Is India’s Banking System Becoming like Humpty Dumpty?

After Humpty Dumpty fell and broke to pieces, all the king’s men could not put it together again, as the famous nursery rhyme goes. India’s gigantic banking system has not yet reached that stage but it is sure headed for some rough times.

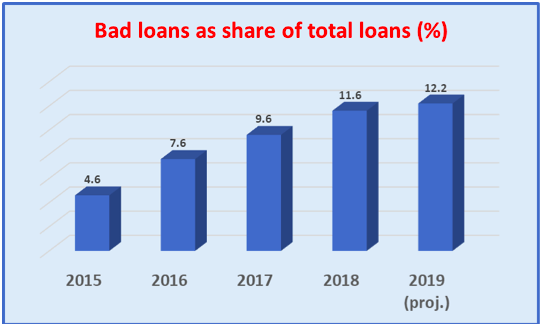

The most recent Financial Stability Report released by the Reserve Bank of India (RBI) on 26 June, 2018, paints a worrying picture. Bad loans (called gross non-performing assets or GNPAs) crossed Rs. 10 Lakh Crore this March. They make up for a record 11.6% of all loans given by all banks in the country, whether public or private sector.

Also Read: The Push for Privatising Banks

But that’s not all. The RBI report, basing itself on ‘stress tests’ that it periodically performs, predicted that bad loans will continue to increase and reach 12.2% of all loans by March 2019.

Bad loans are those that the loan-taker is unable to return in the specified period. The RBI report says that 85.6% of the bad loans are with large borrowers, mostly corporates. This proportion has largely remained constant over the past few years, with such loan takers accounting for 86.4% of bad loans two years ago. It is not as if large corporate borrowers make up a similar share of total loans taken. They take only 54.8% of all loans given by banks yet end up with nearly 86% of bad loans.

“The worsening NPA position should be seen in the context of slow credit growth, which indicates slowing investment,” said Surajit Mazumdar, professor of economics at JNU. “There is no demand in the economy, so loans taken are not giving any returns. Hence the rising tendency of not returning loans.”

Also Watch: 4 Years of Modi Government and the Banking Sector

Why has this crisis arisen at all? Mazumdar explains it as a direct result of the govt.’s continued unwillingness to invest itself and encouraging the private sector to borrow more and more to invest.

“Govt. can raise resources by taxing corporates and other rich sections and invest them in important sectors like infrastructure or irrigation. But it’s commitment to the neo-liberal dogma of ‘minimum government’ means that it is reluctant to do so, forcing the banking system to get weighed down by this crisis of bad loans,” he said.

The industry segment reported a gross NPA ratio of 22.8 percent in March 2018, compared to 7% in agriculture, 6% in services and 2% in retail. Within industry, the stressed advances ratio of sub sectors such as gems and jewellery, infrastructure, paper and paper products, cement and cement products and engineering are particularly on the rise.

RBI’s sectoral risk analysis found that the power, textile and engineering sectors could add to the bad loans of the banking industry in the event of a severe shock to the sector.

Also Read: Loans Worth Rs 2.72 Lakh Crore Written Off by Modi Sarkar

The report has also revealed the way in which the Insolvency and Bankruptcy Code (IBC) is being implemented to ‘recover’ bad loans. Of the 701 cases that were admitted by the National Company Law Tribunal, 525 were still undergoing resolution. Of the 176 cases which were closed by the NCLT, 67 were closed on appeal or review, 22 were resolved and 87 yielded to liquidations.

Humpty Dumpty may not have fallen off the wall but the king’s men are certainly displaying a high degree of incompetence – a matter of worry for Indian people whose money is kept in these banks.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.