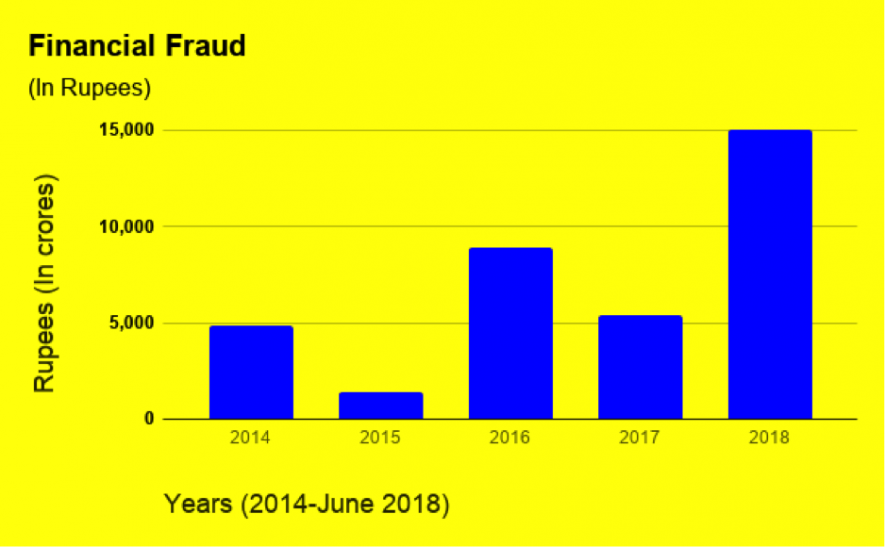

Bank Fraud Cases Between 2014-2018: Loss Of Over Rs. 34,000 Crore

On the 20th of July,a parliamentary reply by the Minister Of State for Finance, Shiv Pratap Shukla revealed shocking details about the losses in bank fraud cases in the country from 2014 onwards.

The list of offenders provided on the floor of the house revealed 28 cases involving higher officials of the public sector and private sector banks in financial frauds. However, it should be noted that the parliamentary reply only pertains to guys who have fled the country. It also includes loans which involve amounts larger than one lakh rupees.

In 2018 alone,the losses calculated were close to a whopping Rs. 15,000 crore. Trials in none of the listed cases stand complete with many still under investigation.

A closer yearly understanding of the losses incurred due tothe financial frauds show that in 2014 alone frauds worth overRs.4,800 crore were committed. The offenders’list mentions absconding industrialist Vinay Mittal in 6 cases. The collective figures from 2015 and 2016 show losses worth more than Rs. 9,000 crore, a major chunk of which comes from the case of Vijay Mallya.

Mallya is accused of siphoning off a big chunk ofthe Rs.6,027-crore loan he took from a consortium of 17 banks for his now-defunct Kingfisher Airlines,to shell companies in seven countries, including the US, UK, France,and Ireland. While State Bank of India (SBI) had a maximum exposure of Rs.1,600 crore, other public-sector banks that gave loans to Kingfisher are Punjab National Bank with an exposure of Rs.800 crore, Bank of India (Rs.650 crore), Bank of Baroda (Rs.550 crore), Central Bank of India (Rs.410 crore), UCO Bank (Rs.320 crore), Corporation Bank (Rs.310 crore), State Bank of Mysore (Rs.150 crore), Indian Overseas Bank (Rs.140 crore).Mallya is currently living in London, without any qualms.

Following these cases which showed gross violations, the Lok Sabha had cleared the Fugitive Economic Offenders ordinance in the monsoon session of the parliament in 2018. The bill was initially approved in April by the cabinet in hopes of empowering authorities to attach and confiscate properties and assets of economic offenders such as loan offenders who end up fleeing the country.

However, the existing criminal mechanism did not prove to be a strong deterrent when the PNB financial fraud came to the fore which led to diamantaire Nirav Modi and Mehul Choksi fleeing the country after defrauding the Punjab National Bank. In his latest attempt to escape extradition, despite a red corner notice being issued, Nirav Modi had appealed to the Singapore government for a residence permit this week which was then quashed.

The PNB scam, which reportedly began in 2011, was detected only in January this year, after which PNB officials reported it to the probe agencies.

A special court under theFugitive Economic Offenders Act in Mumbai last week had issued public summons to Nirav Modi's sister and brother for questioning in the PNB bank fraud case. The court also asked them to appear before it on September 25.

In another reply given on the floor of the house, Minister Of State for External Affairs, Gen. V.K.Singh informed the parliament that as many as 28 Indians involved in financial irregularities with banks and other offenses are currently living abroad. He offered assurances stating the Central Bureau of Investigation (CBI) and the Enforcement Directorate (ED) are pursuing legal actions against these fugitive Indians, and efforts are on to bring them back. However, the existing mechanisms have proven to be futile in the face of the severity of the problem. The absence of offenders and the government’s inability to nab them and extradite them from foreign countries has led to hindrances for the probing agencies. As of March 2018, the Indian government has signed extradition treaties with over 48countries.

For deterring economic offenders, the government is hoping to implement a speedy confiscation of the proceeds of the crime in India and abroad to force fugitives to return to India and to submit to the jurisdiction of the courts here. However. the measures on the ground suggest otherwise, due to the administrative loopholes and the lack of political will, fugitive offenders have repeatedly been able to evade government probes because of the weak extradition initiatives taken by the government. The recent figures provide a damning insight into the nature of fraud committed by the corporate giants who were given a freeway to leave the country.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.