The Great Petro Robbery

Since the prices of petroleum products were deregulated some years back and supposedly “linked” to markets, the central government has weaponised this to simply impose an indirect tax burden on the people.

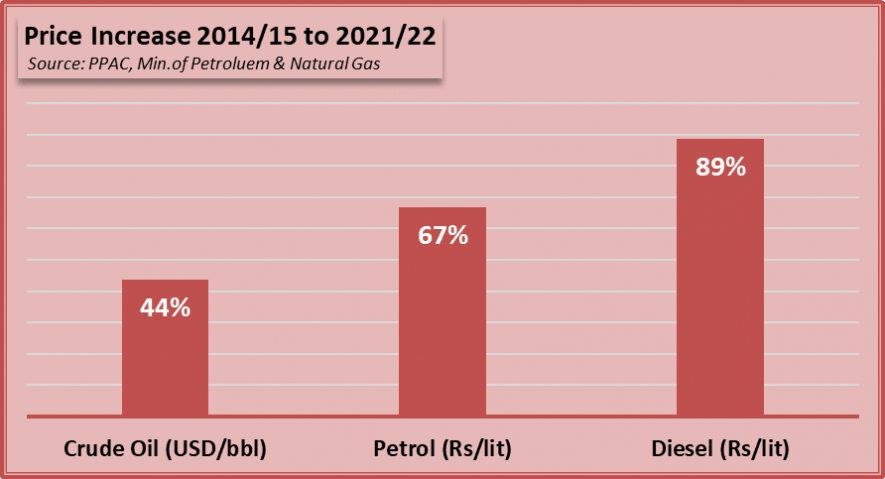

Take the four big metros: Delhi, Mumbai, Kolkata and Chennai. On an average, petrol prices have increased from about Rs 58.91 per litre in 2014-15 to Rs 98.26 on June 15, 2021. That’s an increase of nearly 67% in seven years. Similarly, average diesel prices rose from Rs 48.26 per litre to Rs 91.01 per litre in the same period – a numbing hike of nearly 89%. [See chart below]

The full list of daily prices going back over the years is available with the Petroleum Planning and Analysis Cell under the Ministry of Petroleum and Natural Gas.

India meets most of its petroleum products needs by importing crude oil in a certain combination from other countries and then refining it into various products including petrol, diesel, LPG, and a host of other useful chemicals. It has been often argued that domestic prices are increasing because of rising global prices of crude oil. Nothing could be further from the truth.

As the chart above shows, crude oil (Indian basket) prices increased by about 44% in the seven years past – from an average of $46.59 per barrel in 2014-15 to $66.95 per barrel in May 2021-22. Yet domestic prices increased much more, indicating that the sky-high prices of petrol and diesel have nothing to do with international prices of crude oil.

Then what is the reason behind these high prices? It is the ever increasing tax on production of various petroleum products that the government of India imposes on the oil marketing companies. These taxes include: central excise duties, integrated goods and services tax (IGST), central GST, customs duties, etc. There is also a cess on crude oil. But the bulk of tax is collected by the government in the form of central excise duties.

Massive Increase in Excise Collections

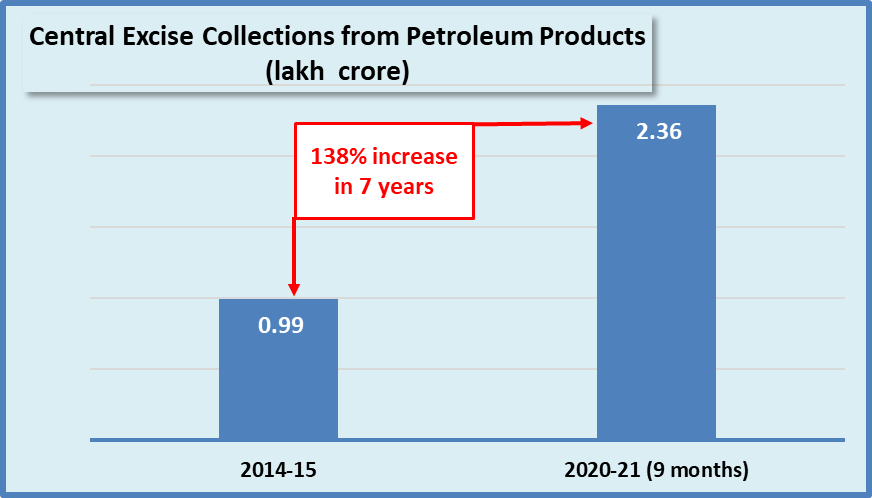

Central government’s revenue from excise duties on petroleum products has increased by a jaw dropping 138% since 2014-15, as the chart below shows. Note that for 2020-21, complete data is not yet available. Only nine months data has been published by PPAC.

In 2014-15, when Prime Minister Modi took the reins of power, excise collections were just short of a lakh crore rupees – Rs 99,068 crore to be precise. In 2020-21, till December, the same collections had jumped to Rs 2.36 lakh crore! That’s an incredible increase of 138%. For the Modi government, taxation of petroleum products has become a golden goose.

Needless to say, that it is the people of the country that are paying this increased tax. Petrol and diesel are primarily consumed for transportation needs. They drive trucks and railway engines, besides being used for public and private transport of people. Also, diesel is widely used by farmers to run generator sets for pumping water for irrigation of fields.

Also read: Fuel on Fire: After Mumbai, Hyderabad Sees Rs 100/litre Petrol After Price Hiked Again

Transporters do not absorb the increases in petrol or diesel. They simply pass it on to their clients. So, if a truck is transporting vegetables or pulses or cereals or any other commodity, an increase in prices of the fuel is passed on to traders and producers, who in turn pass it on to the final consumers. It is estimated that in the last six months only, increase in petrol/diesel prices has translated into 10-15% rise in commodity prices.

Some have tried to argue that bigger excise collections are because of increased consumption of petroleum products and not so much because of excise rate hikes. This is not true – consumption has gone up by merely 29% between 2014-15 and 2019-20 (the last year for which data is available). After that it wouldn’t have increased much because most of 2020-21 has gone in the pandemic which saw a full lock down and complete stoppage of trains and a large segment of road transport. So, consumption couldn’t have increased.

State Taxes Are Not As Onerous

Apart from the taxes imposed by the central government, there are a few taxes that each state government also imposes, which is why prices of petrol and diesel vary from state to state. These include state GST, VAT, octroi, entry tax, etc. Some have tried to suggest that it is the state government’s taxes that are responsible for the high prices. This also is not correct.

According to the data available with PPAC, state tax revenue from petroleum products increased by 37.5%, from Rs 1,60,526 crore in 2014-15 to Rs 2,20,841 crore in 2019-20. Clearly, this cannot be the reason for high prices because the central government’s excise collections increased by 125% till 2019-20.

Why Does Modi Govt Increase Taxes?

This is the billion dollar question. In principle, a government can carry out various expenditures mainly on the basis of the revenue it collects through taxes and duties. In a country like India, where there is very high inequality, with a very large number of very poor people, a just and rational taxation policy would mean taxing the rich more in order to serve the people better.

However, the Modi government has turned this upside down. It is providing enormous tax cuts and exemptions to the rich. Then, in order to conserve its resources, it undertakes either expenditure cuts or it imposes additional taxes on the common people.

Also watch: Petrol Prices on Fire: Here's Why

As explained earlier, increasing taxes on petrol and diesel is an insidious way of increasing taxation on a vast number of people. Because of the multiplier effect of hikes in petrol/diesel taxes, a very large number of people end up paying the government more.

Rather than use its resources to reduce the economic burden on the people, the Modi government has reduced the burden on corporate sections by cutting corporate taxes which led to an estimated loss of Rs 1.45 lakh crore to government revenue. It has also granted various concessions and exemptions amounting to Rs 6.08 lakh crore between 2015-16 and 2019-20 (Rajya Sabha Q.No.1656; March 9, 2021). Over Rs 5.9 lakh crore worth of bank loans (mostly to big corporate houses) have been written off in 2018-19 to 2020-21 (Lok Sabha Q. No.2286; March 8, 2021).

It is to make up for this largesse to corporates that the Modi government is squeezing the common people through policies like increasing petrol/diesel prices.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.