huge employment, with some five lakh employees working in CIL itself, although just about 2.7 lakh of them are regular employees (the rest are on various types of contract or casual workers). In fact, CIL is counted amongst the world’s top 10 coal mining companies.

So, it seems strange that foreign capital – that means, foreign companies – are being invited to a invest in Indian coal mines. Why this is so has been written about earlier in Newsclick, but here, let’s take a look at who all are likely to join this party.

The Big Mining Companies

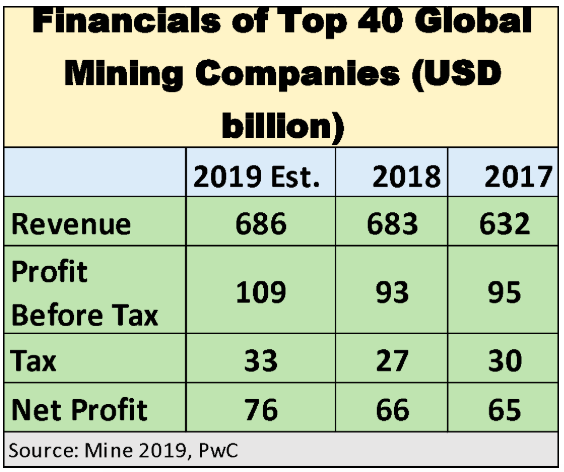

According to a recently published report of the global auditing company PricewaterhouseCoopers (PwC), the revenue of the world’s top 40 mining companies was a staggering $683 billion in 2018 and was likely to increase to $686 billion in 2019. Their combined profit before tax was $93 billion in 2018 and was likely to increase to $109 billion in the current year. That’s a jump of nearly 13%! Their net profit (after taxes and all other deductions) was $66 billion in 2018, likely to increase to $76 billion in 2019 – an increase of a phenomenal 15%.

These mining conglomerates are part of the larger set of major transnational companies (TNCs) that are today dominating the world’s economy. As a Tufts University/UNCTAD study of 2015 showed, the top 2,000 TNCs held assets that were 229% of world GDP, while their net sales made up nearly half (48.8%) of world GDP (gross domestic product) . The mining companies – or more properly, the extractive industries’ companies – made up about 5.5% of these 2,000 top TNCs. The study revealed that profits of extractive TNCs rose from 9.3% in 1996 to 13.3% in 2015.

What about coal mining specifically? As the table below, drawn from Statista, shows, five of the top 10 coal mining giants in the world are Chinese and one is Indian – Coal India. The Modi government is unlikely to invite the Chinese to exploit Indian coal. So, the potential candidates are the top three, or number five.

Note that Coal India is already among the top 10, yet the balance is being shifted elsewhere – out of India, towards one of the British or Australian companies.

How Do Mining TNCs Make Profit and Where Does It Go?

These giant companies are not coming to India to do charity work. They want to make profits -- more and more. Various studies, summarised here, have shown that these companies ensure large profits by

-

Intentionally establishing operations in countries where it is possible to exploit low-wage workers.

-

Investing in locations where it is possible to take advantage of regressive tax codes.

-

Ensuring business-friendly production-sharing agreements with local governments.

Nate Singham, writing in Common Dreams (from where the above is drawn) quotes empirical studies done by the Tricontinental Institute of Social Research (TISR) in Zambia to show that Konkola Copper Mines (KCM) corporation, a subsidiary of Vedanta, gives an average monthly wage of $172 to local mine workers whereas the statutory monthly minimum wage in Zambia is $176.4. TISR reviewed wage agreements to supplement their empirical surveys and found that the owner of Vedanta, Anil Agarwal, earned 584 times of what the temporary contract worker was earning in copper mines.

The PwC report quoted above shows that the top 40 mining companies spent, on an average, just 22% of the value generated by their mining business went to their employees while 25% went to shareholders. This shows that the mining operations of these TNCs are highly exploitative of labour. It is this key factor that will draw Big Coal to India because wages here are quite low, especially among contract workers.

The tax part is also important. The PwC report shows that the top 40 mining companies paid $27 billion as taxes of all kinds in 2018 over revenues of $683 billion. That’s an effective tax rate of just 3.95%! With these kind of tax rates, it is small wonder that the mining companies are raking in profits with both hands.

It might be argued that India will not have such low tax rates as prevalent in very poor and weak African countries. That is possible, but here we need to note the immense power these TNCs wield over the political rulers of the countries they operate in. Once they get their teeth into mining operations in a country – as Modi is inviting them to do in India – the full force of their deep pockets, their political clout with governments in the UK, the US or Australia, their connections with multilateral finance agencies, such as the International Monetary Fund and World Bank, and with financial institutions, like banks, will become increasingly evident in India too. They will ensure that by hook or by crook, their profit margins are not affected by anything, especially taxation.

So, as New India gets ready to welcome these ruthless giants to start operating fully in the country’s natural resources sector, dark clouds are amassing for lakhs of workers who will see retrenchments, changes in service conditions and curtailment of benefits. More than that, the country will be sucked dry by these companies. Keeping this in mind, the five lakh coal workers who are going on a protest strike on September 24 against this disastrous decision, deserve a salute – they are not just fighting for themselves; they are fighting for the country’s sovereignty.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.