Urging US and China to Halt Trade War, IMF Admits no Culpability

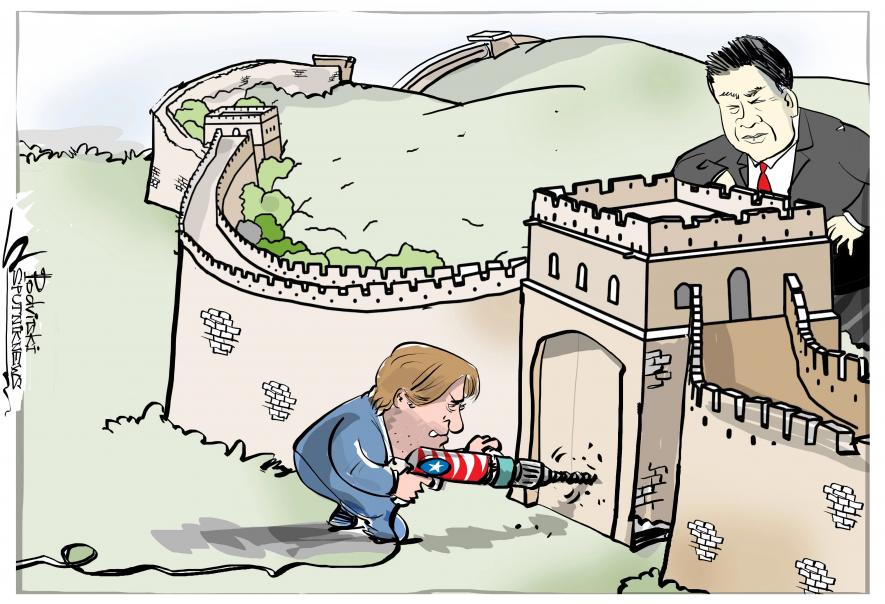

The trade war between US and China is continuing, which, IMF warns, poses a significant threat to global growth. (Image: Sputnik News)

The IMF and the World Bank has urged the US and China last week to not disrupt the world trading system by further engaging in the Washington-declared trade war, warning that the negative consequences of it will be felt not only by the two countries, but globally. Soon after the warning, there appeared to be a sudden decline in investor confidence, as the Wall Street suffered the biggest losses in the last eight months, following which share markets in Asia plummeted to a 19-month low.

US has been demanding China to change its intellectual property rights (IPR) policies in line with the interests of America and its corporations, to reduce the subsidies the Chinese state has been providing for high-tech industries, and to open up those industries which it regards as “commanding heights of the economy”, to foreign competition.

China has refused so far to toe the line, for it regards these subsidies, its IPR policies and state-control over certain industries as crucial for building up its industrial and technological capacity, in a world where the developed countries – who have already advanced their industrial/technological capabilities with the support of massive state expenditures – have a competitive edge in the international market.

This frustration of the US is further compounded by its trade deficit of over $375 billion with China in 2017, resulting from the fact that US exported only $130 billion dollars of goods to China while importing $506 billion worth of goods that year.

A significant portion of these imports constitute products whose assembly has been outsourced to China by American manufacturers themselves, in order to cut the cost of production by hiring cheaper labour in countries with a lower standard of living – a practice very much encouraged by the IMF-sanctioned neoliberal policies, known otherwise as the “Washington-consensus”. The finished products that arrive back to the US are counted as imports from China.

Despite raising the tariffs on Chinese washing machines, solar cells, steel, and aluminium since the beginning of this year, by July, American trade deficit with China for this year had already reached $222.6 billion.

Trump Blames China’s “Unfair Trade Practices”

Instead of acknowledging the role “Washington-consensus” has played in generating this trade deficit by facilitating the flight of jobs and manufacturing capital from US in search of cheaper and more ‘flexible’ labour; the Trump-administration, blaming China’s “unfair trade practices” for this situation, has declared a trade war against the country.

The opening salvo was fired in July with an imposition of 25% tariff on $50 billion worth of goods imported from China, including a range of electronic products, parts of aircrafts and medical devices. Accusing the US of waging “the largest trade war in economic history”, China retaliated with 25% tariffs on an equivalent amount of goods imported from the US.

Another 10% tariff – set to increase to 25% by the end of this year – was imposed on an additional $200 billion worth of imported goods from China last month, following which China retaliated with an average of 7% tariffs on another $60 billion worth of US goods.

Considering the additional tariffs imposed since July, the IMF on Tuesday revised its previous economic growth projections for 2019. The forecast for the US economic growth rate in 2019 has been reduced from April’s prediction of 2.7% to 2.5%, and that of China has been reduced from 6.4% to 6.2%.

Explaining why the American economy’s growth forecast for this year has not been revised, the IMF’s latest report stated, “In the United States, the momentum is still strong as fiscal stimulus continues to increase, but the forecast for 2019 has been revised down due to the recently announced trade measures, including the tariffs imposed on $200 billion of US imports from China.”

Neither has the forecast for the Chinese economy been revised for this year. The central bank of China has reduced four times this year the minimum fraction of deposit a bank is obliged to hold in reserves – thus, facilitating an easier availability of credit to cushion the impact. However, both economies are not likely to be able to maintain the stimulus package at levels high enough to offset the damage throughout next year, which is when the full economic impact of the recently imposed tariffs will be felt.

The impact will be even greater if the plan floated by Trump administration of imposing 25% tariff on another $267 billion worth of Chinese goods is followed through, erecting tariff barriers before virtually all of Chinese imports into the country. Further, the administration is also planning to impose the same tariff of 25% on imports of all cars and car parts from all countries, potentially opening another front by dragging Europe – especially Germany – into the trade war.

The Worst is Yet to Come

Should the Trump administration implement these plans, and should both China and Europe retaliate – China by subjecting all its US imports (worth about $130 billion dollar) to 25% tariffs and Europe by subjecting all US automobile industry imports to the same tariff – the drop in the projected growth rate of American GDP will not be mere 0.2 %, but over 4 times higher, at 0.9%. Even after recovering from the immediate shocks, by 2023, the US economy is predicted to remain about 0.4% below what the IMF’s forecast would have been in absence of the trade war.

These figures are the result of a simulation exercise run by the IMF, using models to assess not only the direct impact, but also the indirect impacts resulting from reduced investor confidence and increasing financial unpredictability. Results from this exercise also predicts that decline in China’s GDP, under such circumstances, will be 1.6%. However, the long-term impact on Chinese economy is forecasted to be less than half of that on US. By 2023, once its economy has re-aligned itself based on the new trade-environment, the simulation’s result suggests that China’s GDP too will remain below what it could have been without the trade war, but only by less than 0.2%. The GDP of the Euro zone, it is expected, will be decline by about 0.6% next year, although no long-term impact is forecasted, with full recovery predicted by 2023.

But the economic impacts of this trade war will not be limited only to US, China and the Euro zone. A large number of developing countries known as “emerging markets” have economies which – in pursuit of IMF’s diktat of “free trade” guided by the so-called “principle of comparative advantage” – have become heavily dependent on exports to the US. Even in the absence of tariffs standing in the way of their exports, an overall decline of US GDP will result in a decline in demand for their products, thus affecting even those countries which had no participation in the trade war.

Further, given the crucial role China plays in the global value chains by serving as the trading bridge between the developed and developing countries, a decline in China’s GDP and its access to the American market would also affect the emerging markets. According to the simulation, the emerging markets will suffer a GDP loss of 1.2%.

“The risk that current trade tensions will escalate further—with adverse effects on confidence, asset prices, and investment—is the greatest near-term threat to global growth,” the IMF’s economic counsellor Maury Obstfeld had warned last month. This month’s report revises the global economic growth forecast for 2019 as 0.2 percentage points down, from 3.9% as predicted in April to 3.7%. Taking into account the additional tariffs yet to to be imposed and its consequences, the world’s GDP by next year, as per the simulation, will drop to around 3.1%, and see an almost recovery only by 2023.

However, in the five year period before the recovery, the changes that countries will be forced to make to its economic model in order to adjust itself to the new trade environment, and the resulting global increase in the mistrust over the reliability of the current trading system, may possibly hold the potential to mark the beginning of the end of the current trade regime.

Fearful of these consequences, the IMF’s managing director Christine Lagarde urged Washington and Beijing to “De-escalate. Fix the system. Don’t break it.” While urging the US to approach the WTO to resolve its dispute with China over the latter’s IPR policies and its refusal to open up the industriesto foreign players, she also sought to soothe China by suggesting that the WTO might need to make some accommodations for China over its subsidies.

The free movement of goods and capital, along with increasing austerity, privatization and ‘labour-flexibility’, is the package prescribed by “the system” that Lagarde is urging the US not to break. This has left an average American worker today with a lesser hourly wage, inflation-adjusted to 2018, than they had in 1974.

While Trump may not be keen on heeding Lagarde’s cry for preservation, he is far from taking any measures to see through a systematic reform of the international economic order necessary to address these grievances of American workers. Instead, by singling out China as the enemy of the American worker, Trump has declared a reckless economic war, the brunt of which will be borne by workers not only in China and the emerging market, but also those in the US.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.