Cash is King, But Modi Govt. Just Doesn’t Get It

Image Courtesy: Zee News

While the govt. and RBI is tying themselves into knots explaining why there is a cash crunch across India, emerging facts show that the Modi govt. is still trying to surreptitiously push cashless transactions on to hapless people. This can be the only explanation for the present crisis of cash shortage – a thing that is unheard of in any country of the world.

Here are the facts. According to the Confederation of ATM Industry CATMI) – a body consisting of all the private companies that pick up cash from banks and put it in their ATMs – there has been a sudden and unexplained dip in the cash supplied to them by the banks in the last couple of weeks.

“Until the end of March, banks used to give us 90% of the indent we raise. Since the start of this month, it has dropped to 30%. States like Maharashtra, Madhya Pradesh, Gujarat, Karnataka and Telangana are facing an acute shortage. We are yet to ascertain the reasons for the crunch but it looks like banks are not getting enough cash from the RBI,” said V Balasubramanian, board member of CATMI and managing director of payments company FSS, quoted by Economic Times.

That’s Fact #1: govt. cut down cash supply.

Meanwhile, cash withdrawals from ATMs have gone up, according to Navroz Dastur, MD of NCR Corporation, which operates around 50 percent of ATMs in India. He reportedly said, "People are pulling out more cash from ATMs. Now, it is hovering around Rs 3,500-4,000 per transaction, a huge increase as compared to Rs 2,500-3,000 earlier in pre-demonetisation times."

Remember: this is the harvest and post-harvest season in which money transactions increase as wages are paid, produce is sold, etc. This fact is known to all, it has always been like this. Yet the govt. in its wisdom decided to apply a squeeze on cash supply to ATMs right at this time.

That’s Fact #2: Cash demand was peaking because of harvest season.

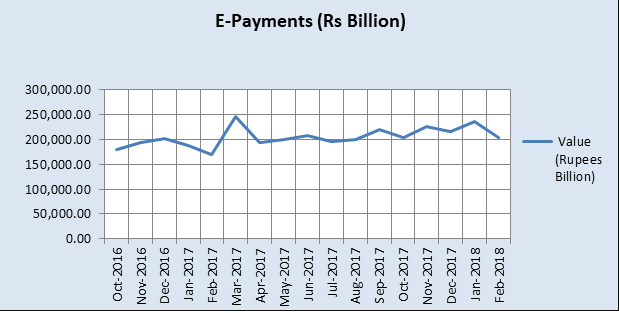

Now have a look at the e-payments scenario. RBI payment system indicators data (available till February 2018) clearly shows that e-payments of different kinds have not taken off in India despite Prime Minister Modi’s repeated exhortations. Between March 2017 (that’s five months after the disastrous demonetization of November 2016) and February 2018, electronic payments declined by over 17%. All the increase – some 38% - took place during the demonetization months of November 2016 to March 2017. After that people have en masse gone back to using cash.

That’s Fact #3: People prefer cash not e-payment modes.

So put these three facts together and add key ingredient of a govt. least concerned with people’s lives – and what do we have? E-payments are stagnating, people are increasingly turning to cash – and the govt., precisely when more cash is needed suddenly cuts short the supply to ATMs. There can be only one explanation to this: this was a deliberate attempt to force people to embrace cashless transactions. One doesn’t know really, but many are speculating that there is a nexus between such e-payment private operators like PayTm and even Reliance who want govt. help to grow their business. They fondly remember the euphoria of the heady post-demonetisation days!

All the other half-baked pseudo-explanations provided by finance minister Jaitley (sudden and unusual increase in demand), RBI (uneven distribution of currency notes) and others are their inept attempt to cloak the move in the usual fog. This ineptitude is of course reminiscent of the post demonetization weeks when all kinds of pretexts were trotted out to explain the foolish move and the bumbling fire fighting done after that.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.