Oil Profits Raise Questions About Tax, Green Investment

Massive profits posted by major oil companies have led to calls for governments to impose 'windfall' taxes on them.

The global energy crisis and high inflation crisis are causing pain and uncertainty for consumers, but it means historically good business for the world's biggest oil companies.

On Tuesday, BP became the latest oil major to report a huge increase in profit for the second quarter of this year.

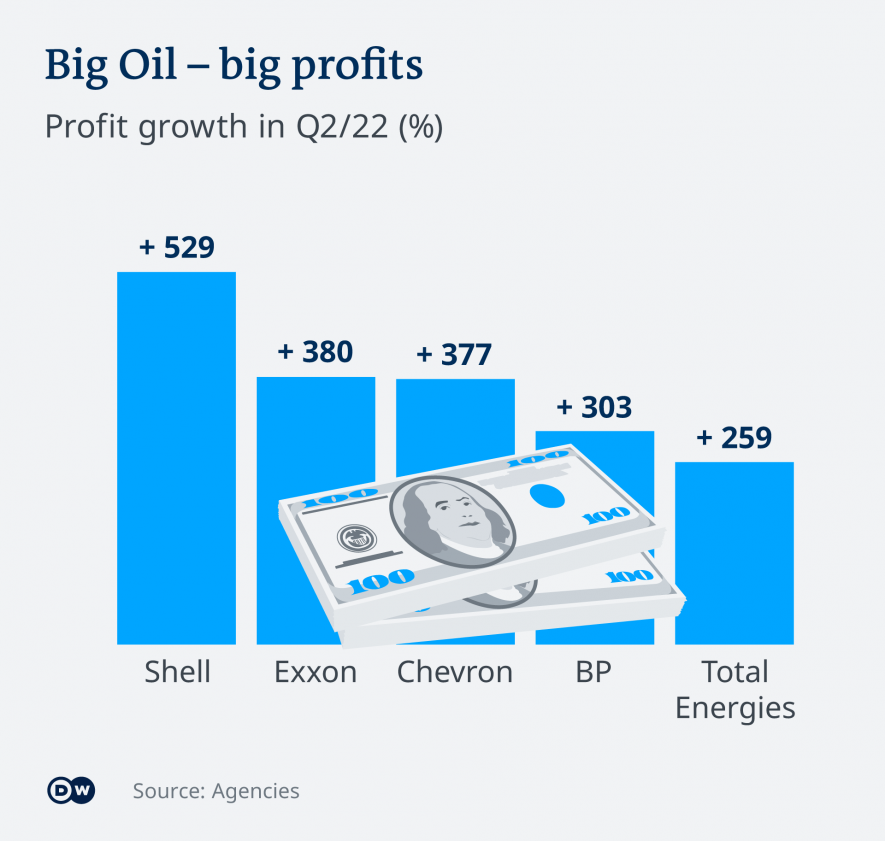

The British company reported its highest quarterly profit in 14 years, with its underlying profits soaring to $8.5 billion (€8.4 billion) — that's more than three times what it recorded for the same period last year.

It's the company's second most profitable quarter in history and the latest in a string of eye-watering earnings reports from the oil industry.

US energy giants ExxonMobil and Chevron also recently announced record quarterly profits. Exxon pocketed $17.9 billion in the quarter ended June 30, smashing its previous record by $2 billion. Chevron's second-quarter profit was $11.6 billion, also a record.

Europe's largest oil company Shell last week announced it had broken its profit record for the second quarter in a row, with earnings of $11.5 billion.

Taxing question

The record profits have come on the back of soaring energy prices and turmoil in commodity markets sparked by Russia's war in Ukraine.

"Profits are driven largely by the crude oil price cycles," says Bob McNally, president of Rapidan Energy Group, a consultancy based in Washington DC.

"The oil industry incurs most of its expenses up front as it finds and develops production assets," he told DW. "Afterward, operating costs are fairly low. So when prices boom, so do profits."

The massive profits — coming at the same time as a huge spike in inflation around the world — have led to calls for governments to impose higher taxes on oil companies.

In May, the UK announced a 25% "windfall" tax on oil and gas producers' profits. Italy has brought in a similar bill. In the US, President Joe Biden has come under pressure from members of his own party to introduce a windfall tax legislation, although such a move would face major hurdles.

In Germany, the finance minister, Christian Lindner, has consistently rejected calls for such a tax, although his coalition partners in the country's three-party government are in favor. Lindner is a member of the pro-business Free Democrats (FDP), who share power with the Green party and the center-left Social Democrats (SPD).

German Finance Minister Christian Lindner is opposed to a windfall tax on oil companies

Lindner has argued that such a tax could risk fuelling inflation. That view appears to be backed up by the independent advisory group of economists who provide advice to the German finance ministry. In an expert opinion, they have warned that politicians need "to be very careful when using such popular, but in the long term economically dangerous excess profit taxes."

Green investment

The oil companies have been firmly against windfall taxes, proposing instead to ramp up investment in greener energy as a way of achieving decarbonization in the industry.

BP's profit announcement came alongside pledges to invest in wind power and electric vehicle charging. Shell's chief executive, Ben van Beurden, has spoken in favor of green investment as an alternative to taxation.

"There is a responsibility with making money and that responsibility is that we continue to invest in energy security…and in the energy transition," he said. "Ultimately that will make society less dependent on the volatility of oil and gas."

McNally says oil companies know they are going to come under increasing pressure as long as profits remain so high, but they expect a balanced approach from governments.

"Companies realize they are entering an extremely challenging and uncertain period due to extremely volatile oil prices and profits as well as political pressures to finance government expenditures while also accelerating decarbonization," he said.

Earnings reports from companies such as BP have broken records

"They would prefer that governments implement clear, durable, and reasonable policies that strike a balance between adequate investment to supply the energy the world needs to function while pursuing other environmental and budgetary objectives. Their biggest challenge is volatile, uncertain, and unrealistic government policies."

Watch the oil price

The high profits have been heavily criticized by politicians, trade union officials and environmental activists in the context of the energy and inflation crisis.

"These eye-watering profits are an insult to the millions of working people struggling to get by because of soaring energy bills," said Frances O'Grady, general secretary of the Trades Union Congress in the UK.

Earlier this year, Greenpeace decried the "shameless profiteering" of oil companies, calling their first-quarter profits "immoral." Biden himself has also been very critical, saying recently that companies like Exxon Mobil make "more money than God."

However, it appears that prices are not going to fall any time soon. McNally says as long as the oil price remains as high as it is — predominantly driven by the uncertainty prompted by the war in Ukraine — energy companies will continue to record such profits.

"The main risk to higher oil prices is a recession. Reluctance to invest will endure for a while longer as the trauma of the previous seven-year oil price bust phase recedes from memory," he said.

He also points out that if the oil price were to fall sharply again, companies would suffer in direct proportion. "When prices bust as they did two years ago, profits collapse," he said.

Edited by: Ashutosh Pandey

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.