Raje Has Ruined Rajasthan

As Rajasthan prepares for Assembly polls on December 7, the BJP government led by Vasundhara Raje is facing a tough battle. One of the key reasons for huge public discontent is the anarchy and mismanagement of state finances by the ruling party. Despite a variety of gimmicks and declarations, the state government has been unable to provide essential services like education and healthcare, or give relief to farmers weighed down by decreasing returns. This has happened even as the government has borrowed heavily to keep itself afloat.

Raje took over the state’s reins in 2014. Rajasthan’s debt has increased by a whopping Rs 1,599.9 billion between 2012-13 and 2018-19, as per Reserve Bank of India’s report on state finances. That’s a 96% increase. Liabilities which stood at Rs 1,186.3 billion in 2012-13, rose to Rs 2,786.2 billion in 2017-2018 (revised estimates), and were estimated at a staggering Rs 3,134.6 billion in the 2018-19 Budget Estimates. (1 billion = 100 crore)

The loan burden of the state increased from 24% of the Gross State Domestic Product (GSDP) in 2012-13 to 33.2% (Revised Estimate) in 2017-18. For the current year, it is estimated at 33.6% of GSDP.

The government has, rather weakly, tried to argue that the “amount has exponentially increased since 2015 after central government had introduced Ujwal DISCOM Assurance Yojana (UDAY) that forced the state government to bear some amount of DISCOM loans”. However, that cannot explain the steep rise in borrowings. In any case, the central government is controlled by the same party and passing the buck satisfies nobody.

As a result of this mounting debt, interest payments by the state increased to Rs 214 billion in 2018-19. These include interest on loans from the Centre, on internal debt [market loans and National Social Security Fund (NSSF)] and on borrowings from small savings, provident fund, and others. Internal debt itself stood at Rs.172 billion this year on which Rs.97 billion was due as interest payments. The RBI figures suggest that the government has to fork out as much as Rs 4 billion as interest to the Centre in the current year. It appears that there has been an uptick in borrowing this year, perhaps to help the government tide over the excess spending in an election year. This is a typically myopic policy since the debt will have to be squeezed out of the people in the coming years.

With the change in the government five years ago, there was also a change in policies in general, specifically towards the social sector. The incumbent government seems to be relying more on technology like almost mandatory use of Bhamashah and Aadhaar cards for availing the benefits of government schemes, use of point of sell- POS- machines for PDS. It is also tilting towards the privatisation or PPP of services like health and education, favouring health insurance and not free medicine and diagnostic schemes, and focusing more on private sector-driven industrial and economic growth in general.

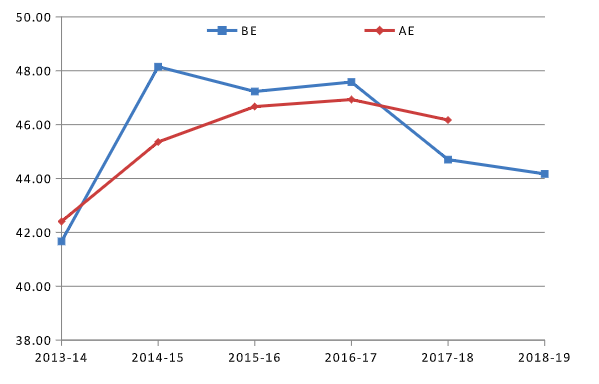

Budget allocations for social sectors increased in the first year of the Raje government but after that these have slid down. (See graph below) Actual expenditure has been lower and that too has plateaued. Social sector spending includes health and family welfare, education, urban development, urban housing, water and sanitation, welfare of SCs, STs, OBCs and minorities, labour welfare, social welfare, nutrition and rural development.

Social Sector Share in Total State Budget (%)

The big jump in 2014-15 is primarily due to routing of allocations for Centrally Sponsored Schemes (CSSs) through state budgets, explained Nesar Ahmad, coordinator of the Budget Analysis Rajasthan Centre (BARC), speaking to Newsclick.

“The decision of Union government to route support provided for the CSSs through the state budget, which earlier used to bypass the state budget and go directly to the accounts of the agencies implementing the CSSs, in most of the cases. From 2014-15, this amount is now included in the Rajasthan state budget and it has increased the reported allocations of the CSSs and social sector as whole as most the CSS are part of the social sector,” Ahmad said.

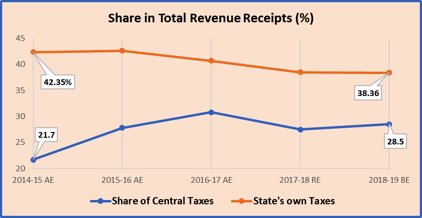

“Union Government’s acceptance of the recommendations of the Fourteenth Finance Commission (FCC) which said that the union government should increase the share of states from 32% to 42% in the total divisible pool of the central taxes. With this, the transfer from union to state under the head “Share in Central Taxes” has increased, while other transfers (like grants and central allocations for the CSSs) has declined,” he added.

Notably, the state’s own tax revenue is declining. As a share of total revenue receipts, it went down from 42.35% in 2013-14 to 38.36% in the Budget Estimates of 2018-19.

Source: Collated by BARC from the State Budget Books

What does declining own-tax revenue share mean? Most of the own taxes are derived from property, stamps and registration, vehicles, sales of goods and services, and state GST. While GST has increased, clearly concessions given to corporates and real estate developers and mining companies have deprived the state govt. of enough taxes. This is what has caused the increase in borrowings in order to meet expenditures. As collateral damage, funding for social sector has not been commensurate to needs in a socio-economically backward state like Rajasthan.

Underutilisation of the Budget Allocations

Another important trend here is underutilisation of the allocated budget, particularly in the year 2014-15. In 2014-15 the actual expenditure was more than 16% lower than the allocation for the total of the social sectors. This under spending has reported across all the sectors included in the social sector. The underutilisation was mostly due to the lower transfer from the Union government under the grants in aid (which includes share of union government in the CSSs).

It declined not only in percentage to total revenue receipt of the state government from 26% in BE to 21% in actual in 2014-15 but also in absolute term from Rs. 27.7 thousand crores to Rs. 19.6 thousand crores. The trend of underutilisation of budget, however, continued in later years except 2017-18 for which we only have revised estimates and not the actual expenditure data.

Lower allocations to CSS

In the important rural jobs guarantee scheme (MGNREGS), state govt. spending has seen a sharp decline of about 36% since 2014-15: from Rs.3,290.56 crore to Rs.2,084.19 crore. This is the key scheme that provides some employment to the rural poor, in an otherwise bleak jobs landscape. Cuts in this scheme have disastrous consequences for lakhs of people across the state. Moreover, delays in payment of wages and authentication problems have further killed the scheme.

There have been cuts in spending this year in two crucial schemes, Indira Awas Yojana and the National Health Mission. In Indira Awas Yojana, allocation in 2018-19 was Rs.1,328.64 crore compared with Rs.5,507.25 crore spent last year as per revised estimates. That’s a cut of over 75%. Similarly, the allocation for National Health Mission has been cut by over 13% this year compared with last year.

Decline in the budget for state government schemes

There is not only a visible decline or no significant increase in the budget for various CSSs, there is also a decline in allocations and expenditure under various state government schemes, more notably under popular schemes like Chief Minister Free Medicine and Free Diagnostic Schemes. Budget allocation for free medicine and free diagnostic schemes was Rs. 382.96 crore and Rs. 119.37 crore, respectively, in 2014-15 BE. It came down to Rs. 360.36 crore and Rs. 105.50 crore in 2016-17 BE.

There has been a slight increase in Mukhyamantri Nishulk Jaanch Yojna’s budget this year from Rs. 156.54 crore in year 2017-18 BE to Rs. 185.39 crore in 2018-19 BE. The little higher increase can be seen in Mukhya Mantri Nishulk Dava Yojna as it has increased from Rs. 416 crore to Rs. 557 crore.

Less allocation and underutilisation under these crucial schemes is certainly going to decrease the people’s access to these schemes. But the government’s focus in health seems to be more on promoting insurance-based support to the patients and less on universal primary health care schemes.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.