Industrial Production High? Think Again

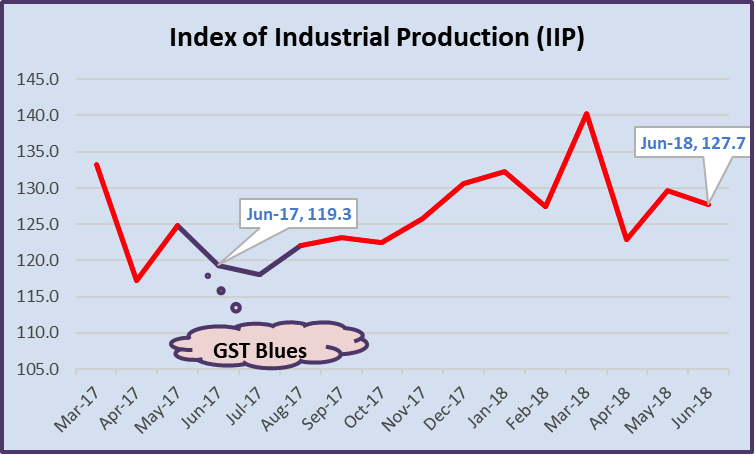

Desperate to show that the economy is booming, govt. spokespersons are patting themselves on the back at the latest Index of Industrial Production (IIP) data for June which shows a jump of 7% over last year June. They fail to reveal that this 7% increase is compared to a low that the IIP hit last June as industry prepared to get hit by GST. Producers unloaded stocks instead of producing more before GST was rolled out from 1 July 2017.

“Excellent numbers of IIP growth for June. IIP rises by 7%. Capital goods growth 9.6%. First quarter IIP growth stands at 5.2% with manufacturing also recording same growth. 19 out of 23 industry groups recorded positive growth with computer and electronics growth at 44%,” economic affairs secretary Subhash Chandra Garg tweeted.

Mr. Garg, as the top bureaucrat in the department of economic affairs would surely be aware of the concept of ‘base effect’ which means that if you start from a low base value, growth always appears more. For example, if India gets two gold medals in the 2020 Olympics, it will be a 100% increase over the previous best of Abhinav Bindra’s one gold medal in 2008! But it is still only two golds.

As the chart above shows, IIP keeps going up and down with usual peaks in March every year coinciding with end of financial years. In June last year, IIP was 119, down from the March high of 133. It further dipped to 118 in July 2017 stung by GST. From this trough it recovered steadily again reaching a peak of 140 in March this year. Then again it went into a slide and now stands at 127.7 in June 2018. This behaviour is hardly a sign of a healthy or booming economy.

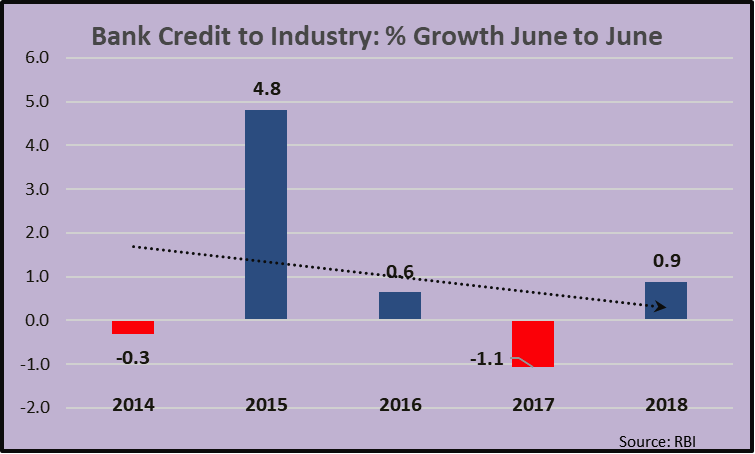

But, perhaps this June data is some sign of recovery of the economy? Looks very unlikely. Take a look at a sure shot indicator of how industry is performing – the level of bank credit to industry. As the chart below shows, credit growth, as reported by RBI, was an abysmal 0.9% between June 2017 and June 2018 which is the same period in which IIP is reported as growing.

In fact, in 2017, bank credit to industry actually declined by 1.1%. The trend of credit growth during Modi’s reign is downward with the best being a mere 4.8% growth reported back in 2015. During four years of Modi Sarkar, total bank lending to industry has grown by 5.3% - that’s an annual growth of just 1.3%.

If industry is not borrowing from banks then it means there is hardly any investment taking place in increasing productive capacity. This directly implies that neither is production output going to increase in any substantial measure and nor is fresh employment going to be created.

This is further confirmed by the fact that the IIP has grown by an average of just 4% per year since June 2014, when Modi swept to power promising jobs for one crore people and a strong economy. Put all of this together and you can easily understand the dire straits India’s real economy is in. No amount of tweeting and craven praise by mainstream media can hide these truths.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.