NBFC Crisis Likely to Intensify, Indicates Data

Image courtesy: Financial Express

The crisis in India’s non-banking financial companies (NBFCs) sector is further deepening as a record amount of debt of about Rs 1.1 lakh crore is due to mature by the end of next quarter. While the inherent flaws of the shadow banking sector are emerging, it is crucial that the authorities bring in reformative measures to tackle future instabilities.

At the centre of the crisis is the breakdown of Infrastructure Leasing and Financial Services (IL&FS) Group which sent shockwaves across sectors involved with NBFCs in some business or the other, despite the government’s takeover of the reigns of IL&FS. Several investigations into the financial irregularities of IL&FS revealed how the top management misled creditors by projecting rosy picture of their finances taking help from auditors. IL&FS group had around Rs 94,000 crore outstanding debt in September 2018.

India’s shadow banking sector primarily comprises NBFCs, housing finance companies and other finance vehicles that offer services like commercial banks outside the banking system, but are not subject to strict regulatory oversight. According to the latest statistics of Reserve Bank of India, more than 11,402 firms with a combined balancesheet of Rs 22.1 lakh crore operate in India’s shadow banking sector.

After the IL&FS debacle came to light in September 2018, fund houses have tightened their refinancing adding difficulties for NBFCs in both borrowing and repayment obligations. As per a Mint report, at the end of April, banks’ exposure to NBFCs is estimated at Rs 6.23 lakh crore, while mutual funds exposure is Rs 3.1 lakh crore. This pushed the liquidity-starved NBFCs to go for asset monetisation to meet debt obligations. For instance, two other major NBFCs – Dewan Housing Finance Ltd (DHFL) and Reliance Capital Ltd (RCAP) could repay due amounts through asset monetisation, such is the liquidity crunch in the sector.

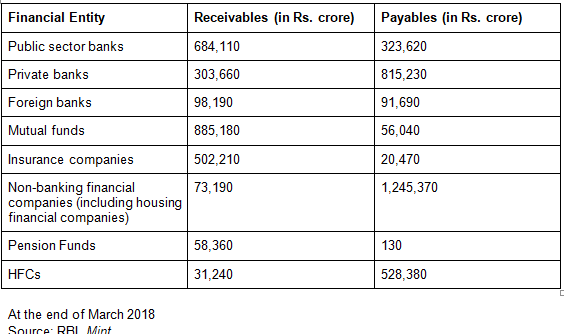

The following table shows the financial position of crucial sectors in India.

According to RBI’s financial stability report (2018), NBFCs received 44% of total funds from banks, followed by 33% from asset management companies managing mutual funds (AMC-MF), and 19% from insurance companies in 2018. Such is the interconnectedness of the system.

Inherent flaws of NBFCs

One of the major flaws in IL&FS operations was borrowing short term loans and lending for long term projects such as infrastructure and real estate projects. But data shows that the problem is spread across the sector. It is astonishing that 99.7% of shadow banking in India makes long-term loans against short-term funding, primarily carried out by NBFCs and housing finance companies, states the Mint report quoting an RBI research paper.

While it is clear that toothless regulations in the shadow banking sector have prompted the growing crisis, the country’s financial system awaits imminent reformative measures.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.