Ominous Economic Distress: No Buying Power, No Jobs, Rising Prices

Recently released estimates of the country’s economic output show that people are not spending enough. The only reason this can be is because they do not have sufficient income, and their buying power is limited. On the other hand, prices of all essential commodities are increasing at a disturbingly high rate. This will further restrict spending. Industrial production has grown at a snail’s pace, and with people not having enough to spend, demand will continue to be low and industrial output too will languish. Bank credit for large industries is growing very slowly. So, prospects of any check on raging unemployment continue to be bleak because there is unlikely to be a fresh investment that would create jobs.

It is an ominous situation – and the Modi government, which is celebrating eight years of 'sushasan' (good governance), appears to be indifferent to it. All of their neoliberal prescriptions have failed spectacularly – tax cuts to the corporate sector did not spur new investment, squeezing funds on welfare schemes did not encourage private capital to move in, and putting public sector units for sale has not received many takers and hence not much disinvestment funds, opening up various sectors to foreign direct investment has not led to any boost to the economy and employment. In fact, the government's policies have led to a tanking economy and widespread distress for people, which is sought to be salved by free foodgrain distribution.

NO BUYING POWER

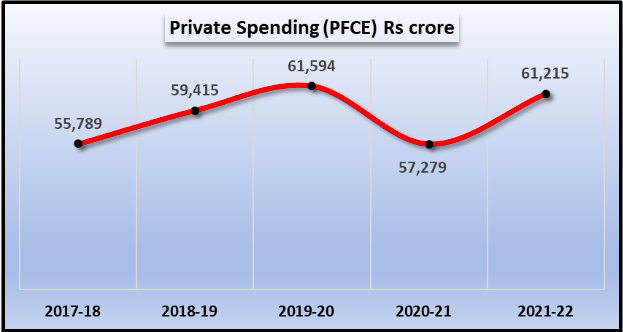

The provisional estimates for Gross Domestic Product (GDP) for the fiscal year 2021-22 show that per capita Private Final Consumption Expenditure (PFCE) was Rs.61,215, down from Rs.61,594 two years ago, in 2019-20. During the pandemic year 2020-21, it had slipped to Rs.57,279. PFCE represents spending by all non-governmental entities and hence includes all families besides business entities. Comparing it with two years ago is sensible because it shows that the spending has still not recovered to pre-pandemic levels (see chart below).

What this means is that for a majority of the people of this country, there is no increase in their buying power. This is because either earnings have become very low or they are unemployed. High prices are further robbing them of their meagre earnings. As a result, demand for products and services will remain low. PFCE makes up the most substantial part of the economy, making up 56.9% of GDP, the same as in 2019-20. Hence the whole economy can’t revive unless private consumption spending picks up.

What about government spending, which could have provided the requisite demand? Government spending (called Government Final Consumption Expenditure or GFCE) increased slightly in the pandemic year to 11.3% of GDP, but it has since declined in 2021-22 to 10.7%. In other words, the government has started pulling its hands back and restricting its expenditure. So much for the talk of all the beneficial schemes that one hears endlessly from the Modi government! Government spending would be the only way this crisis can be resolved, but the Modi government is shackled by its neoliberal dogmas, unable to lift itself out of the paralysis.

INDUSTRIAL PRODUCTION SLUMP

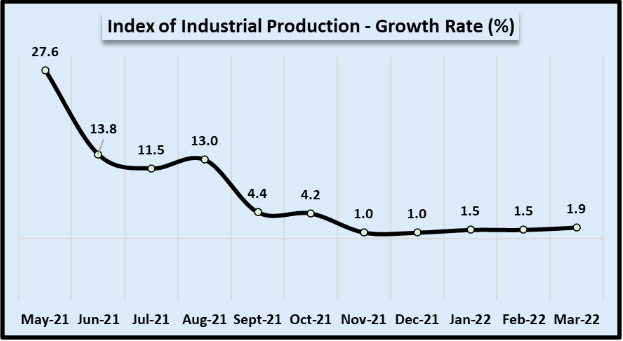

As shown in the graph below, the Index of Industrial Production (IIP) has been showing very weak growth for the past year.

The high growth rate for May 2021 and, to some extent, for the following three months are merely because growth is being computed in comparison to a year ago since then – and a year ago was May 2020, the lockdown that stopped all industrial activity. The next few months also reflect this base effect as the comparison is with the slowly reviving industrial activity in those months of 2020. However, once the base effect goes away, the real situation emerges – the IIP slumps to a very weak, almost negligible growth of 1-2% every month.

IIP measures a basket of different types of industrial output. If one looks only at the manufacturing sector, which forms the backbone of the economy, the growth is even weaker. For instance, in March 2022, when the overall index grew at 1.9%, the manufacturing sector grew at just 0.9%.

All this is meant to show that the industrial sector – especially the big corporate sector is not growing, thus causing the increase in unemployment and the prevalence of insecure, low paying jobs in agriculture or the informal sector.

The likelihood of growth in the coming months is bleak because, as we saw earlier, demand is low. This is confirmed by the fact that bank credit to the large industry is growing at a measly pace, according to RBI data. Loans outstanding to large industry increased by just 1.6% between April 2021 and April 2022. In the previous year, credit had slumped by -3.6% because of the pandemic. Credit to the MSME sector has grown by leaps and bounds, driven by the easy credit made available by the government to that sector as part of its pandemic management strategy. However, since there has been hardly any demand, the sector is still facing a crisis.

RISING PRICES & UNEMPLOYMENT

This situation becomes even more desperate for people because of rising prices and continuing joblessness.

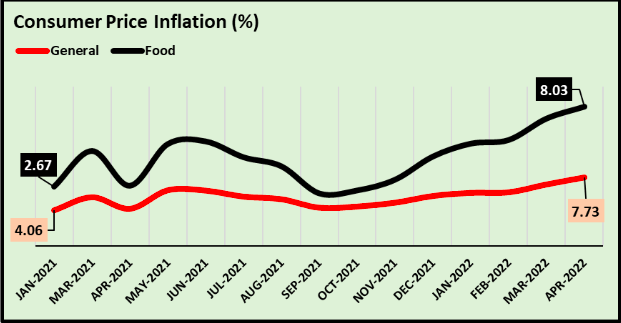

Prices of essential items of use – from food to fuels – have risen inexorably over the past years. This has led to cutbacks in consumption. Retail inflation, that is, the rise in prices of what common people pay for various commodities or services, was recorded at 7.73% in April 2022. Within this general rise in prices, food items have increased more, topping off at 8.03% in the same month.

As shown in the chart below, based on data from the Reserve Bank of India, retail inflation has zoomed up since September last year.

2021-22 has become the year with the highest average yearly wholesale price increase in the past decade at 13%. Much of this increase is driven by fuel prices, which accounted for 25% of the jump in wholesale prices. Petrol and diesel prices have risen mainly due to the imposition of excise duties by the Modi government, which saw this as an easy way of raising resources. Price rise is actually direct robbery – it is the transfer of resources from the pockets of common people to rich traders and industrialists.

Meanwhile, unemployment continues unabated, having remained over 6.5% since September 2018, that is for 44 months continuously, according to CMIE. This includes the almost 25% rate of unemployment that was hit in April 2020, as the lockdown was imposed unexpectedly in India. In May 2022, average unemployment was clocked at 7.2%, while urban unemployment was higher, still at 8.2%.

The combination of these features has become an unbearable burden on the Indian people – and there appears to be no hope of any relief soon because the Modi government is only planning more of the same policy prescriptions

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.