India’s Growth Story is Unraveling, Yet the Government is in Denial

India’s growth story is unraveling, yet the government is in denial. If we go by the official figures, Indian economy is growing steadily at around 7% - an enviable growth rate by any standard. Especially, considering that the growth rate of the world economy in the year 2016-17 was below 2.5%.

On the other hand, every other indicator and every other survey, except the official growth figures provided by CSO, are pointing to an economy that is going downhill.

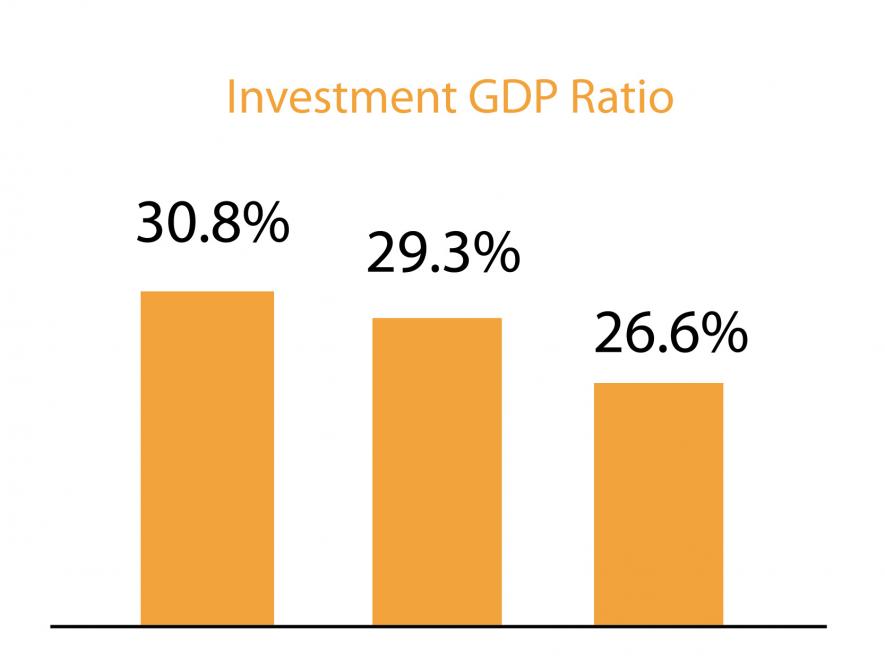

Where is the investment?

One of the crucial, perhaps the most important, indicators of economic activity in any country is investment. It is the primary engine of the economy - simultaneously creating employment and spurring demand for more economic activity, thereby generating growth. But at the moment, this very crucial element is weakening in the Indian economy.

Data Source: Economic Survey

Investment to GDP ratio, has been fallen considerably since 2014, the year Narendra Modi came in power at the Centre. For all the trips around the world that PM has taken, seeking foreign investment and for all the hype around ‘Make in India’, ‘Start Up India’ and so on – the investment clearly is going down hill.

The high rates of economic growth that Indian witnessed since 2004, were mainly due to the external demand, in the form of service and commodity exports – coupled with substantial investments in infrastructure. Huge infrastructural investments in power, steel, telecoms, roads, airports and other construction activities have created direct employment, as well as jobs downstream.

These large investments, undertaken by big corporate players, were financed by substantial cheap loans, from Public sector banks under the government’s directions. Many of these investments today are turning unviable - some due to diversion of funds and mismanagement and others due to the slowdown in global demand – resulting accumulation of bad loans (NPAs)with the banks.

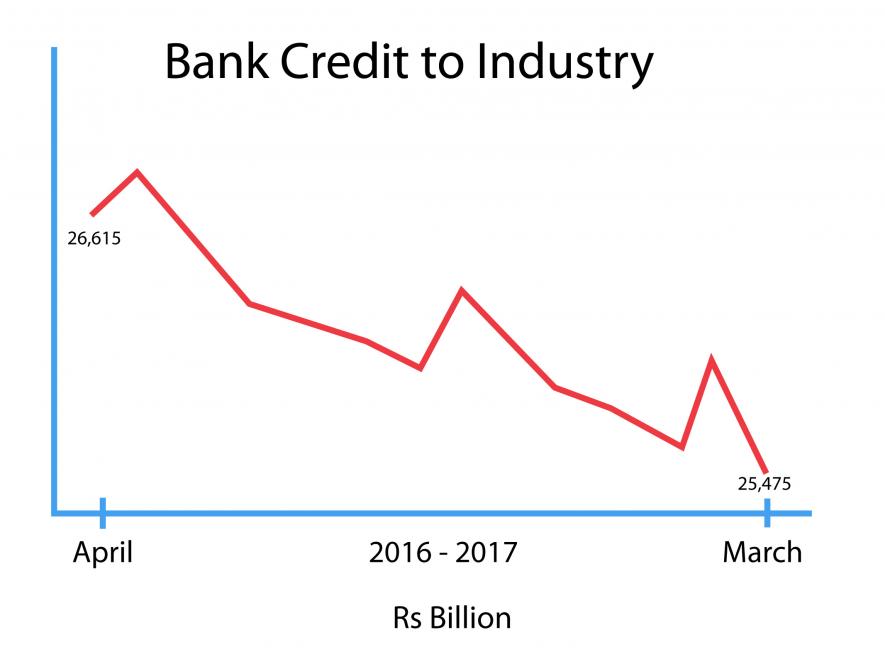

Data Source: RBI

It is estimated that the Indian banking sector is holding more than Rs. 10 lakh crore worth bad loans in its books. As a result, banks have become wary of lending and credit growth for the industry has turned negative. The small and medium scale industry have been particularly effected by this, as credit from banks has taken a nose dive. It is the financial lubricant for industry’s functioning, without which, will be difficult to sustain economic growth. And the recent data bears this out.

Nikkei’s Purchasing Managers Index (PMI) for manufacturing has fallen to 47.9, the lowest in 8 years. PMI for services has fallen to a 45.9, lowest in four years. PMI below 50 indicates economic contraction, while 50 indicates stagnation and above 50 indicates economic expansion.

Before dismissing this as a small hiccup in the Indian growth story, or as a temporary result of demonetisation and the introduction of GST, we should bear in mind that investment and credit have been going downhill even before demonetisation. Demonetisation and GST have simply aggravated the already existing problem.

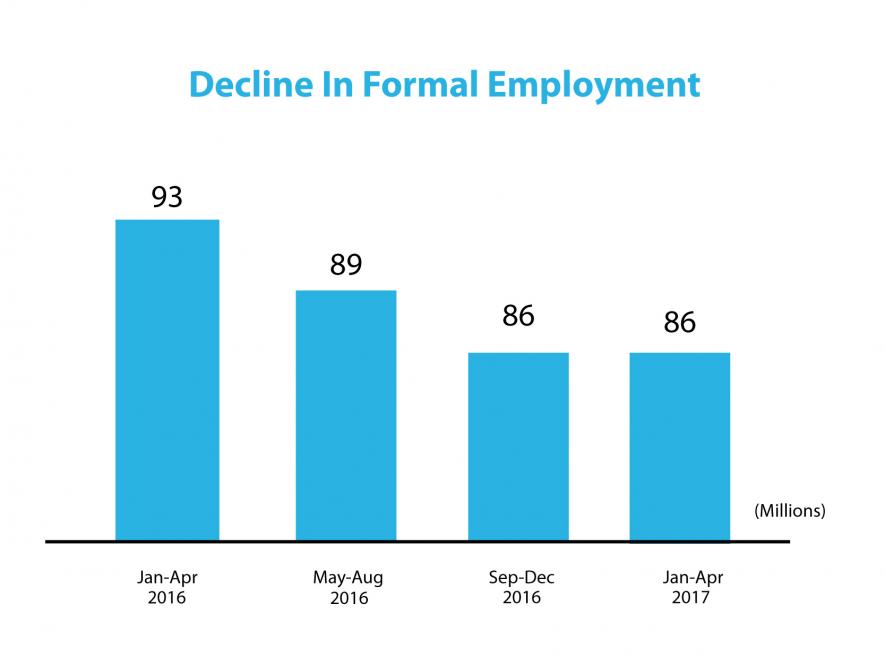

Job losses

The direct result of falling investment is the loss of jobs. According to CMIE, there was consistent loss of formal jobs in the last one year. Total number of formal jobs fell from 93 million in 2016 to 86 million in 2017 – a net loss of 7 million jobs.

Data Source: CMIE

In informal sector too, there is a significant loss of employment – manifesting in the form of disguised unemployed and declining labour participation rates. CMIE data shows that labour participation rate has fallen from 47% in 2016 (April) to 43.5% in 2017 (April). Clearly, those who were unable to find work simply withdrew from the labour force.

Narendra Modi came in to power with the promise of providing 1 crore jobs every year. The way the present government is going, one would think the promise was to lose 1 crore jobs a year.

No signs of revival

From all indications, the problem is only going to get worse.

According CMIE, investment proposals have been falling and continues to fall through 2017. Between 2014-15 and 2016-17, new investment proposals fell by Rs. 2 lakh crore ( from Rs 10 lakh crore to Rs. 8 lakh crores). This means that growth and employment creation is going to be low.

Among the investment proposals that are made, very few are in employment and growth generating sectors like manufacturing, power, infrastructure etc., due to large existing unutilized capacity. For example, one third of India’s thermal power capacity is lying unutilised. Similarly, 25% of steel industry’s capacity and 30% of cement industry’s capacity remain idle.

Most of the new investment proposals have come in sectors like aviation and telecommunications – which are not particularly known for their employment potential. For example, 50% of the investment proposals that have been made in the first of half 2017, are in the aviation sector, to buy aircrafts. Considering that India does not manufacture aircrafts, this is an investment that will take the form of imports which are not going to generate economic activity within India.

Government is doing nothing

If the private investment is lagging behind, the government is also not doing so great. Instead of reviving the economy with public investments in infrastructure and other necessary areas, the Modi government has cut back on investments. Government’s investment proposals have come down by half in the past three years.

Since 2015, the fiscal deficit to GDP ratio has come down from 4.1% to 3.5% - reducing the resources available for public expenditure. As a result, the public expenditure as a share of GDP has been coming down since BJP came in to power. From all indications so far, the government seems foolishly determined keep the fiscal deficit at 3.5%.

Not only is the government doing nothing, but it has actually aggravated the situation with the decision to demonetize and impose GST. Demoentisation dealt a deadly blow to the informal sector and from all indications GST is going to finish the job by killing it. More over, GST has resulted in an increase in the taxation on consumption. This is going to lead to a fall in consumption in the long term. Coupled with an already falling investment, this is not a good news for the economy.

Disclaimer: The views expressed here are the author's personal views, and do not necessarily represent the views of Newsclick.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.