‘Efficient’ Private Banks? Here is the List of Failed Private Banks in India

With the ballooning of NPAs in the public banking system in India, and the recent PNB scam, the clamour from the private corporate sector for the privatisation of public sector banks has intensified. Industry bodies such as Assocham, FICCI and CII have demanded that public sector banks (PSBs) be sold off to the private sector.

One of the arguments being used to call for the privatisation of PSBs is the claim that private banks are more “efficient”. If this was the case, surely it could be expected that private banks would be more stable and less prone to failure. Whether the banks, which handle massive amounts of money belonging to the common people, are stable or not would be something that the public would be very much concerned about.

History tells us that one of the reasons for the Indian government’s decision to nationalise the biggest banks in India was the huge number of instances of private banks going bust.

Between 1947 and 1969, 559 private banks in India failed, with numerous people losing their life’s savings. “A total of 736 private banks failed, amalgamated, ceased to function or transferred their liabilities and assets, or went into liquidation between 1948 and 1968,” says Thomas Franco, General Secretary of the All India Bank Officers’ Confederation (AIBOC).

It was only after the nationalisation of the biggest banks in India in 1969 that the banking system attained stability.

“Those were all in the past. Now the private sector has become bigger and better,” say some advocates of bank privatisation. If that is the case, could we expect that private banks no longer fail?

It turns out that even after bank nationalisation and with more stringent regulation of the banking system by the Reserve Bank of India, private banks in India continue to fail.

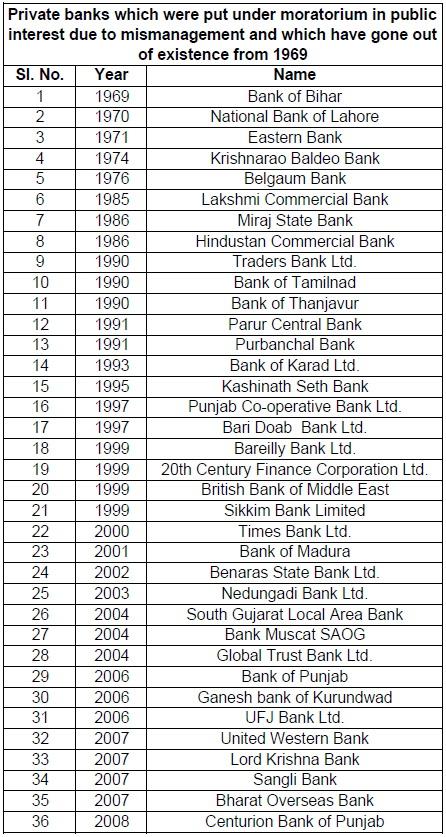

From 1969 onwards, 36 private banks have been put under moratorium in public interest, due to mismanagement and have gone out of existence. Several of them were merged with healthy PSBs, such as the high-profile case of the Global Trust Bank which was merged with the Oriental Bank of Commerce in 2004.

See the full list below:

“If private banks are really efficient, why were these banks merged with others? Most of these banks were merged with public sector banks. PSBs have become the Neelkanda Mahadev to swallow the poison of failure of many private banks,” Franco said over e-mail. ”It is funny that Assocham is asking PSBs to be privatised now. We understand their greed, but they cannot claim that private banks are more efficient.”

“With respect to the alarming rise of bad loans in banks, who are the delinquents and who are the defaulters? Aren't all of them private companies, industrialists and corporate houses? Twelve cases of NPAs have been referred to NCLT for insolvency and bankruptcy proceedings involving Rs. 253,000 crores. Who are they? Aren't all of them top private corporate borrowers? Why they did not repay the loans? Is it their efficiency? Should banks be privatized and handed over to these people?”

“In the PNB fraud, no doubt there is an unpardonable sin on the part of those officials who went out of their way to favour Nirav Modi. But who tempted them and influenced them? Is it not private corporate giant Nirav Modi? Take any major fraud in our country, and one will see the hand of private corporates in it.”

“Let them not forget that bulk of the loans given by public sector banks are to private corporate houses. If public sector banks are not efficient, why do they avail these loans from PSBs and why have they not taken such loans from private banks?” Franco asked.

Unsurprisingly, the depositors in India have kept their faith with public sector banks. Viral Acharya, Deputy Governor of RBI and an advocate of PSB privatisation, admitted this when he said, “Indian private banking hasn’t raised its market share beyond 25 per cent. In fact, it shrunk after the 2007–08 crisis because the depositors, especially the corporates, flew back to State Bank of India and other public sector banks.”

The experience of the United States, where private banks rule the roost, is a pointer to what could happen to the stability of the banking system if Indian PSBs are privatised.

Since October 2000, 555 private banks have failed in the US.

The problem of PSBs lending huge sums of money to the likes of Nirav Modi illegally and without due diligence cannot be solved by handing over PSBs to the likes of Nirav Modi.

Most certainly, the hard-earned money of the common people of India would be considerably less safe in the hands of private banks.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.