Budget 2020: With Eyes Wide Shut, Modi Govt Gropes for Solutions

For the first time in two decades, corporate and income tax collections are expected to fall in 2019-20. This is an indication of the gigantic mess created by the Narendra Modi government with its dogmatic commitment to reduce taxes on corporates and squeeze its own expenditure to supposedly boost the flagging economy. As February 1 approaches, when the new Budget for 2020-21 will be presented, the government is running around seeking solutions – but nobody is answering.

The target for direct tax collections in the current financial year, 2019-20, was about Rs.13.4 lakh crore, up by about 12% over the previous financial year’s revised estimate. According to latest reports quoting government sources, the actual direct tax collection till January 23 has been only about Rs. 7.3 lakh crore. Various experts are predicting that there is likely to be a shortfall of up to Rs.2 lakh crore finally by the time the financial year ends.

Why Falling Tax Revenue?

Apart from the economic slowdown caused by dipping demand and other factors, direct tax revenue has also fallen because of the bizarre decision to cut corporate taxes. It has been estimated that the cut announced in September last year would mean a loss of Rs.1.45 lakh crore to the public exchequer.

Base corporate tax for existing companies was cut from 30% to 22%, and from 25% to 15% for new manufacturing firms – the largest cut in 28 years. This was part of the whole approach of the government that helping corporates, the “wealth creators”, as Modi called them, will lead to more investment by them and thereby kickstart the economy. In line with this, the government had also cut capital gains tax on portfolio investors, leading to loss of Rs.11,400 crore. Various other measures to help specific sectors have also contributed to draining resources.

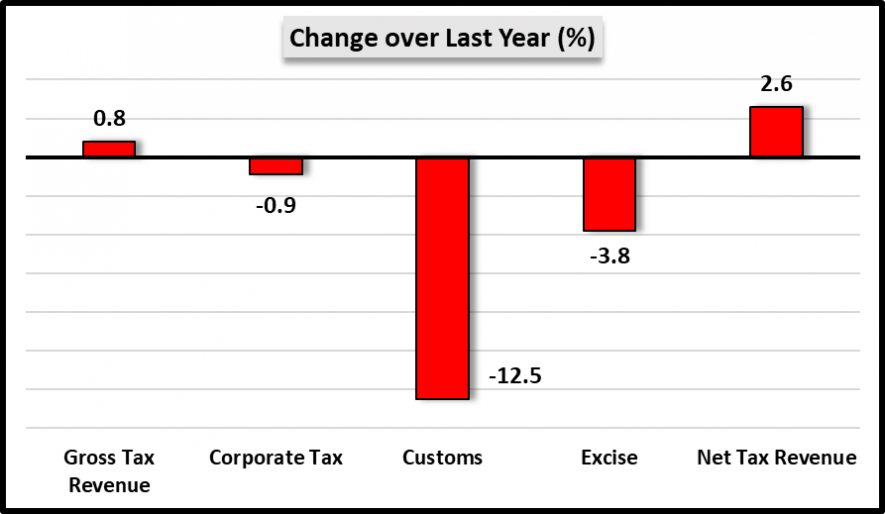

Among indirect taxes, customs duty collections dropped year on year by 12.5% and excise duty collections by 3.8% till November, as per officially released data from Controller General of Accounts. (CGA). Goods and Services Tax collections increased but only by a measly 3.9%.

Theoretically, if the government has to meet its target of net tax collections in this financial year, it will have to collect an impossible Rs.9 lakh crore in the past four months – that is, about 54% of the total taxes. Clearly, this is impossible. Hence, the projected shortfall.

So, the government’s own mismanagement stretching over the years of its rule, has led to this situation which is dire to say the least. Had it not cut taxes on corporates and stock market sharks, and boosted its own spending in more worthwhile ways, the economy may not have been in this tragic condition. A direct effect of this has been rising unemployment and dipping consumer spending, which are further aggravating the crisis. And, obviously, causing immense distress to people.

Spending Squeeze

Further evidence of the short-sighted policies of the government comes from latest spending data of ministries. CGA, which releases monthly data after a two-month lag, has released the latest, which is November. After that, there is no more data because the Union Budget will be announced.

The November 2019 data shows this chilling picture: Ministry of Agriculture had spent only 49% of its allocation, Ministry of HRD had spent 60.7%, Railways 60.2%, Ministry of Women & Child Development 59.9% and Department of Drinking Water & Sanitation 59.5%. This shows that some of the key ministries that run programmes for benefitting a large number of deprived sections are being very tight fisted. There is an austerity drive in progress, kept under wraps but evident on the ground.

In addition, the government has told all its wings that their spending should be limited to 25% of the Budget estimate in the last quarter of the financial year. Earlier, this limit was 33%. For the last month, spending limit is now 10% as opposed to the earlier 15%.

This means that many ministries and departments will not be able to spend a hefty chunk of their allocation. The die is already cast for them. Details of schemes and programmes are not available but it is certain that most of them are getting squeezed.

As a recent report indicates, there can be another effect of funding squeeze: needs will not be met by limited funds, even if they are in line with allocation. The example is of the rural jobs scheme (MGNREGA) where almost all funds have been used up by this month and a big question mark hangs over work for the remaining period. This is in a period when demand for MGNREGA work is rising very rapidly due to lack of jobs.

All this is, of course, for the current year. How Modi is going to handle the coming year, which will be reflected in the upcoming Union Budget, is unclear. But, one thing is almost certain – things will only get worse if the government persists with the present policies.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.