Questioning the Death of Coal–II: COVID Blackhole and Renewable Energy Future

Representational Image

This is the second of a five-part series that examines the global and Indian commitment to transitioning from fossil fuels to clean energy, on why coal is here to stay in India and how replacing fossil fuels with renewables, which are far from clean, will lead to an equally sinister extractive disaster.

Reduced factory emissions and those from power stations and even from the grounded airline industry have given people a taste of clean air. The lockdown has taken out the equivalent of almost 1.5 billion tonnes of carbon dioxide in China and could curb global emissions from air travel by 11% to 19%, says a March 11, 2020 report by Bloomberg Intelligence. There is thus immense wishful thinking around renewable energy, as the International Energy Agency (IEA) position confirms.

There is realism, too, says Heymi Bahar, senior IEA analyst, Renewable Energy Markets and Policy Commentary. He is categorical in his assessment of April 4, 2020, that "as the world deals with an unprecedented global health crisis, the economic shock waves have rippled through the renewable energy sector, threatening to derail its progress".

Arguably, government policies will determine the extent of the derailment, so signals between February and May 2020 merit serious consideration. The longer the COVID-driven confinement, the worse will be the future of renewable energy. It began with supply chain disruptions that upset the renewable energy momentum where it had picked up and slowed things further in countries like India, with delays in project completion.

Incentivising Renewable Energy

The immediate concern is that the incentives for investing in renewable energy projects are set to expire by end 2020. In both China and the US, developers have to connect wind and solar PV (photovoltaic) projects by the end of December to qualify for expiring incentives.

In the European Union, 2020 is a milestone year for member states to reach binding renewable energy targets. How countries address this question, will hold the key to renewable energy progress, which has thus far depended on favourable policies and incentives.

The lockdown in China took care of some 70% of the global supply of solar panels and left the sector floundering from January 2020. Another 10-15% of supplies from Chinese companies operating in Southeast Asia were also hit, with matters worsening over the next couple of months and affecting plants in Southeast Asia, India and the US. China is yet to ramp up production to original levels.

The wind energy supply chain is not as dependent on China, with Europe a major hub for wind turbines. Even so, operations were affected by the Chinese lockdown and got severely hit with the virus overwhelming Spain and Italy. Indian wind turbine and solar PV component manufacturers downed shutters till mid-April with force majeure notices from suppliers warning developers about possible delivery delays. Such developments do not augur well for timely completion of renewable energy projects.

Matters are not helped with workers unable to get to work and social distancing in place. As Heymi Bahar points out: “Renewable projects require multiple meetings to take place in person at both the government and community levels. Various stages of a project’s development, including securing permits and acquiring land, requires significant human interaction. With multiple government offices and energy agencies shut down around the globe, permitting processes will be delayed unless a coordinated online system that spans multiple authorities is made available”.

Community Connect

Renewable energy is not a run of the mill business. It needs a community connect with regular engagements with local communities to usher in a project. Social distancing affects this critical engagement and with key constituents not on board, there will be delays, both administrative and social, which will “have a direct impact on projects that are due to be commissioned in 2020 or 2021”.

In 2019, a fifth of the renewable energy capacity was commissioned by individuals and small-to-medium-sized enterprises installing solar PV panels on their roofs or business sites. These operations have little staying capacity or strength of tide over the COVID-injected delays. The distributed solar PV sector accounted for upward of 40% of the global solar PV deployment in 2019 and found costs at manageable levels.

That no longer holds good, margins are under severe pressure and investments have turned risky because distributed solar PV has got stalled under lockdown conditions. Ordinary households cannot afford to invest in solar power under the prevailing circumstances. Clearly then, whatever the level of incentivisation, distributed solar PV will suffer a setback.

Even the wind energy sector has run into headwinds with just around 10 GW (giga watt) of wind equipment manufacturing capacity in India. Imports account for about 85% of India’s solar cells and modules requirement. In an effort to incentivise domestic manufacturing, New Delhi has announced provisions to enable levy of basic customs duty on import of solar cells and modules.

Even so, energy research and consultancy company, Wood Mackenzie, says that India is likely to see over 3GW of solar and wind projects delayed under lockdown conditions, as it downgrades year 2020 solar PV outlook by 24.8% because the industry is dependent on importing modules from China. In total, it expects to see solar PV build out reduced by 2.9GW to 8.9GW.

Wood Mackenzie has also held supply and labour disruptions potentially responsible for delays vis-à-vis 400 megawatts (MW) of 2020’s scheduled 3GW wind build into 2021, equating to a downgrade of 11% for 2020. Overall, it projects a 21.6% downgrade to this year’s build out.

Wood Mackenzie principal analyst Robert Liew said: “The timing of the lockdown is unfortunate as Q1 is typically one of the busiest periods for wind project installations” and the current supply and labour disruptions “will have an outsized negative impact on 2020 installations”.

Rishab Shrestha, senior analyst with Wood Mackenzie, said Q1 is expected to be strongly impacted with a potential 60% year-on-year quarterly downgrade that would mean a 1.2 GW fall from about 3 GW in Q1 2019 and there is little clarity on how things pan out in Q2. Wood Mackenzie full year downgrade, at 2.9 GW, is a 24.8% reduction resulting in a revised 2020 outlook of 8.9 GW of solar PV installations.

Matters are not helped by Gujarat, the emerging hub of renewable energy investments, being amongst the badly affected states. Wood Mackenzie points out, Gujarat delivered 58% or 1.4 GW of new added wind capacity in India, in 2019 and unfortunately, is one of the top10 worst hit states in terms of the coronavirus infections.

On the solar front, Karnataka (2 GW), Tamil Nadu (1.6 GW) and Rajasthan (1.7 GW) were the top three states accounting for 55% of solar PV installations in 2019. These are among the top 10 worst COVID-hit states.

Even so, the optimistic Institute of Energy Economics and Financial Analysis, which has been backing the renewable story, insists that given the cost competitiveness of the sector in India, there could be no reason why debt or equity capital providers would “fund a high emission, highly polluting new coal-fired power plant at double the cost of deflationary renewables?”

With the government’s latest commercialisation of coal, there are reasons aplenty.

Promising Signals

Globally, the US and Europe may have the resources to back renewable energy with renewed vigour and there are some promising examples.

- The UK allotted over £1 billion ($1.23 billion) toward improving access to EV (electric vehicle) charging infrastructure (£500 million) and the support of EV purchases (£532 million).

- In the US, 11 states have this year made use of Volkswagen settlement funds to invest in fleet electrification and charging-behaviour optimisation.

- In January 2020, the New York Public Service Commission authorised the allocation of $454 million for heat pump installations across the territories of the six electric investor-owned utilities in the state through 2025.

- On the West Coast, the California Public Utilities Commission proposes to spend $200 million on two residential-focused building decarbonisation pilots.

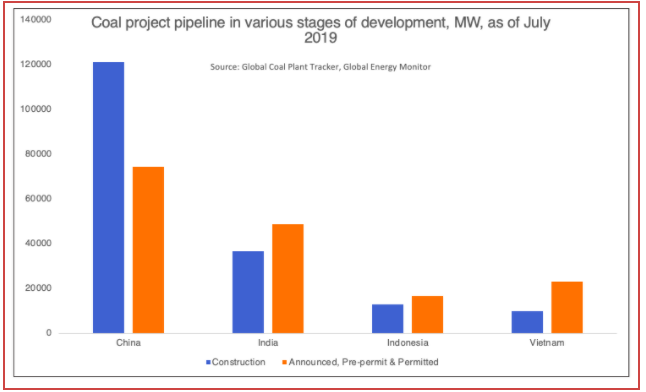

Will all this add up to giving renewables the real leg-up that it needs? On the face of it, the Asian and the Western scenarios are totally different. If there is some hope in the West, there is little in Asia. Andrew Affleck, managing partner of Armstrong Asset Management, owner of a Southeast Asia clean energy fund, says: “With renewables’ financing constrained post-pandemic, Southeast Asian policymakers may ignore environmental impacts and buckle to the lure of Chinese build and finance coal power plants”.

Not just is the investment required to transition to a sustainable economy falling, demand for renewables is lower, too, in the short term, with lower fossil fuel prices compounding the short-term problem. While there is resilience in the renewables story, the industry “is faced with highly competitive wholesale prices in a market that is not going to need a lot of new capacity to be able to keep up with demand growth”, says Wood Mackenzie.

An even more convincing argument comes from an MIT study on the Future of Coal that underscores why coal will certainly continue to “play a major role in the world’s energy future”.

·First, it is the lowest-cost fossil source for base-load electricity generation, even taking account of the fact that the capital cost of a supercritical pulverised coal combustion plant (SCPC) is about twice that of a natural gas combined cycle (NGCC) unit.

·Second, in contrast to oil and natural gas, coal resources are widely distributed around the world.

It is possibly this easy access and simple technology that makes coal attractive. The dirt does not matter.

(To be continued)

The writer is a freelance journalist who has been writing on coal from the 1980s. The views are personal.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.