Modi Government’s Economic Stimulus: Only 10% from Government Funds, Only 4% in People’s Hands

Representational image. | Image Courtesy: New Indian Express

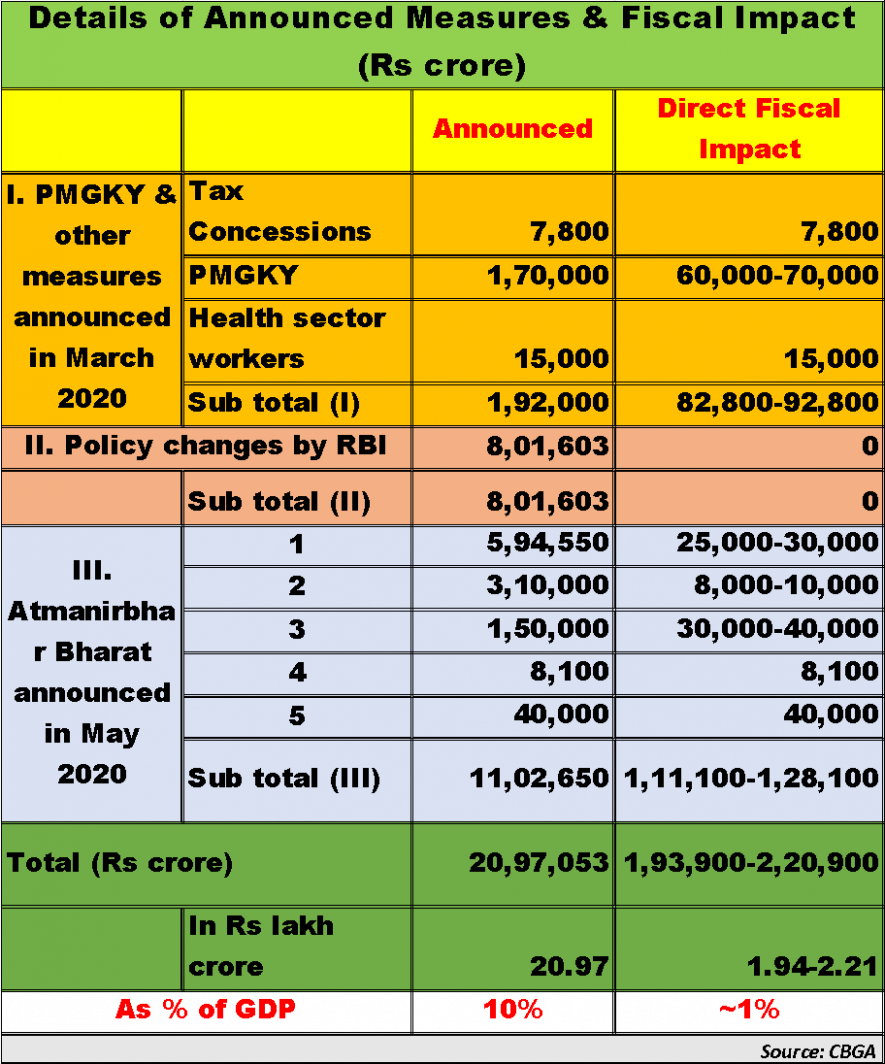

After the lockdown began on March 24, the Modi government made a series of announcements that were spun out as relief and welfare measures for the people facing immense hardship due to the pandemic and the consequent lockdown. The total amount of these packages was Rs 20.97 lakh crore, which was declared as a historic economic stimulus amounting to about 10% of the GDP.

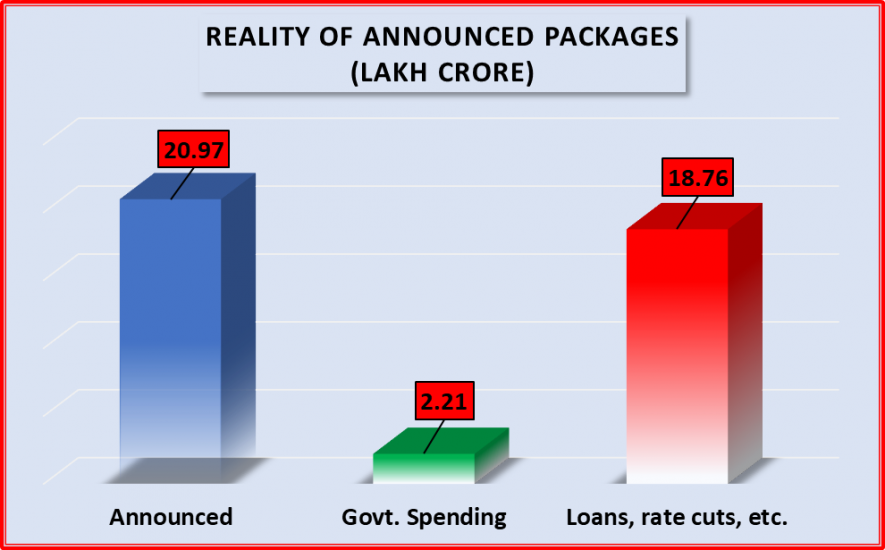

However, a detailed study done by Delhi-based think tank Centre for Budget & Governance Accountability (CBGA) shows that only about 10% of the package has any fiscal impact, that is, comes from government funds. The rest of it is all loans to be given out by banks, and various rate cuts and other monetary policy steps to be taken by the Reserve Bank. So, the government's own funds spent in this package amount to just 1% of the GDP.

To put it another way, only about Rs 2.21 lakh crore (or 10% of the total funds) will have a fiscal impact while the remaining Rs 18.76 lakh crore will all be banking system features. [See chart below]

CBGA study refers to various analyses by experts to arrive at this sombre conclusion. It also reveals an even more distressing feature: the total amount of funds that would directly flow to the people are estimated at just Rs 76,500 crore. That’s a mere 0.38% of the GDP and just 4% of the total package. Included in this direct flows are free food items through the public distribution system, direct cash transfer of Rs 500 per month to Jan Dhan account holders, etc.

Many economists have stressed that it is this direct flow of funds into people’s hands that was needed at a large scale to not only alleviate the distress but to boost the economy. That’s because, unless demand is created by putting buying power in people’s hands, no amount of loans to industry are going to help in increasing production or employment. Why should industry owners – big or small – restart or increase production if there is nobody to buy their products?

However, the Modi government has continued to peddle this discredited approach, and these packages reveal its myopic policy in spades.

Asked about how the fiscal impact of such policy measures like the availability of Rs 3 lakh crore worth of collateral free loans to MSME sector was made by CBGA, Subrat Das, its executive director told NewsClick that the only fiscal impact arises in such cases if and when the creditor defaults on loan repayment.

“This is incremental lending by banks and financial institutions, of up to Rs 3 lakh crore in total. These loans will have a four-year tenure for repayment along with a moratorium of 12 months. However, the fiscal impact of this intervention of collateral-free loans will be lesser (than the total amount of incremental loans, Rs 3 lakh crore), as it will depend on the amount by which enterprises default on the repayment of the loans. Also, since the tenure is of four years, the fiscal impact would come only later; it does not seem to have an immediate impact on the government's fiscal arithmetic for FY 2020-21”, he explained.

According to estimates made on the basis of previous records of default rates, CBGA has assessed the total fiscal impact of the Rs 20.97 lakh crore package as between Rs 1.94 to Rs 2.21 lakh crore. That works out to about 1% of the GDP and a mere 10% of the total package. [See table below for details]

As can be seen, all the Reserve Bank of India-initiated measures, amounting to just over Rs 8 lakh, crore are characterised by zero fiscal impact. On the other hand, measures like free provision of 5 kg food grains to migrant workers (costing about Rs 3500 crore) or Rs 40,000 crore fresh allocation to the rural job guarantee scheme (MGNREGS) are tagged as fiscal provisions because the money will flow from government accounts.

A global study carried out by a group of researchers has collated the economic stimulus packages given by governments of 168 countries. The updated dataset (available on the website) puts India’s fiscal stimulus at about 3.8% of GDP. But this increased share is due to a persisting grey zone between what are monetary measures (like easy loans) and fiscal measures and also inclusion of some State government schemes. Be that as it may, India still ranks well below many other countries like Japan, US, Spain, France, Brazil, etc. Notably, most of these countries have included direct income support to workers left without any earnings and/or jobs due to the pandemic or subsequent administrative measures like lockdowns. India has however failed to provide any such protective income support, apart from transfer of Rs 500 per month to Jan Dhan account holders.

The CBGA analysis makes a robust case for far greater fiscal spending if India’s deeply distressed people are to be given some relief, and also for the future prospects of reviving the economy.

Also watch: Pedalling for Reporting: Meet Journalist Duo Who Cycled Hundreds of Kilometres

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.