Listed Companies See 3rd Quarter of Exponential Profits, But Overall Economic Recovery Still a Distant Dream

Image Courtesy: 123RF

Listed companies have made a hat trick of record profits in the quarter ending March 2021, revealed a report released by the Centre for Monitoring Indian Economy (CMIE) on May 28 even as the second year of pandemic brought millions closer to severe impoverishment. Listed companies are the ones that are included and traded on a particular stock exchange.

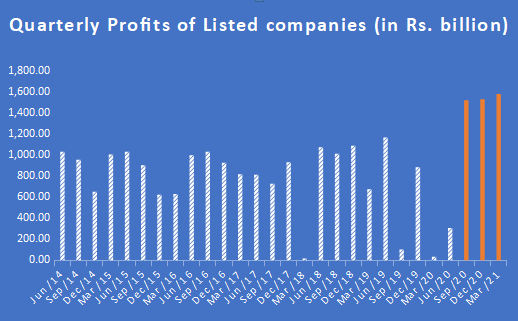

The 4,406 companies listed on the Bombay Stock Exchange (BSE) had registered a profit of Rs 1.52 trillion and Rs 1.53 trillion in the quarters ended September and December 2020. Data from March 2021 shows that 935 of the listed companies have already booked a profit of Rs 1.58 trillion. About three-fourths of the listed companies are yet to declare their financial performance from the previous quarter. These companies had reportedly made a collective profit of about Rs 250 billion in September and December quarters. Similar rates of profit, it is estimated, will lead to the listed companies registering a total profit of Rs 1.8 trillion in the March 2021 quarter.

While profits made by the biggest listed companies continued to soar for a third consecutive quarter, government estimates released on May 31 showed that India’s GDP contracted by 7.3% in 2020-21.

The following chart shows the quarterly profits made by companies listed in the BSE. The data is sourced from the CMIE.

If assessed year-on-year basis, the top-line has grown by 14.7% in the March 2021 quarter and net profits of listed companies have increased by 212.4%. Profit margins have grown from 0.2% in the March 2020 quarter to 10.8% in the March 2021 quarter. According to the CMIE report, the exponential growth in profits in March 2021 reflects both a bad base period as well as an exceptionally good current period. The bad base period refers to March 2020 when profits had plunged.

The analysis by CMIE noted certain important differences between growth during the March 2021 quarter and growth during the September and December quarters in 2020. During the September and December quarters, top-line growth was concentrated entirely in financial services companies as the non-financial companies witnessed shrinking profits. However, the growth in the March quarter emanated from a shift in profits in favour of non-finance company, which constitute the real economy producing goods and services. While the non-financial companies suffered a fall of 11% and 1% respectively in September and December quarters of the previous year, in March 2021, they saw a strong top-line growth of 18.6%. At the same time, finance companies saw an increase of 2.1% in their top-line growth.

The share of non-financial companies in the total profits of the corporate sector increased from 73% in the September 2020 quarter to 78% in the March 2021 quarter. The increase in profits of listed companies is also due to cutting of costs. This has been achieved despite an increase in raw material costs. Cost cutting is essentially achieved by cutting costs on labour, reducing workforce, no fresh hiring and reducing new investments. The CMIE report highlights that wages have increased by a small 10.3% and other expenses have shrunk by 1.8%.

The total profits of the 1,750 listed manufacturing companies escalated from Rs 721 billion in the September 2020 quarter to Rs 854 billion in the December 2020 quarter. As compared to this, merely 483 manufacturing companies had delivered a net profit of Rs 928 billion in the March 2020 quarter. The CMIE report predicts that the results of the remaining listed companies in the coming weeks will show an increase in concentration of profits in manufacturing and non-financial services companies.

Three consecutive quarters of profits for corporations may lead to some seeing ‘green shoots of recovery’ in the economy. However, exponential profits for corporates do not reflect a healthy economy and this is evident in the 7.3% contraction suffered by the GDP in the year 2020-21.

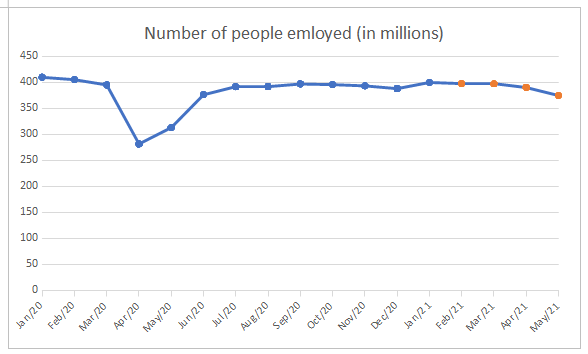

Recent data from the CMIE shows that unemployment rate has shot up again from 8% in April to 11.9% in May 2021. The CMIE report also highlights that the employment rate fell from 36.8% in April 2021 to 35.3% in May 2021 – a very sharp fall for a single month.

The following table shows the number of people employed between January 2020 and May 2021. The data is sourced from CMIE.

The graph above shows that the rate of employment has not even reached the pre-pandemic level before it began to decline again from January 2020. From 400.7 million in January 2021, the number of employed people has come down to 375.5 million – a cumulative loss of 25.3 million jobs. In the month of May alone, there has been a loss of 15.3 million jobs or a 3.9% fall in employment in the month. Even as lockdowns are eased with the second wave of COVID-19 receding, the recovery to the 2019-20 level of 404 million jobs appears distant.

The generation of humongous profits by large corporations – both domestic and international - has been a marked feature during the pandemic, a piercing reminder of the contradictions within capitalism. Just last month, data released by the Forbes highlighted how monopoly rights over COVID-19 vaccines has created nine new billionaires and has helped the existing ones in multiplying their fortunes. However, exponential profits by top companies will not by itself help in generating employment, stimulating demand or reviving economic growth. This will require the government to take proactive steps by boosting up its spending, reviving demand by ensuring income in the hands of people and by bringing the COVID-19 situation under control before a third wave hits the country.

The writer is an author and a Research Associate with Newsclick. The views expressed are personal. She can be reached on Twitter @ShinzaniJain.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.