Data Removed and Data Modified: Archive Reports on Jan Dhan Yojana Website Undergo Changes

On 15 August 2014, Prime Minister Narendra Modi launched the Pradhan Mantri Jan Dhan Yojana (PMJDY) scheme with the claimed objective of nation-wide financial inclusion. In his speech, he stated that the initiative was aimed at eradicating ‘financial untouchability’ by opening at least one bank account per household in less than six months. Among other special benefits, there would be no minimum balance requirement for the accounts created under this scheme. The government claimed that 1.5 crore zero-balance accounts were opened on the inaugural day.

While the government took pride in publishing these details in 2014, it seems they feel differently three years later. Earlier last month, the data pertaining to zero-balance accounts was removed from the archive reports on the website of PMJDY. Apart from this, data pertaining to the number of Aadhaar-seeded accounts was removed, while data on the number of accounts opened under the scheme and on the balance amounts in those accounts were modified.

Prior to these changes, the archive reports on the PMJDY website provided details of the number of accounts (urban and rural) opened, the number of RuPay debit cards issued, the balance amounts in Jan Dhan accounts, the number of Jan Dhan accounts with zero balance and Aadhaar-seeded accounts.

From April 2017, the archive reports stopped publishing the number of accounts with zero balance and the number of Aadhaar-seeded accounts. While the website stopped publishing these two columns from April 2017, some recent ‘updates’ have removed these two columns from previous reports entirely. It is ironic that a scheme aimed at eradicating ‘financial untouchability’, has made its own data untouchable.

On 13 September 2017, while speaking at the Conclave on Financial Inclusion organised by the United Nations in India, Finance Minister Arun Jaitley mentioned that zero-balance accounts under PMJDY have come down from 77% to 20% in three years – thereby claiming successful financial inclusion under the scheme.

Interestingly, data accessed by an RTI dated exactly a year back (13 September 2016) shows that out of 23.4 crore PMJDY accounts at that time in 27 public sector banks, at least 1.2 crore accounts had a balance of only Re. 1.

Several banks admitted that they had deposited small amounts (Re. 1, Rs. 2 or Rs. 5) in PMJDY accounts to reduce the number of zero-balance accounts under the scheme. However, in response to a Lok Sabha question on 25 November 2016, the government denied this by stating, “All Public-Sector Banks have denied giving any instructions to deposit Rs. 1-2 in the zero-balance accounts”.

After Demonetisation

Soon after these reports of government pressurising the banks to make PMJDY look good, came demonetisation. With demonetisation, PMJDY was impacted in two significant ways. Firstly, the proportion of zero-balance accounts under the PMJDY scheme first came down and then showed an increase. In January 2016, the percentage of zero balance accounts was 31.5%, which came down to 22.9% by December 2016. In the months following demonetisation, this figure slightly increased to 24.6% again.

The second point to note was the sudden inflow of money in the same period, almost doubling the balance in PMJDY accounts. It was reported that the deposits into Jan Dhan accounts during the 50 days of demonetisation almost equalled the total balance that these accounts had collected over two years of the scheme.

Observing the increased inflow into Jan Dhan accounts in the first two weeks of demonetisation, the government set a cash deposit limit of Rs. 50,000 for these accounts. It cautioned account holders that they will be prosecuted under the I-T Act for allowing misuse of their bank accounts through the deposit of black money in Rs. 500 and Rs. 1000 notes during the 50-day window. These warnings were too late, however, as by then Jan Dhan Yojana had provided an effective legal mechanism to convert black money into new denomination notes.

While responding to a question in the Lok Sabha on March 17, 2017, the government stated, “During demonetisation, an amount of approximately Rs. 42,187 crore was deposited in cash in PMJDY accounts during the period from 8.11.2016 to 30.12.2016. It cannot be stated whether the deposits are fraudulent or not. Relevant information has been disseminated to the law enforcement agencies concerned”. It is noteworthy that the PMJDY reports stopped providing details of zero-balance accounts two days before this answer was tabled in the Parliament.

With the data on zero-balance accounts raising too many questions, perhaps the government had decided to disseminate the relevant information only to law enforcement agencies? But what led them to completely remove any data on zero-balance accounts from the public domain? Zero-balance accounts had been under almost constant public scrutiny. To questions on misuse of zero-balance accounts or the scheme itself, the government has responded by burying the relevant information. When transparency is sought, access is cut-off.

Figures Modified

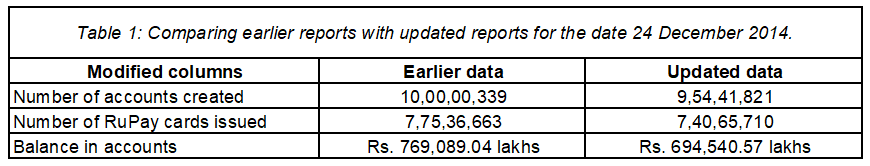

Apart from removal of data from the website, data pertaining to the number of accounts opened, the number of RuPay cards issued and the balance amount in accounts have been modified. For instance, the modified figures state that as of 24 December 2014, the number of beneficiaries of the scheme was 9.5 crores, the number of RuPay debit cards issued were 7.4 crores and the balance in the accounts was Rs. 6945.41 crores.

However, the original (earlier) figures were 10 crores (number of beneficiaries), 7.75 crores (number of RuPay debit cards) and Rs. 7690.9 (balance in the accounts – in crore) for the same date. The modified data has reduced the number of beneficiaries by a few lakhs and the balance in accounts by a few hundred crores.

Table: Comparing earlier reports with updated reports for the date 24 December 2014.

While the ‘correction’ in data for 2014 and 2015 is drastic, there is little or no change in numbers for 2017 data. Even this change is predominant only in the data of regional rural banks and public sector banks. The change in data with respect to private sector banks is negligible in comparison.

This gives rise to even more questions. Why was the data from public sector banks and regional rural banks alone modified recently? Does this render the earlier data erroneous? If yes, how did these errors go unchecked? If not, what circumstance could possibly have led to making changes to data such as the number of accounts created and the number of debit cards issued three years ago?

Two separate RTIs were filed – one requesting the unavailable information (number of zero-balance accounts in the last six months) and another asking why that information was made unavailable. While the Department of Financial Services has provided the data for the number of zero-balance accounts since March 2017 (Table 2), the tougher questions remain unanswered.

Table 2

Note: The archive reports that were removed can be accessed at https://github.com/iotakodali/pmjdy/tree/master/data. The data removal was first mentioned in the mailing list of DataMeet – a community of Data Science and Open Data enthusiasts.

Disclaimer: The views expressed here are the author's personal views, and do not necessarily represent the views of Newsclick.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.