The Truth Behind Modi’s Agri Infra Investment

Representational image. | Image Courtesy: The Tribune

On August 9, Prime Minister Modi unveiled a new ‘scheme’ under which Rs 1 lakh crore will be given as loans to farmers’ organisations and entrepreneurs over the next 10 years for setting up cold storages, warehouses, e-marketing systems, etc. Accompanying this announcement was the usual cliched rhetoric about how this will help farmers get “greater value for their produce”, “increase India’s ability to compete on the global stage”, and “herald a new dawn for the agriculture sector”.

The loans, which will get an interest subsidy of 3%, will of course be given by banks. So, all that the government will be spending will be the interest subvention bit. But that’s a moot point.

The real issues are this: how much credit has been flowing into agriculture? How much has the government been spending? And, will more loans help farmers? Let’s look at these issues.

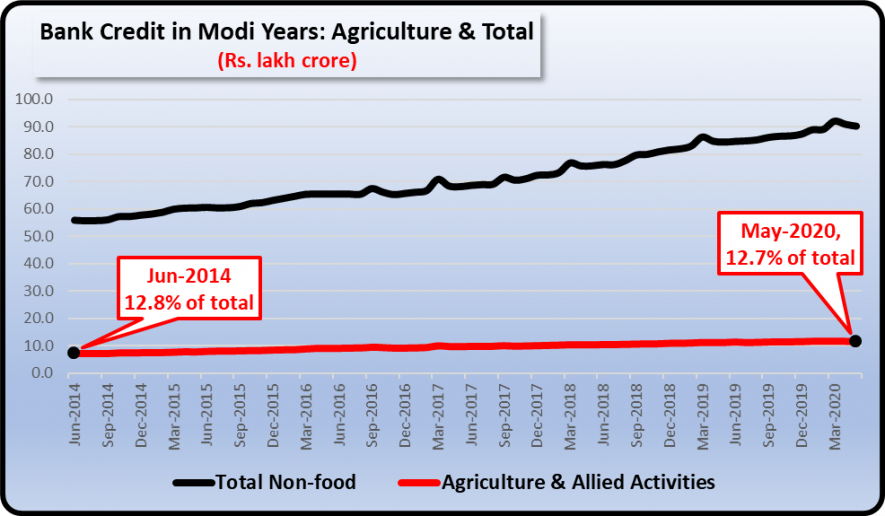

Bank Credit for Agriculture

The chart below, based on data put out by the Reserve Bank of India (RBI), shows that of the total non-food bank loans given out, agriculture (and allied activities) accounted for a mere 13% in May this year. What is striking – and alarming – is that this is virtually the same level as June 2014 when the first Modi government took over power.

So, all these years that the Modi government has been running the show, claiming to be working for doubling farmers’ incomes and so on, the availability and uptake of bank credit has not grown, indicating that investments have been stagnating. This is because investments for infrastructure cannot be done by farmers – either the government does it or private entities do it. But no private entity is interested in investing in say, building canals or mandis or in research. And the government is not willing.

Also, Rs 1 lakh crore that has been announced is about one-tenth of existing credit to agriculture. It’s a drop in the bucket.

Where Is Govt. Spending Going?

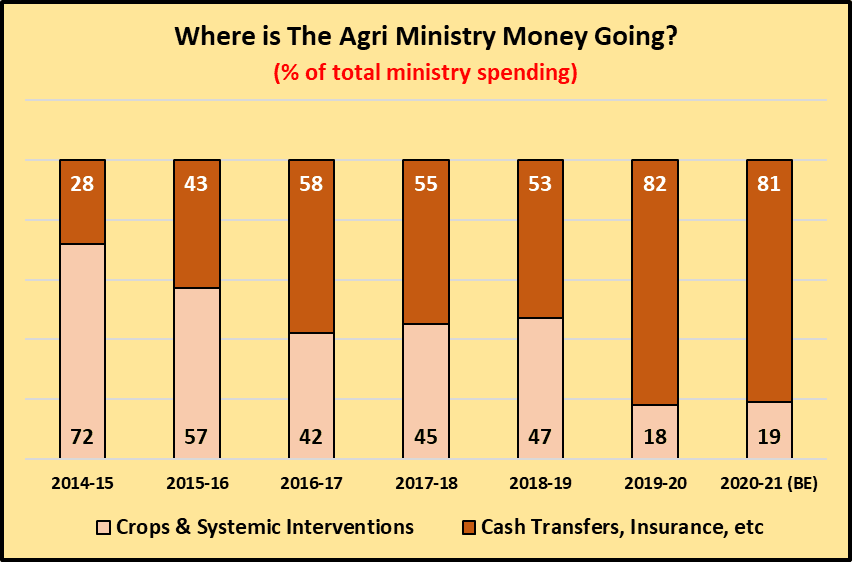

You may ask – what about the government's own spending? As the chart below shows, spending by the Agriculture Ministry was a mere 0.3% of GDP right from 2014-15 to 2018-19. (Data collated by CBGA) Under relentless pressure from farmers’ movements, and with general elections looming in 2019, the government adroitly increased the allocation in the last two years – but only to reach a mere 1% of GDP. This is for a sector that employs over half of India’s workforce and contributes nearly 17% to the GDP!

The story of government spending doesn’t end with this. According to CBGA calculations, of the total money being spent yearly by the agriculture ministry, a staggering 81% was going into cash transfers, insurance premia for the PM Fasal Bima Yojana, interest subvention schemes, etc. Just 19% was being spent on “core” activities, including both crop and non-crop systems, that would strengthen the agriculture sector.

While spending on cash transfers to the besieged farmers is unobjectionable, its paltry nature (just Rs 6,000 per year) and its transient relief show the lack of vision that the government suffers from. As far as the insurance premia are concerned, they are a windfall for insurance companies. As per official information, available for three years (2016-19), the total premium collected by them was Rs 75,772 crore of which over Rs 13,000 crore was collected from farmers while a whopping Rs 63,000 crore was paid by the central and state governments directly to the companies. Notably, the surplus left with the companies after paying out claims was nearly Rs 11,000 crores. This is how the increased spending of the ministry is benefitting not the farmers but the insurance companies.

Real Significance of AIF

There appears to be another goal for this new infrastructure fund: financing private or PPP type entities so that they can get their teeth into the agrarian sector. The road for this had been opened with the recent ordinances that removed government regulations on trade, stocking, and pricing of agricultural produce. Now public money will be used to finance various types of entities ranging from ‘farmer producer organisations’ to straight corporate entities that can build infrastructure according to their own needs and imperatives. This is not a plan to transform agriculture, it is a plan to give the private sector a bite from the agrarian pie.

It is believed by many experts that just building cold chains and warehouses, or having e-marketing will in any case not be of much help since all produce doesn’t need cold chains, and most farmers need ready sales since they can’t afford delays in payment.

Unpacking the new Infrastructure Fund leaves us with the same result as in other grand announcements of the Modi government – big publicity to paltry interventions, that too misguided in conception and favouring the rich, corporate class. It won’t be surprising if some years down the line, it becomes known that this whole agricultural infrastructure house of cards has collapsed.

Also read: UPSC: Why EWS Quota Denies SCs, STs and OBCs Their Due

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.