Debt Crisis Looms for Developing Countries Amid 'Perfect Storm'

For developing nations, higher interest rates are bound to become a financial threat

When Ghana lost access to international credit markets late last year, it was a foreboding of the debt troubles that awaited the developing world. The battle against COVID-19 has left governments vulnerable, saddling them with massive debts they took to soften the economic blow from the pandemic.

However now, with major central banks raising interest rates, those debts may become difficult to service.

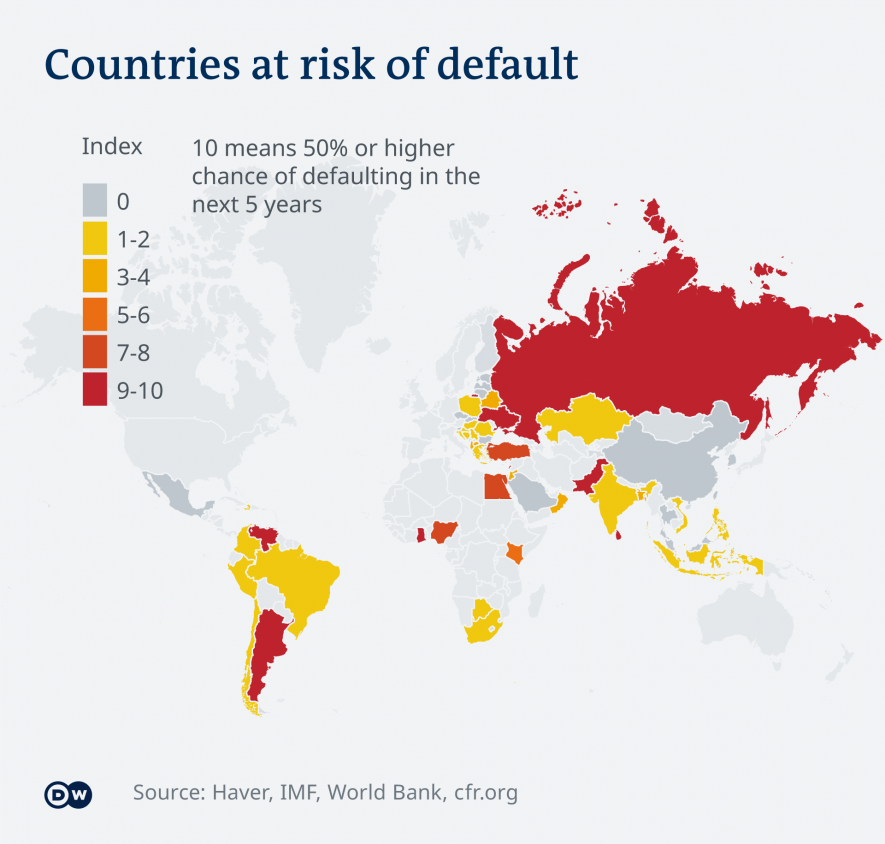

Sri Lanka defaulted on its debt just weeks ago and Pakistan is struggling to avoid a similar predicament. In fact, more than half of low-income countries are currently at high risk of debt distress or already in debt distress, according to the World Bank.

On Sunday, Russia defaulted on its foreign-currency debt. But in this case, the reason was not a lack of reserves. Rather, Western sanctions imposed on Moscow over the Ukraine war simply don't not allow creditors in the West to accept Russia's payments.

What's fueling the debt crisis in developing countries?

After the Global Financial Crisis in 2008, central banks in industrialized countries cut interest rates and made funding cheap. For global investors in the United States and Europe, this meant lower returns on investments at home.

On the other side sat governments in the Global South. They wanted to profit from ultralow interest rates in the North by luring investors with their higher-rated debt denominated in US dollars, rather than local currency.

By the end of 2019, this pile of so-called external debt rose to $5.6 trillion (€5.28 trillion) in emerging economies, a study by the Financial Stability Board found. And as a result of the global pandemic, their sovereign debt in total saw the fastest annual increase in 2020 in the past three decades.

Experts have been warning for years that once interest rates start rising in the US, paying interests on all that dollar-denominated debt would become more expensive.

Now "we have several things coming together in a perfect storm," says Lars Jensen, alluding to high food and energy prices, global economic uncertainty due to Russia's war, and rising interest rates around the world as central banks try to rein in inflation.

Jensen published a report for the United Nations Development Program (UNDP) in 2021 highlighting 12 countries at particular risk to default on their debt amid rising interest rates. Among them was Ghana which saw surging food prices drive up inflation to nearly 30% in May. The Ghanaian currency cedi has dropped 22% against the US dollar this year.

Ghana's debt woes

With the COVID-19 pandemic, the amount of debt the Ghanaian government took to finance spending increased threefold. In 2020, the government of the West African country had to use 45% of its revenue for interest payments, IMF data shows. By comparison, Germany spent just 1%.

Infrastrucure projects in Ghana may suffer from budget cuts in the future

Ghana "has been trying to borrow money in foreign currencies and then use that money to retire some of its domestic debt in the hopes of reducing their debt servicing costs," said economist Jensen. But now, with rising interest rates in the US, Ghana will have to pay substantially more to service its foreign currency debt.

In Ghana, already infrastructure projects remain unfinished and spending on hospitals is scant. Furthermore, as global food prices rise "the debt burden is creating a problem for subsidies on fertilizers," explains John Gatsi.

The professor at the University of Cape Coast's school of business told DW the looming debt crisis is making government services to the population "becoming poorer and poorer."

But the problem is even worse.

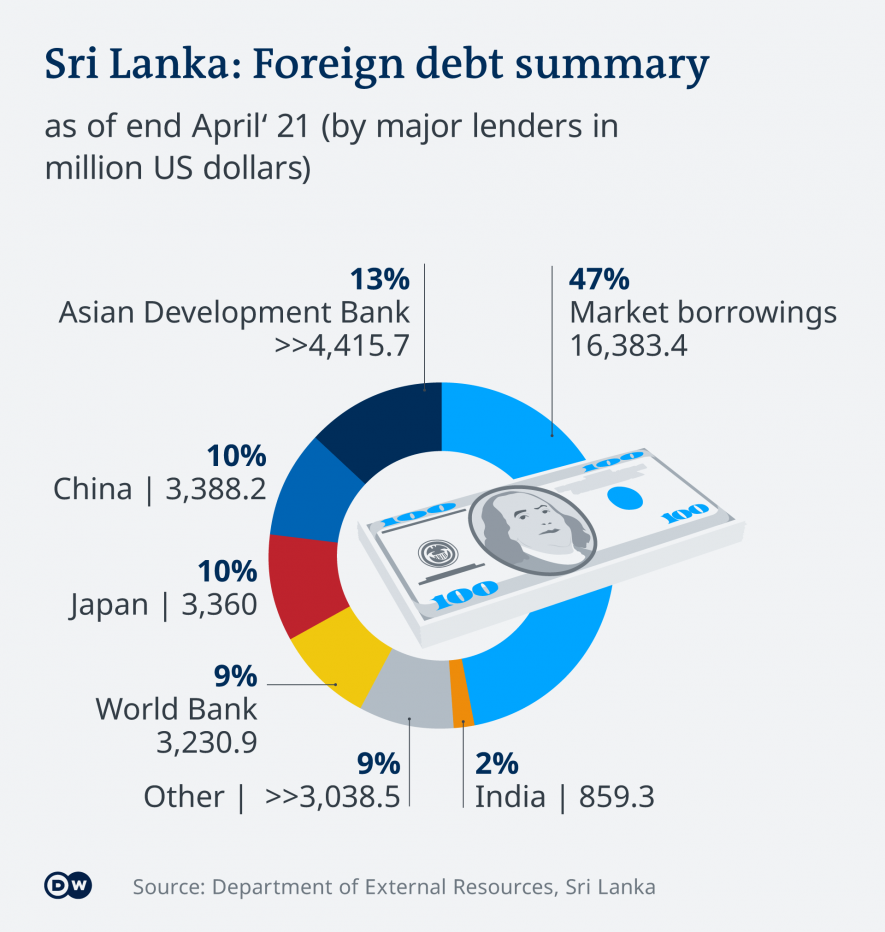

Private lenders dominate the current debt crisis

Unlike previous debt crises in the developing world, like in Latin America in the 1980s, the current turmoil has private lenders at the center of the turmoil.

For example, 57% of Ghana's external-debt payments go to private lenders rather than multilateral institutions such as World Bank or the International Monetary Fund (IMF), according to UK-based nonprofit, Debt Justice. Private lenders are international investment banks, hedge funds, and asset managers who look to maximize portfolios on behalf of their investors.

For the group of 37 so-called Heavily Indebted Poor Countries (HIPC), Jensen estimates that 50% to 60% of their debt is owed to private lenders.

The problem with this kind of debt, Jensen said, is threefold: It is generally more costly than debt negotiated between governments. It is much more difficult to renegotiate in case of payment difficulties as there are numerous actors involved, and, most importantly, it is prone to price swings.

"When central banks in the North decide to raise interest rates, the interest rates on international financial markets rise broadly," said Jensen, which would prompt private lenders to seek higher interest payments from their borrowers. "And this, of course, increases countries' costs of servicing their debt."

Is there a way out of the debt spiral?

Solutions to the problem are still out of sight. After Zambia became the first country to default in November 2020 amid the spreading coronavirus pandemic, the country had entered into negotiations with the IMF. The Zambian government said at the time it was confident to end negotiations by September 2022. However, a large pile of the country's debt was held by private asset manager BlackRock which didn't show any interest in renegotiating the debt.

Also, the Debt Service Suspension Initiative, put in place by the World Bank in May 2020, had a very limited impact on the mounting debt problem in the developing world. The multilateral approach only allowed to defer payment on debt to a later date, rather than alleviating the burden. The initiative expired at the end of 2021.

Lars Jensen noted that a succeeding debt initiative called G20 Common Framework is also "pretty much dead" in its current form because of the procedural uncertainty involved and as countries using it fear being stigmatized and endangering their creditworthiness in global debt markets.

For Tim Jones, head of policy at Debt Justice, the multilateral programs offered by rich countries and global institutions are not going far enough. "Debt payments have to be stopped so money can stay in the respective countries," he said. He argued it's the private lenders who went searching for profits, pocketing large sums precisely because of the risks involved in poorer countries' debt. So, they, in turn, should take the biggest hit from a default.

Edited by: Ashutosh Pandey

The earlier version of the article wrongly named Lars Jensen as Nils Jensen. It has been corrected.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.