Questioning the Death of Coal-V: Reconciling Renewables Versus Coal Numbers

This is the concluding part of a five-part series that examines the global and Indian commitment to transitioning from fossil fuels to clean energy, on why coal is here to stay in India and how replacing fossil fuels with renewables, which are far from clean, will lead to an equally sinister extractive disaster.

Carbon Tracker, researching the impact of climate change on financial markets, avers that trends in the US, China and India are not far behind those obtaining in the European Union in terms of renewable growth, thanks to “excellent renewable energy resources, low capital costs, and least-cost policymaking.”

In markets where this threshold has not been crossed, like Turkey and Japan, it blames unsupportive policy and unreliable markets. (see box Carbon Tracker’s cost analysis).

Is this assessment fair, at least vis-à-vis India?

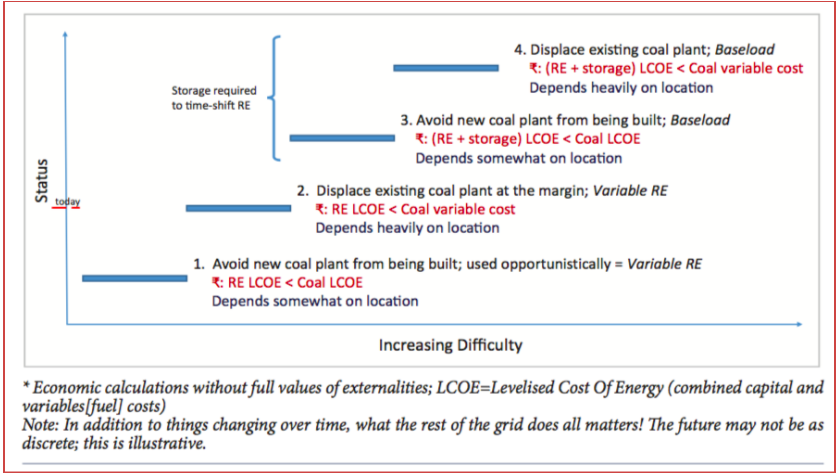

The ladder of competitiveness for renewable energy versus coal, created by Rahul Tongia in 2018, for Brookings India, delves into the pros and cons and the increasing levels of difficulty for renewables to replace coal. Obviously, the transition will neither be smooth nor guaranteed. It will happen over time and depend on the fraction of penetration by VRE. (see chart on increasing difficulty)

Renewable Energy Competitiveness

Tongia explains the transition in four steps for increasingly renewable competitiveness, based on different cost components of coal – fixed (capital) and variable (fuel), insisting that the future will not be as clear cut with a great many imponderables. Renewables have fixed costs (no fuel costs) and once built should always operate. “It is a distortion that load despatchers who balance the grid in India today see only incremental variable costs of coal and compare these with the total (fixed) costs of RE”.

For coal, fixed costs are paid regardless of usage under standard power purchase agreements (PPAs), based on plants being available. Renewables do not enjoy this same framework. The four steps of competitiveness are based on just the fixed versus variable costs of coal and are not reliant on the distortion of power purchase agreements or PPAs, says Tongia.

Carbon Tracker’s cost analysis

The long-run, marginal cost (LRMC) of energy from a power plant (value of energy produced minus ongoing costs of running the plant – fuel costs, variable operating and management costs, fixed O&M costs – plus any accruing carbon costs and the levelised cost (LCOE), or value of energy produced minus running costs (LRMC) and the capital cost of building it, are swerving in favour or renewables, according to Carbon Tracker.

It insists that on the basis of levelised cost, about 60 per cent of the global coal fleet has a higher LRMC than the LCOE of new renewable energy. This trend is most pronounced in the EU with its strong carbon price supporting investment in renewable energy. This does not reflect in global trends; definitely not Asian trends.

There are collateral factors impacting renewable energy economics. The overhang of under-utilised coal capacity and the intractable issue of a time-of-day based surplus are two prime factors. Tongia suggests that states should be committing to buying power by time of day to “enable the rise of peaking power, where one plans for energy at a portfolio level instead of capacity in static blocks”.

Tongia believes that time of day wholesale pricing and flexible markets would also spur storage solutions, smart grids (for both peak management and demand response)”. Indeed, the renewable challenge is quite nettlesome at the state

level, “especially given the concentration of RE potential in a handful of states who today bear costs and risks disproportionately”.

The rise of non-state bids, where power bypasses the state and directly connects to the interstate transmission system, does reduce the renewable concentration on a few states. However, “it has limits since ultimately the counter-party risks from other (further) states remains the bottleneck, any short-term benefits notwithstanding”.

Far-Fetched Targets

Under the circumstances, the projected doubling of wind capacity and solar photovoltaics (PV) four-fold increase between 2018 and 2024 does seem far-fetched. In September 2019, a Crisil report, ‘REturn to uncertainty’ said that policy blues, tariff caps mean capacity additions in India’s renewable energy space are set to fall well short of the 2022 goal.

In India, the marginal operating cost of incremental power generated in existing power plants courtesy improved plant load factor, which is rather low in India in general, is a factor in favour of coal, even though it is limited to the variable cost of coal. While conceding that over the long term, coal might get phased out, Partha Sarathi Bhattacharyya, former chairman, Coal India, points out that “This marginal cost of incremental power generated is likely to remain less than the cost of renewable power even after absorbing the burden of Clean Environment Cess (CEC) of Rs 400 per tonne plus the incommensurately high rail freight for power plants located away from coal fields”. That is something to think about.

Logically, the cost comparison should net out the contribution of coal to CEC amounting to over Rs 30,000 crore annually. “If this done and the marginal cost of power plants close to coal fields are considered, the coal-based power plants will remain competitive vis-à-vis renewables in India for at least another two decades” he predicts. Besides, there is the capex involved in replacing coal-based power capacity by renewable (2.5 GW per 1 GW because of PLF differential), which makes it rather prohibitive.

Therefore Coal

Under the circumstances, there was little surprise that Coal India’s capital outlay was up 18% to Rs 9,500 crore in the 2020 Union budget and that government has gone in for big bang coal commercialisation. The coal ministry has an overall capital outlay of Rs 18,467 crore, a marginal increase over the revised estimate for the last fiscal at Rs 18,121 crore. The capital outlay for lignite miner NLC India for 2020-21 is Rs 6,667 crore and that for Singareni Collieries is Rs 2,300 crore.

Significantly, there is a Rs 700-crore allocation under “Exploration of Coal and Lignite”, which indicates that the focus will be on preliminary drilling to assess coal availability by the Central Mine Planning and Design Institute Limited. This is over and above the robust project pipeline for Indian coal.

The Global Energy Monitor talks about India having nearly 37 GW (gigawatt) of coal capacity under construction and another 49 GW in early stages of development as of July 2019. This represented the second largest coal project pipeline globally, after China. No amount of pressure from climate policies targeting coal will make an iota of difference here. The black diamond will continue to stay at the commanding heights of India’s energy regime.

Carbon Capture

Clearly, the green pursuits must look for cleaner coal with carbon capture. The MIT study on the future of coal steers clear from the naivete of green optimists and examines the continued role of coal as an energy source but in a world where constraints on carbon emissions are adopted to mitigate global warming. It believes that governments will be moved to implement measures to restrict CO2 and other greenhouse gas emissions.

“Indeed, the challenge for governments and industry is to find a path that mitigates carbon emissions yet continues to utilize coal to meet urgent energy needs, especially in developing economies. The scale of the enterprise is vast”. By conservative estimates, India’s coal-fired power plants will need $10 billion and raise tariff by at least a tenth to meet the clean air standards committed to, according to a 'Report on India’s Energy Transition: The cost of meeting air pollution standards in the coal-fired electricity sector' by the International Institute for Sustainable Development and the Council on Energy, Environment and Water.

This estimate comes four years after the standards were set and two years after the initial deadline to comply was missed, which indicates the state of affairs vis-à-vis commitment to cleaning up the air. Will the COVID-19 assault shake things up? Certainly there will be global pressure to do so. Yet, not even the optimist is optimistic.

The report concludes: “The poor history of enforcement and compliance monitoring of regulations and notifications pertaining to pollution standards has meant that the industry continues to drag its feet, despite clear timelines being specified for each plant. This is further exacerbated by the fact that upfront costs are high and the cost recovery process is not clear”.

Cleaner coal is clearly the best future the hapless Indian can hope for but even that future is far from clear.

Finally, there is a massive worry around renewable energy. If renewable energy is to replace coal, it will demand massive increase in material extraction for solar and wind utilities to produce 7 terawatts of electricity by 2050, which can power half of the world’s economy. Double it and the need is for 34 million tonnes of copper, 40 million tonnes of lead, 50 million tonnes of zinc, 162 million tonnes of aluminum, and no less than 4.8 billion tonnes of iron.

The numbers are nightmarish. For neodymium for wind turbines will need a 35% increase in extraction from current levels. Silver (solar panels) extraction may have to increase by 105%. Indium (solar technology) need will more than triple and could end up skyrocketing by 920%. Storage batteries will mean means 40 million tonnes of lithium, 2,700% increase over current levels of extraction.

Replacing the world’s projected fleet of a couple of billion vehicles will demand an explosive increase in mining: global annual extraction of neodymium and dysprosium will go up by another 70%, annual extraction of copper will need to more than double and cobalt will need to increase by a factor of almost four from now to 2050.

Climate change then does not remain a matter of changing how mankind produces energy but how it reduces energy needs.

It demands a new kind of civilisation, considered from any perspective -- of equity, ethics, ecology or economics.

(Concluded)

The writer is a freelance journalist and has been writing on the coal sector since the 1980s. The views are personal.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.