Polyester Prince 3.0: Close Encounters of the Third Kind

Image Courtesy: Flickr

Gurugram: The decade of the 1980s saw one of the most talked-about clashes in corporate India between late Dhirubhai Ambani, the founder of the Reliance group of companies, and Nusli Wadia, the head of Bombay Dyeing, a rival manufacturer of synthetic textiles. In his biography of Ambani, titled The Polyester Prince, published in January 1997, Hamish McDonald detailed the high-profile battle. His book was not available in India due to legal disputes till many years later, in a different version.

Among other things, the Australian journalist McDonald had narrated an elaborate account of how the government changed rules relating to imports of raw materials used in the manufacture of polyester fibre to help the Reliance group at the expense of its competitors. This story is being repeated now for the third time.

In an article for the Economic and Political Weekly published in September 2014, this writer had detailed a similar tussle that was then taking place. In July that year, the government had imposed anti-dumping duties on imports of purified terephthalic acid (PTA), a critical intermediary used in the production of various polyester products, despite bitter opposition from the user industry’s representatives in various chambers of commerce and lobby groups. The decision was to benefit Reliance Industries Limited (RIL), by now headed by Dhirubhai’s older son, Mukesh Ambani, India’s and Asia’s richest man and one of the world’s wealthiest tycoons.

RIL is by some distance the largest domestic producer of PTA. In February this year, the government withdrew these duties. This has been challenged by the company, the country’s largest private corporate entity, before the Gujarat High Court. At the same time, the third round of the infamous polyester wars have started on another front. The government has initiated a similar process to impose an anti-dumping duty on the imports of another intermediary input used in the manufacture of polyester fibre, namely, mono ethylene glycol (MEG).

On December 9, 2019, the Directorate General of Trade Remedies (DGTR) in the Union Ministry of Commerce and Industry commenced an anti-dumping investigation into imports of MEG. The DGTR’s action followed a request by RIL, which is the largest domestic producer of MEG, to initiate such an investigation. RIL has claimed that domestic producers of MEG were suffering “injuries” due to alleged dumping of the imported material by suppliers from Kuwait, Oman, Saudi Arabia, the United Arab Emirates, and Singapore.

The PTA Users’ Association, a body of end-users of PTA and MEG, both of which are critical inputs for the production of polyester fibre and textiles, has written to the Ministry of Textiles opposing the move. The association has sought the ministry’s support to “terminate the ongoing anti-dumping investigation.” The letter sent to the Secretary, Ministry of Textiles, which is in the possession of NewsClick, argues that if the anti-dumping duties are imposed, RIL will be the largest beneficiary, while over 40,000 small and medium manufacturers of polyester fibre, yarn and fabric will suffer losses.

This, in turn, would jeopardise the jobs and the livelihoods of hundreds of thousands of workers at a time when unemployment has gone up and the Indian economy is in recession.

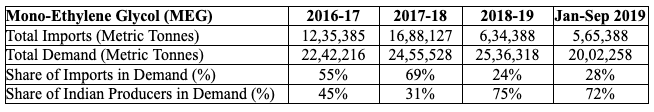

In addition, the letter argues that with total imports of MEG having fallen by nearly 60% since 2016 to occupy a share of 28% of the total demand, the allegations of dumping of cheaper imports are on weak ground.

What are anti-dumping duties?

Anti-dumping duties are a measure provided for under the General Agreement on Tariffs and Trade (GATT), the predecessor to the World Trade Organisation, of which India is a member. Under the Agreement on Implementation of Article VI of GATT, 1994, that India has signed, signatory countries are permitted to impose additional import duties on particular commodities, when they determine that that the producer country is exporting excess stocks at lowered prices or “dumping” the commodity in the importer country and causing “injury” to domestic producers.

Under Indian law, the Customs Tariff Act of 1975, and the Customs Tariff (Identification, Assessment and Collection of Anti-Dumping Duty on Dumped Articles and for Determination of Injury) Rules, 1995, provide the legal framework under which such duties can be imposed following an anti-dumping investigation by the DGTR in the Commerce and Industry Ministry.

If, after its investigation, the DGTR determines that a particular commodity is being dumped in India and is causing injury to domestic producers, it can recommend that a certain percentage of additional import duty be imposed over the prevalent basic customs duty as an anti-dumping duty to the Department of Revenue in the Ministry of Finance.

Reducing Share of MEG imports

According to the PTA Users’ Association’s letter, on December 9, the DGTR initiated an anti-dumping investigation on imports of MEG on a request filed by RIL, which is the largest domestic producer of MEG. Indian Oil Corporation (IOC), a public sector company that is another significant MEG producer, did not join or support RIL’s request, the letter notes. Another producer, India Glycols Limited, described as “insignificant” in terms of its market share, which also produces MEG in India but supplies it only to the export market, filed a “support letter” but did not participate in RIL’s petition.

Stating that “while the applicant RIL, who is the leading producer of MEG, has been performing very well year after year, in contrast the very survival of a large number of small and medium sized end-user industries is at stake,” the letter argues that under the prevailing market conditions there is no justification for such an anti-dumping duty to be imposed on MEG imports.

In support of its position, the association makes two main points. First, it says, the total imports of MEG have drastically fallen since 2016, as has the share of imports in total demand due to domestic producers having added substantial production capacity, as the tables below indicate.

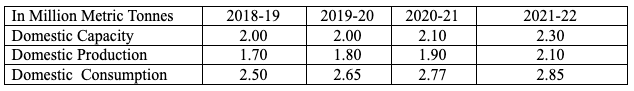

Second, the PTA Users’ Association says that since domestic production capacity is unable to meet to total demand of MEG, there is need for a certain level of imports. While in 2018-19, there was a shortfall of around 80,000 tonnes in domestic MEG production in comparison to domestic demand and a shortfall of 85,000 tonnes in 2019-20, the association projects a higher shortfall of 87,000 tonnes in the current financial year and 75,000 tonnes in 2021-22.

In addition, the association points out, after initiating its investigation, the DGTR dropped Saudi Arabia from the list of countries under investigation for allegedly dumping MEG in India, “at the behest of a request filed by the Indian producer (RIL), even though imports from Saudi Arabia constituted around 35 percent of total imports of MEG into India and was priced more or less equal to imports from other countries under investigation.” This move has been described as “ironic.”

Future of Small-Scale Units at Stake

In its letter sent to the Ministry of Textiles, the PTA Users’ Association says that “prevailing market situation due to Covid-19 has...broken the back of over 40,000-45,000 small and medium polyester fibre, polyester yarn and polyester fabric manufacturers in the country, who are a source of employment for lakhs of people at various levels of the economy.”

If anti-dumping duties are imposed on MEG, the letter claims that it will severely affect the viability of these units since raw material costs would rise. Additional anti-dumping duties over and above the basic 5% customs duty, would cause a shortage of MEG in India, the association argues, adding that domestic MEG producers would increase prices. “This will force the end-users to purchase this key raw material at higher prices and incur further losses,” the letter says.

Effectively, they would be “indirectly forced” to purchase MEG from Indian producers, the association’s letter continues, pointing out that after similar anti-dumping duties were imposed on PTA in 2014-15, domestic producers, that is, RIL, Mitsubishi Chemical Corporation PTA India (MCPI) Private Limited and smaller players “substantially jacked up the prices.”

Based on these arguments, the association has called for “urgent intervention” by the Ministry of Textiles to “impress upon the DGTR, Ministry of Commerce & Industry as well as the Ministry of Finance to consider the larger public interest of small and medium sized end-user textile manufacturers and terminate the ongoing anti-dumping investigation against imports of MEG.”

PTA Battle Renewed

In her Budget speech in Parliament on February 4, Union Finance Minister Nirmala Sitharaman announced that the government was abolishing in the “public interest” anti-dumping duties on imports of PTA from China, Taiwan, Malaysia, Indonesia, Iran, South Korea, and Thailand that had been in place since 2014.

Explaining that PTA is a raw material for many industries, Sitharaman had said “there has been persistent demand that they should be allowed to source that particular product at an affordable rate, even if it means importing it.” She had said easy availability of this “critical input” at competitive prices was desirable to unlock “immense” potential in the textile sector, seen as a “significant” employment generator.

In a petition filed before the Gujarat High Court on August 13, RIL challenged this decision of the government. The petition has been jointly filed by RIL, which produces 70% of the country’s domestic output of PTA, along with MCPI, the Kolkata-based manufacturer of 21% of the output of PTA, and the Chemicals and Petrochemicals Manufacturers’ Association. The petition describes the government’s decision to revoke the anti-dumping petitions as “illegal, without authority of law, arbitrary and in gross violation of the principles of natural justice,” and calls for the decision to be withdrawn.

It is interesting that the petition has been filed before the Gujarat High Court challenging a decision made by the Union Ministry of Commerce and Industry based in New Delhi.

RIL’s petition argues that restoration of anti-dumping duties on PTA is “imperative for the survival of the domestic industry” and that the government failed to follow the due procedures of initiating a “sunset review” investigation in accordance with the Customs Act and anti-dumping rules, which are required in order to revoke an anti-dumping duty within five years of its imposition.

On August 26, Justices R M Chhaya and Ilesh J Vora of the Gujarat High Court issued a notice to the Central government’s lawyers to take instructions from the Revenue Department in the Union Finance Ministry, the DGTR and the Ministries of Textiles, Commerce, and Chemicals & Petrochemicals who are listed as respondents in RIL’s petition.

The PTA Users’ Association is planning to file an intervention application in the case, it is learnt.

NewsClick reached out to spokespersons of RIL and IOC over e-mail on September 8 for their comments and observations on the claims made by the PTA Users’ Association. The article will be updated with their responses as and when they are received.

Abir Dasgupta provided writing assistance.

The author is an independent journalist.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.