Why Subash Chandra had to Resign as Chairman of Zee

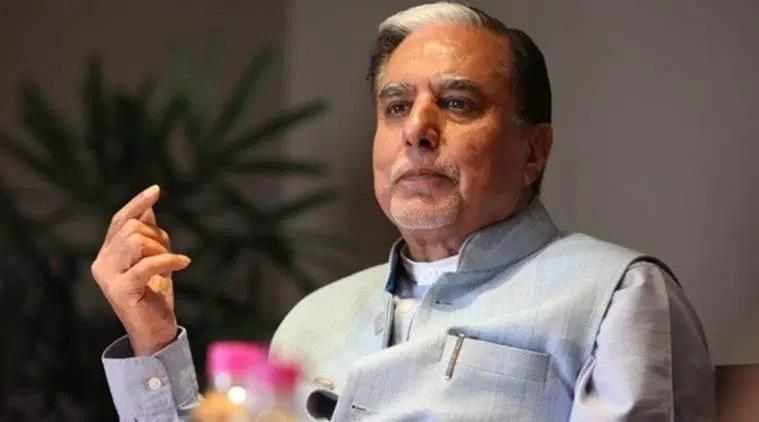

Image Courtesy: Indian Express

On November 25, Rajya Sabha MP Subash Chandra had to resign as the chairman of Zee Entertainment Enterprises Limited (ZEEL) after selling his maximum stake in the company which has now come down to below 5%. Keeping Chandra’s murkier business deals aside, there are two main factors that triggered his new low, one being the collapse of Infrastructure Leasing and Financial Services (IL&FS) and the other was his grand old practice of pledging shares for raising funds.

Earlier this year, lenders of Essel group of which Chandra is the chairman had threatened to release the ZEEL shares pledged with them as he had previously raised money through that way when the group was struggling due to fund crunch. The crisis was triggered by the sudden fears among fund houses including mutual funds as they tightened financing to infrastructure projects, which then appeared to be risky as financial irregularities of IL&FS got exposed.

Essel group has diverse businesses including infrastructure, education, financial services and entertainment.

‘Pledged shares’ is a loan raising system through which promoters of companies raise loans from lenders using the shares held by them as collateral.

Also read: Uncertainty over Another Standstill Agreement of Essel Group with Lenders

By January 2019, the Essel group had gathered an overall debt of around Rs 20,000 crore and ZEEL was the only profit making entity of this group. Following a story published in The Wire pointing out Essel Group’s links to fraudulent entities being probed by the Serious Fraud Investigation Office (SFIO), the share prices of ZEEL fell drastically by upto 30%. As a result, several lenders of the group including Credit Suisse began selling the ZEEL shares pledged with them deepening the crisis in the group.

At that time, Subash Chandra had 39.1 % stake in ZEEL shares, of which nearly 60% have been pledged with various lenders. This prompted Subash Chandra to emotionally appeal to his lenders urging them not to sell the shares pledged with them while guaranteeing them to pay back his dues.

In February 2019, Essel group entered into a standstill agreement with its lenders who agreed for a moratorium till September. Thus, Chandra had to cut down his stake in ZEEL over time and repaid his immediate debt obligations.

ZEEL’s case of pledged shares had created concerns in the financial market and even regulator Reserve Bank of India had this year tightened norms concerning the risky financial instrument. Subsequently, several other corporate giants in the country then had cut down their percentages of pledged shares.

Invesco Oppenheimer is now the largest shareholder in ZEEL with nearly 19% stake.

Furthermore, the crisis in Essel group is far from over as the group is reportedly struggling in its operations.

Also read: Zee Sale: An After Effect of IL&FS Fiasco

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.