Interim Budget 2019-20: GST Revenue Falls Short

The Union Budget 2019, presented yesterday by Finance Minister Piyush Goyal is just an interim budget before the general elections. However, we get the actual figures for last year and the revised estimates of the current financial year in the budget documents. No reliable data on Goods and Service Tax (GST) collection is available yet, since its implementation in July 2017. The 2019-20 budget document provides us with data on the expected (budget estimate) revenue from Central GST (CGST) in 2018-19 and on the revised estimate (RE) of CGST collection for the year 2018-19. There is a shortfall of Rs. 1 lakh crore. The BE figure is above Rs. 6 lakh crore and the RE figure is slightly above Rs. 5 lakh crore.

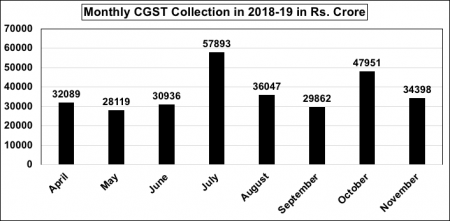

If we look at the monthly data of Controller General of Accounts (CGA), Ministry of Finance, for first 8 months of the financial year 2018-19 on CGST collection, it comes to about Rs. 3 lakh crore (see the chart below). Therefore, in 12 months, it is expected to reach Rs.4.5 lakh crore, which is even less than the revised estimate of 2018-19 (i.e. Rs. 5 lakh crore).

Source: Controller General of Accounts, Ministry of Finance, GoI

Clearly, CGST revenue could not be generated at the expected rate. In fact, the actual revenue from CGST seems to be 25% less than the expected revenue, which is definitely a cause of concern. Now, if CGST collection has happened to be 25% lesser than the expected level, the State GST (SGST) collection is also expected to be lower than the expected level. If the states’ revenue does not increase by 14%, then according to the present understanding of GST council, states have to be compensated for. In that case, centre’s net GST revenue, after states’ compensation, would become even lower.

Also Read: December GST Collections Drop to Rs 94,726 Crore

If the fiscal deficit is kept at its present level, the expenditures have to be compromised. Even if, Rs. 75 thousand crore is earmarked for the proposed PM-Kisan scheme of paying Rs. 6,000 to 12 crore farmer households, the other expenditures would suffer even more. And this would happen even after imposing inequality creating indirect tax like GST at such a high rate. Before implementation, it was told that GST would generate more revenue for both central government and the state governments. It was also told that the tax compliance i.e. the ratio of actual tax collection to potential tax collection, given the tax rates and tax base, would automatically be better, etc. Clearly, these expectations are not being realised. At least, the budget numbers are hinting at that.

Also See: Interim Budget: An Election Advertisement for the Modi Government

Surajit Das is Assistant Professor at the Centre for Economic Studies and Planning in Jawaharlal Nehru University.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.