Ex-Adani Contractor ‘Witnessed’ Inter-Company Money Transfer

Image Courtesy: PTI

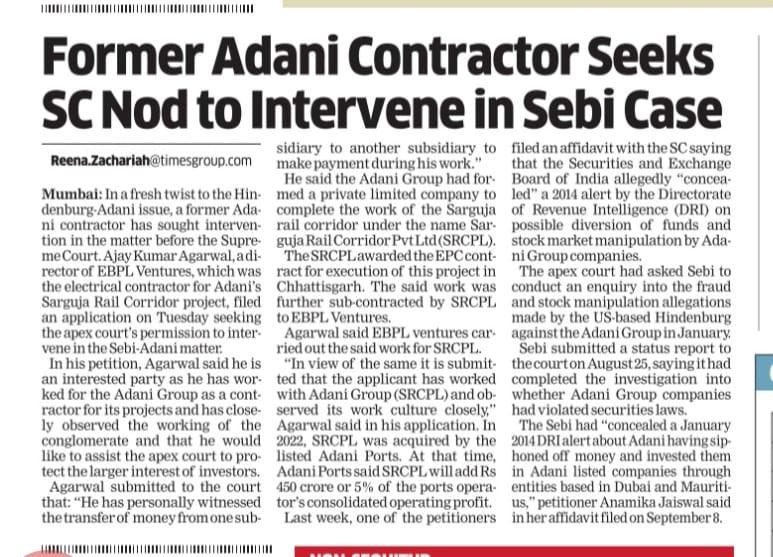

A former Adani Group contractor who “witnessed the transfer of money from one subsidiary to another subsidiary to make payment during his work” has sought the Supreme Court’s (SC) permission to intervene in the Securities and Exchange Board of India’s (SEBI) investigation of the conglomerate.

#LeadStoryOnET | A former #Adani contractor, Ajay Kumar Agarwal, has filed an application before the #SupremeCourt seeking permission to intervene in the #SebiAdani matter.https://t.co/WfkRXNx0Fs

— Economic Times (@EconomicTimes) September 13, 2023

Ajay Kumar Agarwal, a director of EBPL Ventures, which was the electrical contractor for Adani’s Sarguja Rail Corridor project, filed a petition in the apex court seeking its permission to intervene in the Sebi-Adani matter, The Economic Times (ET) reported.

According to the petition, Agarwal worked as a contractor for Group’s projects and “closely observed” the conglomerate’s working. Therefore, he would like to assist the SC to protect the larger interest of investors, the ET reported.

“He has personally witnessed the transfer of money from one subsidiary to another subsidiary to make payment during his work,” the petition read.

Agarwal claimed that the Adani Group formed a private limited company to complete the Sarguja rail corridor under the name Sarguja Rail Corridor Pvt Ltd (SRCPL).

The SRCPL awarded the EPC contract for executing the project in Chhattisgarh. The work was further subcontracted by SRCPL to EBPL Ventures, which completed the said work, Agarwal further claimed.

“In view of the same, it is submitted that the applicant has worked with Adani Group (SRCPL) and observed its work culture closely,” the petition read.

In 2022, SRCPL was acquired by Adani Ports, which said that SRCPL will add Rs 450 crore, or 5% of the port operator’s consolidated operating profit.

On September 8, a petitioner filed an affidavit with the SC saying that SEBI allegedly “concealed” a 2014 Directorate of Revenue Intelligence (DRI) alert on possible diversion of funds and stock manipulation by Adani Group companies.

The top court had asked SEBI to conduct an investigation into the fraud and stock manipulation allegations made by the US-based Hindenburg against the Group in January.

On August 25, SEBI submitted a status report to the SC saying it had completed the probe.

The petitioner, Anamika Jaiswal, claimed in her affidavit SEBI had “concealed a January 2014 DRI alert about Adani having siphoned off money and invested them in Adani-listed companies through entities based in Dubai and Mauritius”.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.