Income Tax Data Shows Corporate Concessions

The Modi govt. is yet again patting its back on the basis of dodgy data. This time round it is the income tax figures, recently released by the Central Board of Direct Taxation. The govt. has claimed that there is steady increase in tax compliance and tax recoveries.

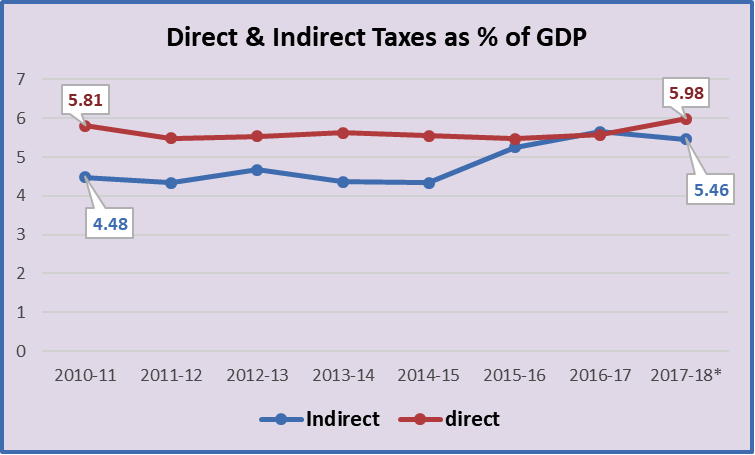

What the govt. is hiding is that in reality, both direct and indirect tax recoveries as a share of GDP are virtually stagnant over the past several years (see graph below).

Absolute numbers of so many crore rupees of tax collected – as the govt. is quoting – are irrelevant because not only are such figures bloated by inflation but the value of country’s gross output (GDP) is also steadily growing over the same period. So, a better way of looking at tax recoveries is as a share of GDP. Looked at in this way, we find that direct taxes made up about 5.81% of GDP in 2010-11 which increased to 5.98% in 2017-18 (for which only provisional unaudited figures are available, indicated by * in the graph above). An increase of 0.18 percentage points in seven years is hardly anything worth crowing about. Indirect taxes as share of GDP rose from 4.48% to 5.46% in the same period, an increase of just 0.98 percentage points.

If you add up these two kinds of taxes, and compute the share of GDP it works out to a mere 11.44% in 2017-18 compared to 11.3% in 2010-11. This is not only a very low growth but the tax-GDP ratio of 11.44% is one of the lowest in the world for economies of this size.

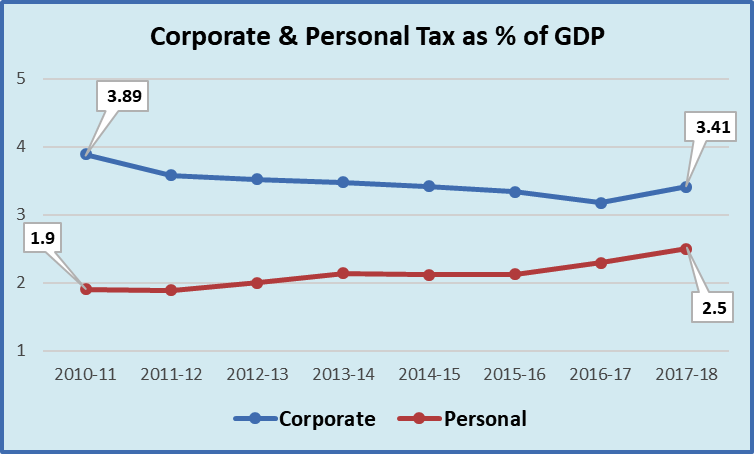

There is another even more shocking reality that the new data reveals – something not being talked about by the Modi govt. It is this: corporate taxes as a share of GDP have declined in this period. Corporate taxes made up 3.89% of the GDP in 2010-11 dipping to 3.41% of GDP in 2017-18.

This is a result of the hugely business friendly policies implemented by the Modi govt, adding on to the previous govt.’s concessions. The bonanza given to corporate bodies flows from concessions and rebates and cuts and exemptions from various taxes and duties that the finance ministry under Jaitley has been doling out year after year.

Meanwhile, personal income tax (applicable to individuals as well as other non-corporate entities including small firms) have gone up from about 1.9% of GDP in 2010-11 to 2.5% in 2017-18.

In other words, individuals and non-corporate entities are being squeezed to the last drop while corporate entities are getting all the tax breaks.

Repeated lamentations of the govt. that it has no resources for carrying out various essential functions and responsibilities – like giving pensions to elderly or giving more funds for health and education – fall flat on their faces once this ‘business friendly’ approach is considered. Why not raise taxes on corporate bodies so that various essential services are provided to all citizens?

Perhaps this question will be asked and answered in the coming elections when the Modi govt. comes back to the voters seeking another mandate.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.