Budget 2019: Modi is Leaving Behind A Monster Debt

Budget 2019: Modi is Leaving Behind A Monster Debt

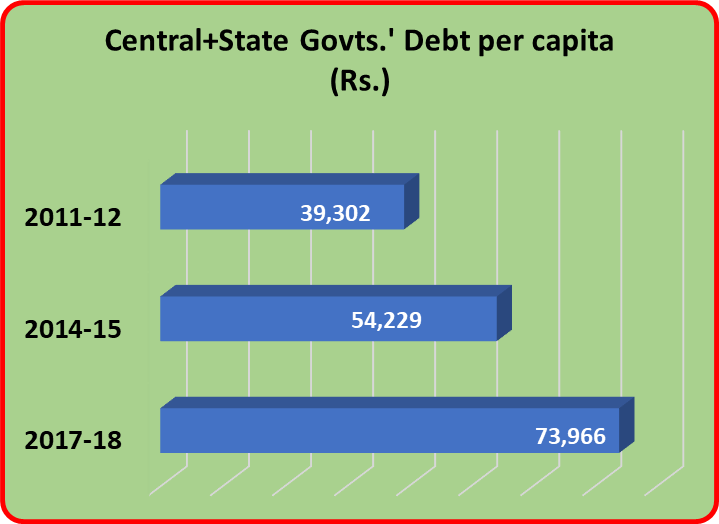

As Prime Minister Narendra Modi’s government gets ready to present its final Budget in a few days, here is a look at one of the key factors in fiscal calculations – debt. The combined debt of central and state governments stands at a staggering Rs. 97 lakh crore, up 59% since the end of March 2014, months before the BJP government took over in June 2014. The scale of this debt can be imagined by distributing it over the whole population (see chart below). This works out to Rs. 73,966 per person in 2017-18 as compared to Rs. 54,229 in 2014-15.

This combined debt – called “General Government Debt” in officialese – was Rs. 68.7 lakh crore in 2014 and Rs. 47.6 lakh crore in 2011, according to the Status Paper on Government Debt for 2017-18, a yearly publication released by the Ministry of Finance.

Within the combined debt of Rs. 97 lakh crore, the Central government’s debt is Rs. 68.8 lakh crore or nearly 71% of the total. It has increased by a whopping 49% over the past four and a half years, that is, since March 2014.

The General Government Debt, as defined by the government actually takes into account what are known as public debt items only, comprising internal debt like market borrowings from securities, treasury bills and other bonds, and external debt. Besides these two, there are some other borrowings too from the National Small Savings Fund, Provident Funds etc. that are given as “Other liabilities”. These are about Rs. 9.1 lakh crore in 2017-18, up by about 30% since March 2014.

Government debt is ultimately recovered from the people through taxation. So, while this debt may seem notional, it is actually something that the people need to be worried about. And, it is not as if all this debt has been incurred to do some wonderful things for the people – on the lines of achche din, so to speak. There is no reflection of this extravagant spending as far as the people are concerned. The spending has been to give largesse to corporates through concessions and exemptions in taxes, through schemes like Ayushman Bharat and PM Fasal Bima Yojana where private corporates get direct benefits transferred to their vaults and through paying for disastrous policies like demonetisation or Goods and Services Tax (GST).

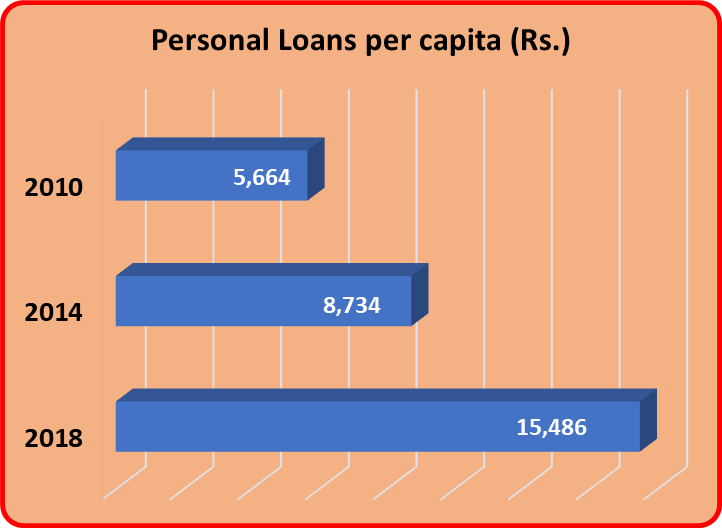

But the debt saga is not yet complete. Have a look (chart below) at the personal loans taken by households from banks only. There is no data available for loans from private money lenders.

The total amount of personal loans as of November 2018 was a mind boggling Rs. 20.7 lakh crore, as per RBI. That works out to about Rs. 15,486 per person in India. Remarkably, the personal loans have increased by 86% since November 2014, showing a yearly growth of over 22%. Compare this to the annual growth rate of just 17% between 2010 and 2014.

Among personal loan categories, loans for consumption expenditure like weddings or sickness etc. have increased by 147%, credit card outstanding amounts have increased 189%, housing loans by 81% and vehicle loans by 66%.

What this means is that the middle class is largely living off debt, just like the government. This is not sufficient to drive up demand in the economy because the middle class is a small fraction of the people. The vast majority of people do not have credit cards or personal vehicles or homes for which banks give loans. But this middle class is highly indebted.

Besides this debt monster that Modi has created, there are agricultural loans amounting to over Rs. 10.7 lakh crore, up by 44% from Rs. 7 lakh crore in 2014. This is despite various kinds of loan waivers.

And then you have the bad loans or Non-Performing Assets (NPA), as they are called, which are a staggering Rs. 10.4 lakh crore, as of March 2018, over 80% of which was due from corporates.

Put all this together and you will get a dystopian picture of India’s economy under Modi’s wise rule. The Budget for this last year of Modi Sarkar may be full of election sops, but Modi will leave behind an economy in ruins.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.