Can Modi Govt Handle Approaching Wheat Crisis?

The Narendra Modi-led Central government is going to be confronted with a crisis that it has never faced yet – shortage of wheat, one of India’s key staples. The worry about this looming cloud is aggravated by the fact that the Modi government has not been particularly successful in dealing with such crises in the past. It couldn’t handle the medical oxygen crisis during the Delta variant phase in 2021 causing widespread distress; it couldn’t handle the coal shortage in power plants recently which caused huge outages even as temperatures were soaring; it has been unable to handle the cooking oil crisis leading to sky high prices.

What was being pictured as an unprecedented opportunity for India to break into the global wheat trade market has very rapidly turned into a prospective shortage within the country, thanks to the unusual heat wave in March which saw temperatures break 122-year-old records. This led to damage of standing wheat crop across Northern India. The evaluation by scientists was that full growth (“filling”) of wheat grains in the field was hampered and the grain became shrivelled and under-weight.

Extreme heat causes wheat output to dip by 6%

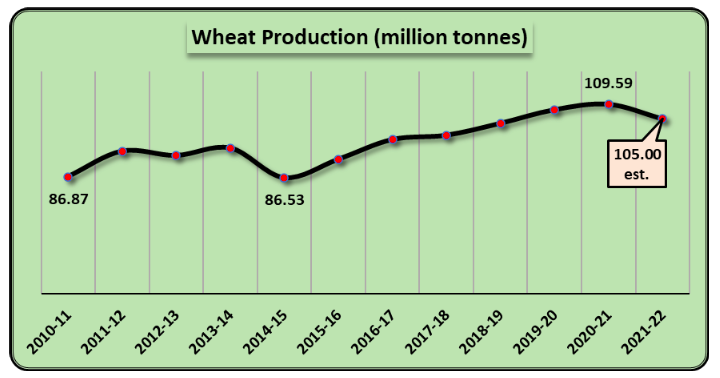

According to Sudhanshu Pandey, food secretary, the projected wheat output has been downgraded from the estimated 111.32 million tonnes to 105 million tonnes in the 2021-22 crop year. Last year, India had produced 109.59 million tonnes of wheat. It is for the first time since 2014-15 that wheat output is expected to decline. (See chart below based on agriculture ministry data)

This means that there will be a nearly 6% dip in wheat output this year compared with the estimated target and a 4% shortfall compared with last year.

These are estimates as of end-April. The actual position may be worse. In itself, this is not too much of a cause for worry as long as the dip remains of this order. But there is more bad news.

Procurement plummets by estimated 55%

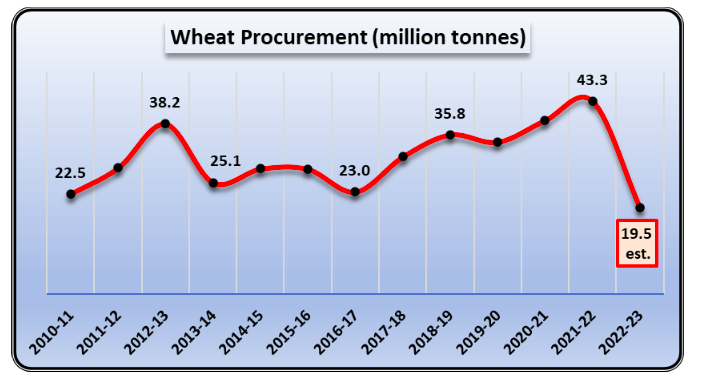

Procurement of wheat by government agencies has sharply declined in the ongoing marketing season which continues till June. According to report based on food ministry sources, it is estimated that wheat procurement will fall to a low of 19.5 million tonnes this year. Currently, about 17.5 million tonnes has already been procured.

This is one of the lowest procurement in recent memory, taking the level down to the early 2000s. This is a steep drop of about 55% compared with last year when 43.3 million tonnes was procured. (See chart below based on Food Corporation of India data).

A slew of reasons are being said to have caused this shocking decline in procurement. These include: lucrative export prices leading private traders to buy up wheat from farmers, holding back of wheat harvest by farmers in hope of better prices and, of course, the dip in output itself.

Prime Minister Modi held a meeting with top officials of the ministries concerned to review wheat supply, stocks and prices situation on May 5, after his return from the European tour. These factors were reported to have been among those discussed at the meeting. He “directed that all steps be taken to ensure quality norms and standards so that India evolves into an assured source of food grain and other agricultural products” according to a press release by the Prime Minister’s Office.

Dangerous Complacency

The tenor of officialdom is that there is nothing to worry about. Farmers are getting prices more than minimum support price or MSP, the shortfall in output is very small, and despite the big drop in procurement, the stock position is still comfortable.

According to the food and public distribution department’s monthly Food Grain Bulletin, wheat stocks in the Central pool were 18.99 million tonnes in April this year, over 8.3 million tonnes or 30% less than last year. Officials are sanguine about this because the food stock norms say that at this time of the year, 7.46 million tonnes of buffer stock of wheat is needed.

Clearly, current stocks are double that, causing this optimism. The Prime Minister’s advice to bureaucrats to ensure that quality norms should be adhered to shows that at the very top levels there is more concern about the export market than internal availability. All this is indicative of complacency that India can ill afford.

Already, the effect of declining procurement is visible in wheat allocation for the PM Garib Kalyan Anna Yojana under which 5 kg free foodgrain is to be distributed to all eligible families. The government has ordered that 5.5 million tonnes of rice should replace wheat in this scheme. Although this is being projected as a measure to push fortified rice, it appears to also to compensate for the wheat procurement shortfall.

In the coming months, this shortage of wheat could affect the public distribution system seriously. It could also affect prices of wheat in the open market, as India is still encouraging exports and about 10 million tonnes have been already exported. If the export market falters, the held over wheat bought at higher prices by traders (as claimed by the government) will hit the open market and raise prices of wheat.

Farmers also could get affected if the volatile export market does not materialise fully. Government procurement will close in June and subsequently, they will have to sell the wheat at whatever price they get from avaricious traders.

In short, the immediate future portends all kinds of pitfalls and dangers. With the Modi government displaying its usual sangfroid in situations of crisis, the country could be heading for another – more severe – crisis.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.