Fiscal Indicators of North-East States Remain Below the Indian Average

Image Courtesy: Zee News

The Reserve Bank of India (RBI) published the third edition of The Handbook of Statistics on Indian States on 5 May. The publication provides quantifiable data under seven headings: social and demographic indicators, state domestic product, agriculture, industry, infrastructure, banking sector, and fiscal indicators. The present edition provides figures up to the fiscal year 2016–2017.

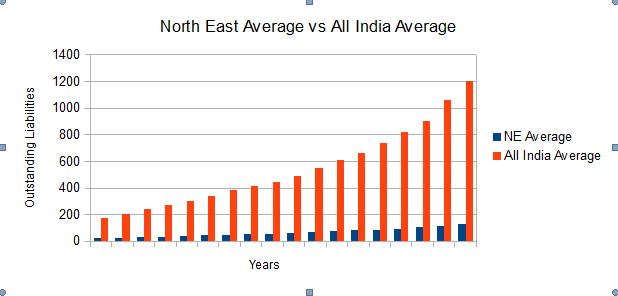

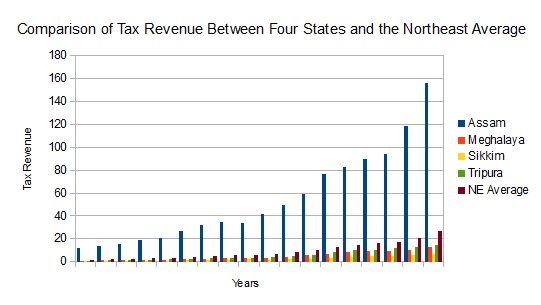

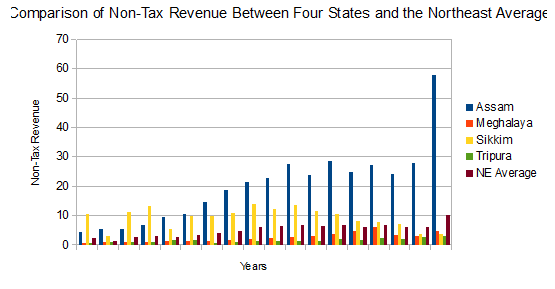

Using the data provided in the handbook, we take a cursory look at the fiscal performance of the eight north-eastern states under two headings — their outstanding liabilities, and revenue generation (both tax and non-tax).

The data used is from the fiscal year ending in 2000 till 2017.

As can be seen, the average outstanding liabilities of the north-eastern states tend to be a lot lower than the average of all Indian states and Union Territories. However, among the north-eastern states, Assam has had the highest outstanding liabilities while Sikkim has had the lowest. While it may be easy to blame the low outstanding liabilities to the unrest in many parts of the region, Sikkim has never faced the kind of unrest that Assam has. On the other hand, Assam does not have statutory limitations placed on land ownership and transfer, which may explain why the state was able to incur more debt. Another reason may also be due to the mineral reserves that Assam possesses, which contribute to its tax revenue.

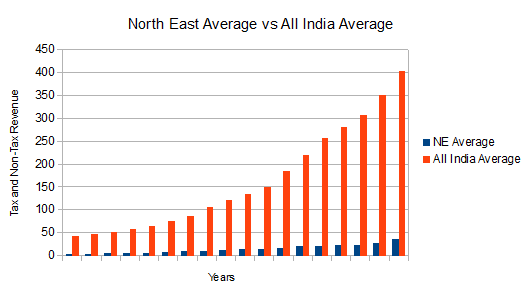

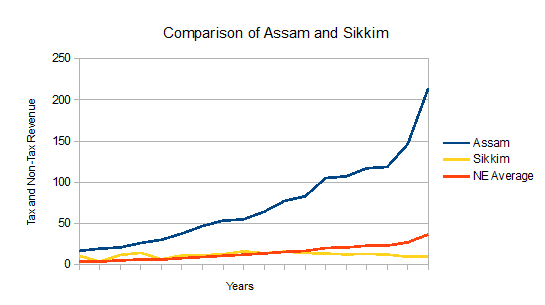

In terms of revenue, whether tax revenue or otherwise, all north-eastern states are well below the all-India average. Yet, as can be seen, Assam tends to collect the most tax revenue, which may explain why Assam is able to take more loans. On the other hand, both Meghalaya and Tripura tend to have higher tax revenues than Sikkim. This, on the other hand, may also be due to Sikkim’s small population in comparison to the other states. Since Meghalaya too has certain limitations on land ownership and transfer like Sikkim, it can be safe to say that this outcome is due to Sikkim’s small population. This is further compounded by the fact that Tripura gains more in tax revenue than Meghalaya despite large parts of Tripura being designated as ‘tribal land’. Hence, the economically viable parts of Tripura for migrants and capital tend to be the more densely populated plains around Agartala.

When looking at non-tax revenue, Sikkim outperformed the north-east average till around 2015-16. Sikkim also earned more non-tax revenue than all the other states in the north-east till 2004. From this point on, Assam has begun to consistently earn more non-tax revenue. Meghalaya earned more non-tax revenue than Sikkim in 2016-17, while Tripura’s non-tax revenue remained relatively lower throughout. One explanation for Sikkim’s higher non-tax revenue may be due to the number of PSUs in the state, such as the State Bank of Sikkim, which does not fall under the jurisdiction of the RBI. However, the fall in non-tax revenue from 2008-09 onwards represents a trend that may not be easily explained, other than by the fact that — from around this time — alternative banks may have become more popular in the state.

In terms of the total revenue that was calculated taking into account only tax and non-tax revenue, the north-east has remained well below the Indian average.

Assam has, however, remained well above the north-eastern average for tax and non-tax revenues. Sikkim, on the other hand, fluctuated till 2010, after which its revenue has consistently fallen. This also coincides with the fall in non-tax revenue in the state. The State Bank of Sikkim as a factor, however, is a likely explanation as two popular banks in the state, Axis Bank and HDFC, offer higher interest rates on deposits. However, the region as a whole tends to have lower revenue than the all-India average, possibly due to fewer PSUs and lower population.

What remains surprising is that despite the rich natural resources that are often boasted about, the region tends to have low revenue generation. In Assam, it is tea and oil, whereas in Sikkim it is hydro-power. Arunachal Pradesh too has reserves of oil and coal which are being mined as well as a multitude of hydro-power projects; however, in terms of revenue, these rich resources do not seem to be reflected. Although the National Green Tribunal (NGT) placed a ban on coal mining in Meghalaya, the state still extensively mines limestone. But this, too, does not seem to have brought much revenue to the state. It appears that despite the much-touted projects and Prime Minister Narendra Modi’s claims of turning north-east India into a “gateway” to south-east Asia, the region remains lacking.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.