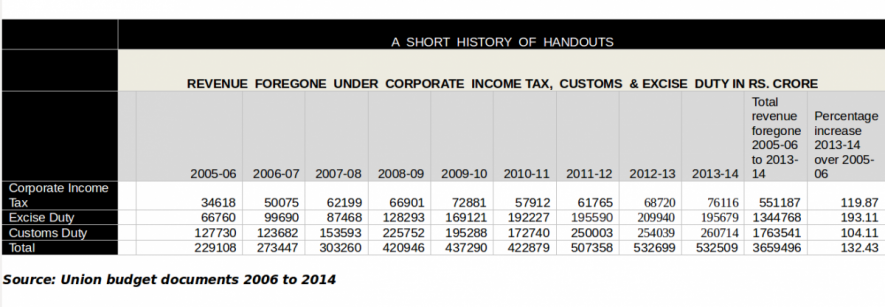

Corporate karza maafi at Rs. 36.5 trillion

It was business as usual in 2013-14. Business with a capital B. This year’s budget document says we gave away another Rs. 5.32 lakh crores to the corporate needy and the under-nourished rich in that year. Well, it says Rs. 5.72 lakh crores but I’m leaving out the Rs. 40 K crore foregone on personal income tax since that write-off benefits a wider group of people. The rest is mostly about a feeding frenzy at the corporate trough. And, of course, that of other well-off people. The major write-offs come in direct corporate income tax, customs and excise duties.

If you think sparing the super-rich taxes and duties worth Rs. 5.32 lakh crores is a trifle excessive, think again. The amount we’ve written off for them since 2005-06 under the very same heads is well over Rs. 36.5 lakh crore. (A sixth of that in just corporate income tax). That’s Rs. 36500000000000 wiped off for the big boys in nine years. .

Revenues forgone in budget documents from 2006 to 2014Revenues forgone in last decade

With Rs. 36.5 trillion – for that is what it is – you could:

Fund the Mahatma Gandhi National Rural Employment Guarantee Scheme for around 105 years, at present levels. That’s more than any human being could expect to live. And a hell of a lot more than any agricultural labourer would. You could, in fact, run the MNREGS on that sum, across the working lives of two generations of such labourers. The current allocation for the scheme is around Rs. 34,000 crore.

Fund the Public Distribution System for 31 years. (current allocation Rs. 1,15,000 crores).

By the way, if these revenues had been realized, around 30 per cent of their value would have devolved to the states. So their fiscal health is affected by the Centre’s massive corporate karza maafi.

Even just the amount foregone in 2013-14 can fund the rural jobs scheme for three decades. Or the PDS for four and a half years. It is also over four times the ‘losses’ of the Oil Marketing Companies by way of so-called ‘under-recoveries’ in 2012-13.

Revenue Foregone Visualisation (Please click here to see the values)

Look at some of the exemptions under customs duty. There’s a neat Rs. 48,635 crore written off on ‘Diamonds and Gold.’ Hardly aam aadmi or aam aurat items. And more than what we spend on rural jobs. Fact: concessions on diamonds and gold over the past 36 months total Rs. 1.6 trillion. (A lot more than we’ll spend on the PDS in the coming year). In the latest figures, it accounts for 16 per cent of the total revenue foregone.

The break-up of the budget’s revenue foregone figure of Rs. 5.72 lakh crore for 2013-14 is interesting. Of this, Rs. 76,116 crore was written off on just direct corporate income tax. More than twice that sum (Rs.1,95,679 crore) was foregone on Excise Duty. And well over three times the sum was sacrificed in Customs Duty (Rs. 2,60,714 crores).

This, of course, has been going on for many years in the ‘reforms’ period. But the budget only started carrying the data on revenue foregone around 2006-07. Hence the Rs. 36.5 trillion write-off figure. It would be higher had we the data for earlier years. (All of this, by the way, falls within the UPA period). And the trend in this direction only grows. As the budget document itself recognizes, “the total revenue foregone from central taxes is showing an upward trend. “

It sure is. The amount written off in 2013-14 shows an increase of 132 per cent compared to the same concessions in 2005-06.

Corporate karza maafi is a growth industry, and an efficient one.

Courtesy: psainath.org,

Disclaimer: The views expressed here are the author's personal views, and do not necessarily represent the views of Newsclick

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.