Amazon Vs Future and Reliance Groups Battle Reveals Lacunas in India’s Retail Industry

Representational image. | Image Courtesy: Business Line

The proposed Rs 24,713-crore deal between Biyani family’s Future Group and Mukesh Ambani-led Reliance Group being delayed by Amazon’s legal battle sheds light on several lacunas in the functioning of the Indian retail industry.

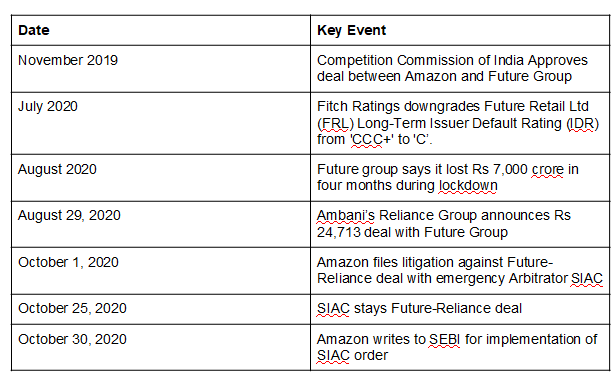

Anticipating litigation from the Jeff Bezos-led Amazon group amid the ongoing tussle involving the three major corporates, on November 3, the Future group approached the Delhi High Court seeking prior notice before an order of any kind being passed against it in petitions or applications that may be filed. The Future Group’s move comes at a time Amazon is reportedly planning to approach Indian courts to seek implementation of a recent order by a Singapore-based emergency arbitrator involving the Future-Reliance deal.

The legal battle is to be centered on a 2019 deal between Amazon and Future. Last year, Amazon purchased a 49% stake in Future Group’s Future Coupons Ltd, an entity that owns about 7.3% of Future Retail Limited (FRL). FRL runs over 1,500 stores in India operating hypermarkets and supermarkets under brands including Big Bazaar, Easyday, Foodhall, HyperCity, FBB and WH Smith. However, in the last few months, Future group was crisis-ridden as it said it had a loss of Rs 7,000 crore in a span of four months during the lockdown imposed due to COVID-19.

On August 29, Ambani owned Reliance Retail Ventures Limited (RRVL) announced that it is acquiring the retail and wholesale business and the logistics and warehousing business from the Future Group’s Future Retail Ltd for Rs 24,713 crore. This came at a time when the debt-ridden Future Group was struggling to repay debt obligations amid speculations that Amazon was trying to acquire a substantial stake in the Group’s FRL after a successful 2019 deal between them.

In a turn of events, On October 1, Amazon filed litigation against the Future Group’s deal at the Emergency Arbitrator, Singapore International Arbitration Centre (SIAC). It claimed that as per Amazon’s existing contract with the Future Group, the Group cannot transact with a restricted list of thirty entities which included Ambani’s entity.

On October 25, SIAC pronounced an injunction order staying Reliance-Future deal.

Following this, in spite of the stay order, both Reliance and Future Groups said in separate statements that they wanted to go ahead with the deal.

Following this, last week, both Amazon and Future Groups have written separate letters to the stock exchanges and the Securities and Exchange Board of India (SEBI) putting forward their arguments which highlight gaps in laws concerning Indian retail markets.

In its letter to the SEBI accessed by the Reuters, Amazon stated that if the Future-Reliance deal "is implemented by completely disregarding the interim (arbitration) award, it will cause irreparable harm and injury to Amazon.” The global e-commerce giant also complained that it “misled shareholders” by incorrectly saying it was complying with its contractual obligations.

In response to this, FRL asked the stock exchanges to not take into cognizance Amazon’s letter to the SEBI or the SIAC order while calling them “misconceived”.

The Future Group is arguing that there are two separate agreements -- one between Amazon and Future Coupon Ltd and the second between Promoters of Future and Amazon. If the two agreements were treated as a single integrated transaction by which Amazon obtained an interest in and rights against Future Retail, then in 2019 when the agreements were executed, there would have been a change in control of Future Retail in favour of Amazon, requiring it to make an open offer to Future Retail’s public shareholders, according to the SEBI (Substantial Acquisition of Shares and Takeovers) Regulations, 2011. No such open offer was made, and thereby suggesting there was no intent by Amazon to consider the two agreements as a single integrated transaction at that point of time,” FRL stated to the exchanges.

“A contractual dispute between the promoters of Future Retail and Amazon cannot restrict or interfere with the authority of the SEBI and the exchanges to approve of the scheme involving the listed entity. To be clear, the emergency arbitrator’s order cannot and does not, in any manner, restrict the SEBI or the exchanges from considering and approving of the scheme,” FRL noted.

While Amazon was negotiating for a bigger deal with the Future Group for more than two years now, which were perhaps delayed due to norms concerning foreign investments in India’s retail markets, the heated competition between Amazon and Reliance in the country’s retail industry shows their larger interest in dominating the country’s massive sector amid unclear legalities.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.