Questioning the Death of Coal-IV: Hype and Hope on Renewable Energy

This is the fourth part of a five-part series that examines the global and Indian commitment to transitioning from fossil fuels to clean energy, on why coal is here to stay in India and how replacing fossil fuels with renewables, which are far from clean, will lead to an equally sinister extractive disaster.

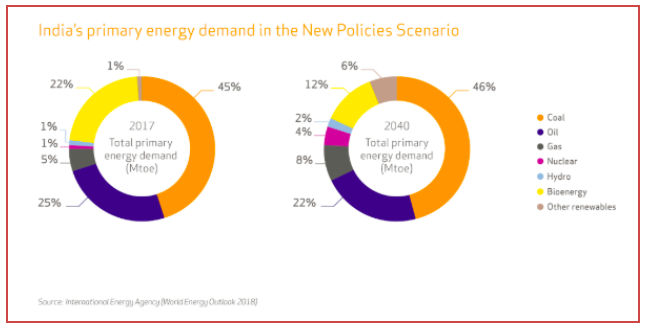

India’s green score is critical for both domestic and global green energy aspirations. New Delhi will overtake Beijing as the largest growth market for energy by late 2020s with its energy consumption growing by more than 4.2% per annum, the fastest among all major economies of the world, according to BP Energy Outlook 2018. It is important thus that India progresses towards its decarbonisation goals.

Yet, the current policy push is for coal as the centerpiece of its energy system. Coal will fuel two-thirds of its electricity generation. For fossil fuel aficionados, New Delhi’s fondness for coal is necessitated by its $5trillion economy dream, howsoever improbable, and its abysmal per capita power consumption. It is at 0.6 tonnes of oil equivalent (toe) against the global per capita average of 1.8 toe.

There are two sides to the emergent question: can India afford the green luxury or should it give itself to take its time to deliver on the renewable promise (see chart on India’s Paris Agreement commitments). The key statistics driving India’s actions are:

·India’s energy demand will more than double by 2040.

·It will be half that of China, up from less than 30% in 2017.

·Its share of global demand will rise to 11% from 5% in 2016.

·The Economic Survey confirms that India must quadruple its per-capita energy consumption to achieve the human development status of an upper-middle-income country.

Where do renewables and coal, respectively, fit into in this demanding scenario?

Green Growth

To begin with renewables, India promised to become one of the largest Green Energy producers globally with 175 gigawatts (GW) of renewable energy capacity to be installed by 2022: 100 GW from solar, 60 GW from wind, 10 GW from biomass and 5 GW from small hydro power. None of this has any hope of materialising, even as the demand and supply will certainly increase.

The quadrupling of the power sector by 2040 means investments up to $2 trillion. Worldcoal.org agrees that large-scale power generation will be at the heart of India’s strategy to electrification, with coal-fired power output forecast to almost double by 2040.

Coal will power up the growing cities, industries and businesses that are key to India’s economic growth, it says. However, “solar will support energy access in rural communities”. Significantly, half of the world’s 10 largest solar parks currently under construction are in India, says the Institute for Energy Economics and Financial Analysis.

Western analysts plugging green optimism insist that it is already cheaper to build new renewables than to build new coal plants, in all major markets. The argument is that:

·Over half the existing global coal fleet is more expensive to run than building new renewables.

·By 2030, it will be cheaper to build new renewables than to run existing coal — everywhere, which means that investors stand to lose over $600 billion on doomed coal plants.

Counterpoint

For starters, this argument seems to be largely based on the US and EU’s experience with their aged plants and diminishing energy demand. Should their argument be correct, why would Japan, a G7 country, not place its faith on solar, wind, geothermal, and hydropower generation, which provide a mere 17% of its electricity? The renewable space is still ridden with problems seen and unforeseen.

For all practical purposes – policy-level dithering and economics included, coal presents itself as the attractive ally, with renewables falteringly contributing along the way. Globally, in a post-COVID regime, government subsidies are still driving plans to build nearly 500 GW of new coal-fired power plants. The bill for this is set to top $630 billion, says a Carbon Tracker assessment.

In Japan’s case, the primary constraints include land shortage, which prevents the deployment of large-scale wind and solar plants. There are complications with power market rules that have also kept solar and wind prices high in Japan. Clearly, there are issues that outweigh the green gains for the country that has already taken a massive Fukushima hit and has an enormous amount of catching up to do.

Like New Delhi, Tokyo realises that it cannot put its eggs in the renewables basket if it wishes to meet its economic and climate goals at the same time. Both countries are prepared to face global and domestic censure over their carbon-driven future.

Cut to a real-life experience. Vikram Solar, one of India's promising solar power producers, threw its hands up in despair in February 2020: its bane, policies that are not quite working.

"The domestic solar manufacturing industry has long been advocating for a level- playing field. However, a slowing economy, inconsistent policy implementations, unfavourable trade policies, and liquidity crises have impacted the sector severely in the past few months. Moreover, recent global events have also impacted supply chains," the company said in a press release as it laid off 320 employees at a West Bengal manufacturing unit.

Both solar and wind auctions of 2018 and 2019 ran into heavy weather on account of

·High tariff bids offered by developers

·Too low upper tariff ceiling set for tenders (In May 2019, the several-times delayed 1-GW Gujarat solar photovoltaic tender was undersubscribed by 700 MW)

·Renewables suffering a material waning of developer interest and a sizeable 26% of the 64 GW of projects auctioned by the Centre and states received no or lukewarm bids, while another 31% faced delays in allocation after being tendered, said Crisil in September 2019.

It was not till December 2019 that there was some improvement in solar tendering activity, with one major auction. Indeed, the government has been as much to blame with its inability to understand the business of sustainable tariff. A 25% safeguarding duty on solar product imports from China and Malaysia in July 2018 falling progressively to 15% over a two-year period, was meant to support domestic manufacturing of solar equipment.

While, this was in line with the government’s ‘Make in India’ campaign, a Castlereagh Associates report on the renewables space in India points out: “China and Malaysia have historically accounted for around 90 per cent of cell imports coming into India and domestic capacity is too limited at present to pick up the slack. As such, project development costs are likely to rise as component costs increase. Or investors will hold off committing to projects until the duties have expired”.

Other concerns are common to renewables across the board, such as grid bottlenecks with integration issues. In India, the technical problem apart, electricity trading between individual states is resisted and grid curtailment has taken the wind off the wind sector’s sails. The increase of inter-state trading and the government’s continued focus on investment into the transmission and distribution network will help mitigate these issues.

The jury is out on whether the rapid decline of renewable energy tariff, that has been a key driver of sector growth, can be sustained. Developers cannot recover costs hereafter. “Establishing viable tariffs, which are attractive to developers but also not unacceptably high for distributors (who purchase the electricity), is increasingly challenging”.

Crisil’s September 2019 projections are important under the circumstances. India’s installed capacity in renewables could increase by just 40 GW to 104 GW by fiscal 2022 from 64.4 GW in fiscal 2019, it says “because of enduring policy uncertainty and tariff glitches”. That would be a good 42% short of the government’s target of 175 GW; a far cry from the projected doubling of wind capacity and solar photovoltaics (PV) four-fold increase between 2018 and 2024. It holds policy blues and tariff caps responsible for India falling well short of the 2022 goal.

Coal Comfort

Where does this leave the future of Indian coal? To reiterate, that will be determined by

·The prevailing mining economics and young coal plants. Mining in India is clearly set for a boost now, even though analysts like Carbon Tracker say that the cash flow of 95% of the world's coal plants (some 7,000 of them) was suspect and that 59% of China's 982 GW coal-fired capacity was running at an underlying loss, with a further 206 GW in the pipeline.

·Government’s comfort levels with persisting with coal as the base-load power while allowing renewables on the sidelines, which seems to be the India story. This is despite credible assessments that 51% of India's operating coal power costs more to run than building new renewable capacity. For the US, this was 47%. In the EU, 62% of existing coal power ran at an underlying loss and was subsidised by the government.

·Emerging technologies that help coal get cleaner, such as carbon capture, utilisation and storage (CCUS). [CCUS is an essential solution that prevents CO2 from being released into the atmosphere. Enhanced co-operation on CCUS between governments, industry and investors will be key to drive commercialisation and deliver the Paris Agreement goals.]

·The underappreciated risks facing renewables expansion, which comprise promised policy support that does not materialise.

There is no gainsaying that India is indubitably one of the largest renewable energy markets globally. Yet the scene is marked by rhetoric that is “overwhelmingly positive, propagated by frequent announcements regarding record low tariff prices, high installation rates and government tendering plans”.

It is also marked by renewable energy performance that is far removed from the promise. Pious exhortations from analysts like Carbon Tracker that "there really needs to be a push on governments to not just look at their existing fleet but also to cancel coal projects in the pipeline, or risk wasting over $600 billion in capital costs and missing out on the Paris temperature goals”, remain just that: pious exhortations.

(To be continued)

The writer is a freelance journalist who has been writing on coal from the 1980s. The views are personal.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.