How Govt Milking of Cash Cow LIC is Endangering India’s Most Trusted Life Insurer

Image Courtesy: MSN

Since 2014, the Life Insurance Corporation of India (LIC) has spent, at least, Rs 48,000 crore so that the Narendra Modi government can meet its disinvestment targets.

Meanwhile, the non-performing assets (NPAs) of the country’s largest insurer have doubled in this period.

For decades, millions of middle- and lower middle-class Indians have associated the name of LIC — a central public sector enterprise set up in 1956 — with trust and reliability. The company has nearly 41 crore policyholders (including individual and group policyholders) as on March 31, 2018.

While the sums assured by its policies (including accrued bonuses) carry sovereign guarantee, the policyholders also expect LIC to invest their premiums in prudent long-term investments that give good returns.

LIC is one of the cash-richest companies in India — with an annual investible surplus of Rs 3-3.5 lakh crore that it invests in a vast array of companies, in both public and private sectors. As a long-term investor, it has made good returns on its investments in the past.

But LIC’s good health has increasingly become a bane for the company, as successive governments — earlier the Congress-led United Progressive Alliance and now the BJP-led National Democratic Alliance in an unprecedented manner — have used LIC as a cash cow and milked it.

Not only have LIC’s funds been used repeatedly by government to rescue other troubled companies, but the Modi government is using LIC to bail itself out more than anything else — to meet its fiscal deficit targets through the destructive sleight of hand known as disinvestment.

But before we delve briefly into the logic behind disinvestment — the Modi government has set itself a disinvestment target of Rs 80,000 crore for 2018-19 — let us look at what has become of LIC.

LIC as Cash Cow

In the past four years, LIC has been used by the Modi government as ‘the lender of last resort’ across sectors, because it is flush with funds. It has been asked to give soft loans to the Railways, it has subscribed to the power sector’s Ujwal Discom Assurance Yojana (UDAY) bonds and was made to invest in the National Investment and Infrastructure Fund (NIIF). Two years ago, LIC’s cash piles were used to buy 10-14% equity of several public sector banks.

As for disinvestment, since the 1990s, the public sector insurer has been the government’s go-to buyer when there are none.

Under the Congress regime, LIC paid over Rs 10,000 crore to help the government in disinvestment of the shares of NMDC and NTPC in 2010.

In 2012, as the Initial Public Offering of ONGC shares was faltering, LIC was made to pay Rs 12,749 crore to buy around 84% of the shares being auctioned.

In 2013, LIC picked up almost 71% of the shares on offer during the disinvestment of Steel Authority of India Ltd.

Under the Modi regime, this was fast-tracked.

Since 2014, fleecing LIC through the charade of disinvestment has continued.

In 2014, LIC bailed out the Modi government by buying another 5.94% stake in Bharat Heavy Electricals Ltd (BHEL) for Rs 2,685 crore, increasing its stake in BHEL to 14.99%.

In 2015, the insurer was made to rescue the government in the disinvestment of Coal India by buying shares worth Rs 7,000 crore, picking up one-third of the public offer, so that the government could meet its Rs 22,557-crore target.

In 2015, LIC bought nearly 86% of the shares on offer of the Indian Oil Corporation to help its disinvestment sail through, paying over Rs 8,000 crore.

In 2017, LIC bought shares worth around Rs 8,000 crore in the disinvestment of General Insurance Corporation of India and again bought shares worth Rs 6,500 crore in the IPO of New India Assurance Company.

In March 2018, it again bailed out the Modi government by subscribing to 70% of shares on offer in the IPO of Hindustan Aeronautics Limited, paying Rs 2,900 crore.

However, this June, the Modi government did something unprecedented. It made LIC buy an entire bank — that too the most debt-ridden one in the public sector with 28% bad loans — the sinking IDBI bank. LIC is shelling out between Rs 12,000-13,000 crore in the deal which is expected to be completed by December.

However, since the deal, some from LIC itself have defended the move on the grounds that LIC anyway wanted a bank of its own to promote its business — as most banks are peddling their own insurance schemes. And while LIC already has stake in several public and private banks, this deal gives it the controlling stake in IDBI. The insurance company’s stake in IDBI will now come to 51%, as earlier it was already holding 11% in the bank.

A similar call was made when the privatisation of Air India was failing, but the government eventually shelved the plan altogether.

In fact, as per news reports, the extent of bad debts that IDBI bank is saddled with is not even clear yet.

Mounting NPAs

Then there is the risk that the crisis in the banking sector — gross NPAs of all banks have crossed Rs 10 lakh crore — can affect LIC too.

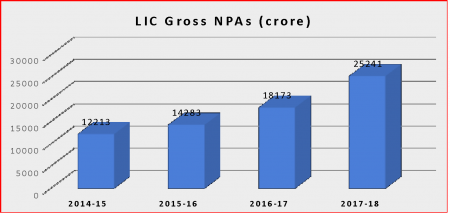

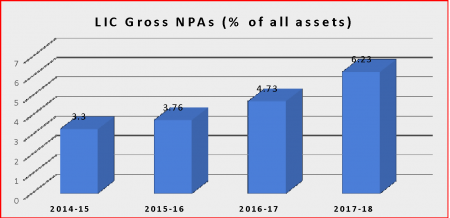

What is clear, however, is that LIC’s own NPAs have already doubled in the four years since the Modi regime took over — from 2014-15 to 2017-18.

Take a look at these figures culled from LIC’s annual reports:

Source: Annual Reports of LIC

In fact, as reported here, LIC has even set up a ‘Stressed Asset Cell’ to monitor NPAs and other loan accounts that may go bad.

As per the financial profile of LIC as on March 31, 2018, it has total investments (which are basically policyholders’ insurance and pension funds) of Rs 25,15,549 crore.

Of this, 81.75% — Rs 20,56,324 crore — has been invested in government securities, approved securities, infrastructure, and social sector. While 18.25% — Rs. 4,59,225 crore — has been invested in equity and preference shares.

The provision for doubtful debts is Rs 71,525 crore (2.84%).

Annual investible surplus is Rs 3-3.5 lakh crore; while average yield on investment for 2017-18 is 7.71%

Meanwhile, the cash and bank balances with LIC — as reflected in its balance sheets — have also been steadily declining since the Modi regime took over.

In 2013-14, the ‘cash and bank balances’ of the company stood at Rs 88,082 crore. This fell to Rs 64,375 crore in 2014-15; further down to Rs 42,910 crore in 2015-16; and then to Rs 32,729 crore in 2016-17. Finally, the cash and bank balances stood at Rs 22,680 crore.

Why Disinvestment?

The Modi government has been making the cash-rich public-sector companies buy other — often ailing — public sector companies as and when they have trouble finding private takers.

While some argue that this is better than privatising these companies, the point is that this fits in with the Modi government’s eventual aim is to privatise all public-sector companies.

Through this particular route of ‘disinvestment’ — getting one government-owned company to buy another — the government not only saves face when no private buyer turns up, it also ensures that healthy companies are set on the path of becoming sick as their cash reserves are depleted. Once a profitable company is made unprofitable, the government can again make a case for privatisation. In this way, the government can eventually privatise larger chunks of the public sector at one stroke after consolidating these companies!

Healthy public sector companies should be using their cash reserves — generated through productive activities — for thier own expansion and modernisation.

This money goes into central government coffers, which is used to stick to the fiscal deficit limits set by the neoliberal international financial institutions, such as the IMF and World Bank, and also presumably to meet the government’s revenue expenditure (not even capital expenditure that has long-term gains for the country).

Take the case of ONGC. The public sector explorer was made to rescue Gujarat government’s unprofitable GSPC and then to buy HPCL, which drowned it in debt.

Besides, the stated (and misguided) premise for disinvestment is to raise money for the public exchequer — but is selling off national assets into private hands the best way to raise finances?

Because, in the meantime, the government continues to grant massive tax concessions to corporates, amounting to Rs 86,145 crore in 2016-17, while getting the public sector banks to write off staggeringly high bad loans (Rs 2.41 lakh crore between April 2014 and September 2017). On the other side, the government continues cutting down its public expenditure, which actually affects employment generation.

As economist Prabhat Patnaik elaborates, this way of “fiscal consolidation” while pandering to private profit shall destroy our country in the long run.

The IL&FS Saga

Now for the saga of sinking infrastructure conglomerate IL&FS — which basically operated a Ponzi scheme of loans.

Involved in some of the biggest infrastructure projects in the country — through the much-vaunted public-private partnership — IL&FS has total debts of over Rs 91,000 crore that it shall be unable to pay back.

LIC is the largest shareholder in IL&FS with 25.34% equity shares. The other shareholders are Japanese financial services group ORIX Corporation (23.54%), Abu Dhabi Investment Authority (12.56%), HDFC (9.02%), Central Bank of India (7.67%) and State Bank of India (6.42%).

At the first hint of trouble, the conglomerate predictably turned to the government to bail it out with public money.

Needing to urgently raise capital between Rs 3,000-4,000 crore, there were talks of LIC bailing out IL&FS.

LIC has rejected the loan facility, and since then the government has taken over IL&FS and constituted a board to manage the affairs of the company — and the board is tasked with formulating a resolution plan, which is likely to include a Rights Issue.

A Rights Issue is when existing shareholders are offered to buy additional shares at a special price in proportion to their existing holdings of old shares.

If a Rights Issue does take place, LIC is likely to participate, said insiders that Newsclick spoke to.

In any case, LIC chairman VK Sharma has said that IL&FS would not be allowed to collapse and that all options were on the table.

However, the question remains as to why LIC — entrusted with insurance and pension funds of millions of policyholders — should come to the rescue of a disaster that is a case of cronyism, mismanagement, fraud and near-complete lack of accountability and transparency?

Meanwhile, there have already been calls from the industry to privatise LIC, even as it continues to rule the roost in the life insurance market, even after private companies were allowed to enter the business of life insurance in 1999-2000.

Speaking to Newsclick, Amanulla Khan, president of All India Insurance Employees’ Association, said, “LIC goes for long-term investments and does it prudently, and so it usually earns good returns. It is a strong company, but if the present trend continues, it does not bode well for the company’s future.”

He said the union was not too concerned about the IDBI bank deal because LIC had wanted a bank of its own, since “all major banks have their own insurance company and cannot act as our agent.”

But, he said, the business of always being made to bail out troubled companies was not good for LIC’s long-term health and financial stability.

“The government must allow functional autonomy to LIC and let it make its own investment decisions. The government should not interfere or force us. LIC is trustee to its policyholders, after all, and while their money is safe (since it carries government guarantee), the immediate question is, what is going to happen to the future returns on the policyholders’ investments? Is this the wisest way to invest the hard-earned money of the people who have taken life insurance from LIC? What will happen to LIC’s future?”

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.