India EU Free Trade Agreement

The ongoing India EU FTA has far reaching consequences for the agricultural sector and its production for both the partners. To better understand the scenario, a brief overview of the background is necessary.

The ongoing India EU FTA has far reaching consequences for the agricultural sector and its production for both the partners. To better understand the scenario, a brief overview of the background is necessary.

Source: Ministry of Agriculture

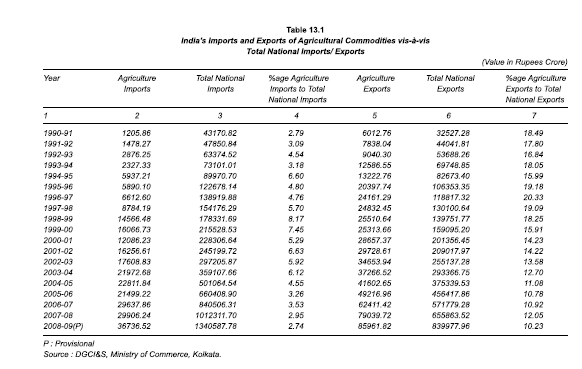

Agriculture is a highly sensitive sector for the Indian Economy, as it supports the bulk of the rural population in terms of employment and livelihood. Traditionally, India has been a net exporter of Agricultural products. Agricultural imports form a very small portion of our total import bill (around 3-4%) while it has accounted for over 10% of our exports earnings over the last 2 decades post liberalization. This is primarily because this sector has still being protected to some extend from the vagaries of international trade despite repeated pressures to liberalize the sector.

Of the main exported commodities, Raw Cotton is the biggest component followed by oil meal, rice (other than basmati), spices, sugar, tea etc. in short, it is predominantly cash crops that form the bulk of our commercial exports to the world.

Imports, though small in share, mainly consists of vegetable oils, wood and wood products, pulses, wheat etc.

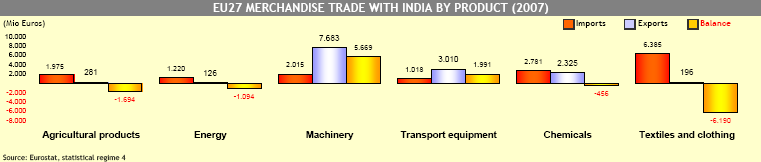

In terms of trade of agricultural products vis-à-vis EU, India doesnot feature as an important partner for the latter.

Source: DG trade Statistics, EU

Of the total EU India trade, Agriculture forms a very small component. India ranks around 12th in EU list of top trading partners in Agriculture. On the export side however, India ranks even lower. Of total EU agricultural exports to the world, India ranked 41st in 2007.

The main reason for such ranking was primarily the mismatch of product categories. EU impost primarily edible fruits nuts, oil seeds and oleaginous fruits, coffee, tea, spices and other such tropical items which India exports. However, EU exports products like beverages, spirits and vinegar, dairy products, eggs natural honey, tobacco and products, meats etc which do not feature in the top imported agricultural commodities of India.

Agricultural trade statistics between EU and India reveal that India has been exporting products like basmati rice, processed fruits and vegetables, floriculture, jaggery and confectionary etc to EU. U.K. (>30%), Germany (>20%) and Belgium (~15%) form the main export destinations while the others EU nations have market shares below 5% of total trade. In terms of imports from EU, Wheat has in recent times featured high in the list, given India had to import wheat in 2006-07 given domestic shortage. Other than wheat, Scotch Whiskey forms the second largest commodity, followed by raw wool and hides for processing. France and Germany are the main source countries, while other country shares are miniscule.

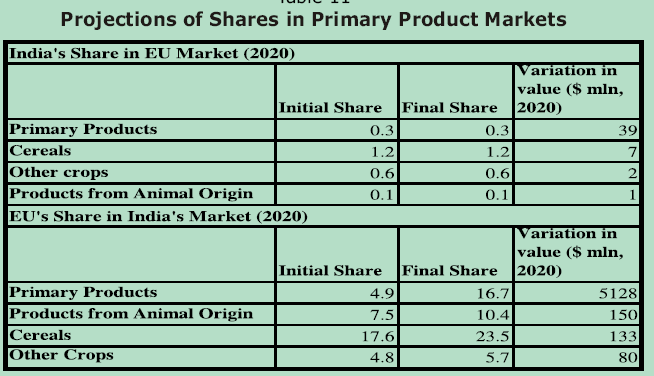

The main thrust of the EU India FTA, from EU’s point of view is to raise the market share of EU primary commodity exports in India. India, along with China, is one of the largest and fastest growing markets in the world. While China figures in the top 10 export destination of EU, India does not. The entire focus of the FTA is rectifiy this situation.

In agriculture, EU is a net importer of raw products with a global deficit of Euro 25 Billion in 2007. Tropical Products, oilseeds and fruits and vegetables form the bulk of it. However, in processed agricultural products, EU is a net exporter with a total surplus of Euro 205 Billion in 2007. In such a scenario, EU seeks to force India into exporting raw materials and importing processed agricultural and food items post FTA. EU will try to push its products top export products like dairy, processed coffee and tea and animal meat products, which do not feature in the top items imported by India.

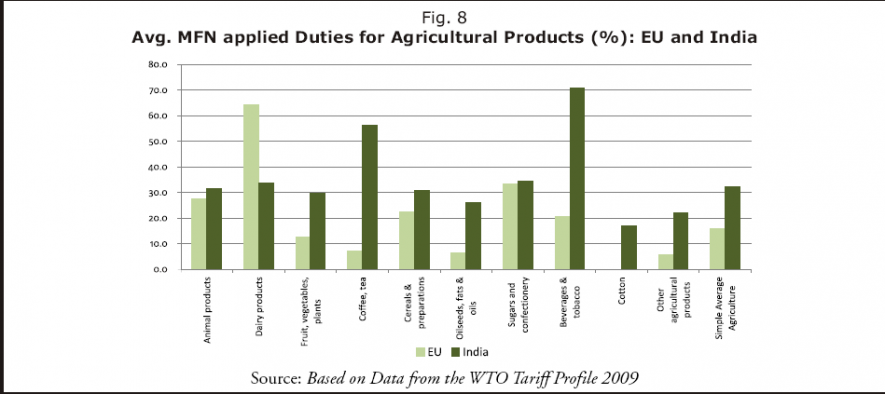

A look into tariff structures reveals that the areas where EU has export advantages are sectors with high domestic protection via tariff in India.

Source: The Eu India FTA in Agriculture and Likely Impact on Indian Women, CENTAD, 2009

While Tariff negotiations at the WTO are on bound rates (maximum applicable rates), which is different from actual rates imposed. EU average bound agricultural tariff rates are very low (15.9% in 2009) compared to India (114.2% in 2009). If current reports of the FTA commitments to bring tariff rates to 0 or near 0 for 90% of products mean India stands to face massive protection loss, much more than EU. Infact, the CEPII-CIREM study concluded that given 29.9% of India’s agricultural exports to EU are already duty free while the rest face low EU tariffs, India’s gain in agricultural exports will hardly increase, as compared to EU’s exports which is poised to gain substantially.

Source: CEPII CERAM Study, Reprinted from CENTAD

Another major reason for lower penetration of Indian products is the gross differences in the level of state support and subsidies farmers receive in both the partners. In EU, farmers receive dual subsidies, one from the individual states and the other through the Common Agricultural Policy (CAP), a centralized EU programme that in 2006 formed 48% of total EU budget at Euro 49.8 Billion. While under reforms, CAP levels are projected to fall to 32% of EU budget by 2013; it is still astronomical compared to India’s budgetary support to agriculture. Moreover, by 2013 the amount of Eu regional Policy expenditures will reach 36%, which may just be rerouting of the subsidies, which will mean that effectively, EU will continue to provide high subsidies to its agricultural sector. CAP is predominantly production subsidies which ensure very low domestic production costs that make exports to EU at such prices to be non-competitive. It also makes EU exports to be very cheap, thus acting as an indirect export subsidy. Comparing this with the Indian scenario (where even this year the fertilizer subsidy has been reduced), it is really a highly unleveled playing field for Indian farmers.

Perhaps the biggest threat to rising exports to EU comes from the various Non Tariff barriers (NTBs) imposed by EU, mostly through the notorious Sanitary and Phytosanitary (SPS) measures. The ministry of Commerce, Government of India itself lists 26 NTBs in agriculture faced by Indian exporters to EU. Most arise from differences in harmonization of standards between EU and India. Ironically, there are differences in standardization between the 26 EU members themselves. Thus while India offers one single large market to EU, EU is actually 26 separate markets which makes harmonization a greater challenge for Indian exports.

Some of these standardizations include stringent quality control measures which donot exist in India. Introducing the same is bound to raise production costs and hence export prices which will lower competitiveness.

Some issues like different MRL by member countries for pesticide, drugs and other contaminants make it almost impossible to resolve.

Issues like definition of product and commodity nomenclature make it impossible for Indian products to qualify for EU markets. For example, EU defines Whiskey to be produced exclusively from cereals by distillation while Indian products have alcohol produced from mollases. Indian Fish exports have been rejected earlier from EU for higher level of Cadmium contents which is beyond control of Indian fishermen.

The India EU FTA is poised to harm India Agricultural sector, and this has been collaborated by studies from CEPII, CENTAD and ECORYS, CUTS CENTAD joint study. Even New Europe, the European news base estimates that with the FTA, India will raise exports by just under 20% while EU stands to raise exports by 57%. Almost all independent studies categorically state that the FTA is beneficial to EU and is detrimental for India in the long run.

Therefore, the Indian government must immediately publicize the entire deal and put it before the parliament before committing and thereby putting the future of the nation at stake.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.