Some Secrets of Private Banks

Image Courtesy: Oivind Hovland

For a variety of reasons, Indians still trust govt. (public sector) banks. Of the total Rs.111 lakh crore worth of deposits in the Indian banking system, some Rs.81 lakh crore or nearly 73% is with public sector banks. They are backed by the government, they reach deep into the rural hinterland and for all their so called tardiness or inefficiency they are the backbone of the country’s borrowing and lending.

But the fraud carried out by diamond billionaire Nirav Modi on the Punjab National Bank, with connivance of bank officials, has caused several financial writers and economists to clamour for privatisation of the government-run banks.

While there are many reasons why this foolish demand should not be entertained, one lesser known aspect is the high volume of tricky liabilities that private and foreign banks have in India. These liabilities are called contingent liabilities or, more popularly, off-balance sheet liabilities. They are not shown in balance sheets (except some times as footnotes) because the exact amounts involved are uncertain.

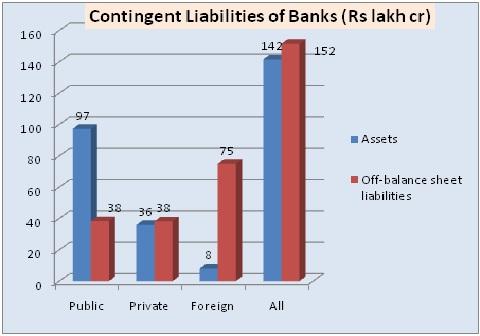

For the fiscal year 2016-17, Reserve Bank of India has revealed how much contingent liabilities are owned by banks in India. It will send a chill down your spine.

While public sector banks have contingent liabilities that are about 39% of their total assets, such liabilities for private banks are 106% of their assets, and for foreign banks they are 926% of their assets.

RBI explains that off balance sheet liabilities include all derivative products (including interest rate swaps); guarantees given;acceptances, endorsements, etc.; and claims against the bank not acknowledged as debt, liability for partly paid investments, bills re-discounted and – hold your breath - Letters of Credit.

The vast bulk of these tricky liabilities are in derivatives, that is, a security with a price derived from one or more underlying asset. In plain English, it is bet. This is the stuff that dominates speculation. Such bets can be laid on any thing from commodity prices to weather. There is a zoo of derivatives including currency rates, interest rates, mortgage rates and so on. It is these derivatives – mortgage-backed securities – that caused the financial crash of 2007-08 in the West.

Indian private banks and foreign banks earn a lot of their money from such dodgy deals, not from the standard bread and butter operations involving taking deposits and lending money. That’s why their assets make up only 27% of all assets of all Indian banks.

Any cascading crash or blow out in this bizarre world of derivatives and other beasts would lead to a collapse of such banks. Their exposure is simply too great. And, hey are exposing their clients to much greater risks.

So – take this clamour for privatisation with a pinch of salt. It is profit making greed that is driving it, not the interests of hard-working Indians.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.