Bank Merger: Will It Help Settle Mounting Bad Loans?

On September 17, the government announced with much fanfare that it had decided to amalgamate three public sector banks – Bank of Baroda, Vijaya Bank and Dena Bank. This would create the third largest bank in the country (after public sector State Bank of India and private sector HDFC Bank by assets) with an estimated gross advances (loans) of Rs.6.4 lakh crore and gross deposits of Rs.8.41 lakh crore. The combined employee strength of the amalgamated bank would be about 85,675 working through a network of 9,489 branches.

The financial services secretary reportedly said that this was “part of efforts to clean up the country's banking system”.

Why the need for clean-up?

Why is a clean-up required at all? And, does merging banks really help in cleaning up?

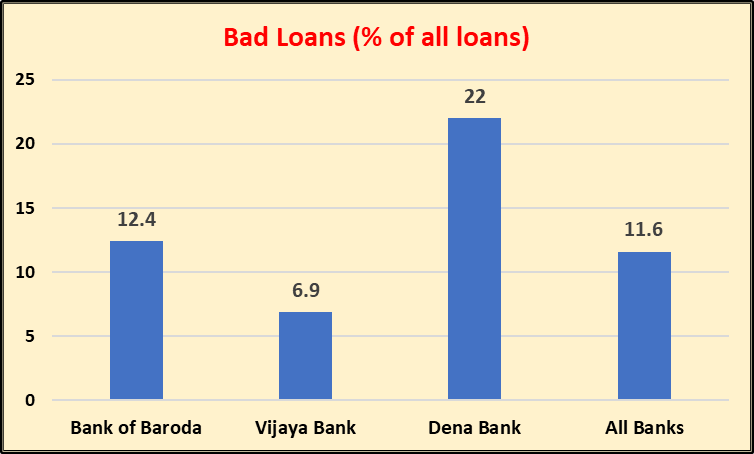

The main crisis in the banking sector is the inter-related problems of burgeoning non-performing assets or NPAs (bad loans) and slowing down of credit outflow. It is estimated that gross NPAs of all scheduled commercial banks hit 11.6% of gross advances in March this year, which works out to some Rs 10 lakh crore approximately. Among public sector banks, the GNPAs stood higher at 15.6%.

The RBI’s Financial Stability Report released in June this year, while giving these estimates, had a dire warning: things are going to get worse. It estimated that while NPAs were going to increase to at least 12.2% by March 2019, in case of severe stress they may even jump to 13.3%. For public sector banks, the GNPAs will increase to 16.3% or even 17.3%.

The out of control NPAs have led to tightening of lending norms contributing to slower credit growth. However, more likely, this connection is because lack of demand and over-lending, coupled with malfeasance by debtors. The NPA crisis is also caused by the slow uptake of credit. It is the doldrums that the economy – mainly created by the large corporate sector - finds itself in that has led to these multiple crises.

Pushing neo-liberal reforms

Seen in this context, the amalgamation of three public sector banks is hardly going to help resolve even the problems of these banks, forget about the larger banking sector issues. What the government is actually doing is a well-known device of pushing neo-liberal ‘reforms’ in the name of resolving this or that financial crisis. These strategies have spectacularly failed in the West (remember the financial crash of 2008) and will continue to fail elsewhere. A look at the financial details of these three banks shows why this is so.

Dena Bank has the GNPAs ratio pegged at a whopping 22%, reportedly the highest in the sector. Dena Bank’s position was so bad that it was put under the Prompt Corrective Action (PCA) framework, which means that it was prohibited from any lending. Bank of Baroda’s GNPAs are 12.4% while Vijaya Bank is the best of the trio with GNPA ratio at 6.9%.

This is not all. Dena Bank’s Credit Risked Assets Ratio or CRAR (the share of its capital to risk-weighted loans) has dipped to 10.6%, quite close to the regulatory limit of 9%. Compared with this, Bank of Baroda’s CRAR is 12.13% while Vijaya Bank’s is 13.91%.

Clearly, a bank in trouble is being merged with two banks that are slightly better off. The hope here is that the exercise will - like a magic wand - make all the bad loans of Dena Bank disappear or at least get diluted within the larger entity. The new amalgamated bank is estimated to have net NPAs of 5.71% compared with the Bank of Baroda’s current 5.4% and Vijaya Bank’s 4.1% because of Dena Bank’s net NPAs of 11.4%. The amalgamated bank’s CRAR will be 12.25%. These figures indicate that the new bank will have financial indicators that will be an improvement as far as Dena Bank was concerned but it will be worse off than the other two merging banks’ respective financials. That’s the effect of tying a sinking ship to the two who are afloat. All get dragged a bit.

Big doesn’t mean better

But considering that even big banks are running high NPAs and are totting up huge losses, what is the guarantee that the new amalgamated bank will be able to tide over the crisis? There is no guarantee, and, if anything, there are tangible possibilities of the whole amalgamated bank too slowly sinking.

The only reason why the Modi government – which has shown itself to be blindly committed to egregiously foolish economic policies (like demonetisation) – continues on this path is because neo-liberal economic advisers think that creating bigger banks is a step forward toward freeing up the banking space in India for private banks to move in. Note that these so- called banking sector reforms include privatisation of public sector banks as the most luscious fruit.

Employees to protest

And, it is for seeing through this game that employees of banks have usually opposed such mergers, as in the case of the recent State Bank merger with five of its linked banks. Employees know that mergers will not only mean retrenchments, cuts in benefits and other losses but they will pave the way for privatisation of the sector.

In fact, bank employees said they will oppose the government’s proposal to amalgamate these three banks.

The All India Bank Officers’ Confederation General Secretary D T Franco was quoted in a report by Hindu Business Line saying that employees were planning to protest in all state capitals under the banner of the United Forum of Bank Unions, and may even take a call soon on going on strike.

Pointing out that the bad loan position of SBI had deteriorated after it acquired five associate banks, C H Venkatachalam, the General Secretary of All India Bank Employees’ Association, told Hindu Business Line that “at a time when we need more branches and financial inclusion, the amalgamation will lead to closure of branches, which is not good for the development of the country.”

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.