Three Key Issues that Union Budget Should Address

Image credit: DD News

In a few days, on February 1, the Union Budget for the coming financial year 2023-24 will be presented to Parliament. It is customary to see this exercise as one involving obscure discussion about revenues, taxes (especially income tax), deficits, debt and so on, all in the service of that Holy Grail of high economic growth. While it may be argued that these are important numbers and weigh upon the well-being of the country, the discussion, indeed the Budget itself, tends to ignore or gloss over some of the key real-world problems that the country’s people have been facing. Some even dismiss these issues as having nothing to do the with Budget, which is one of the myths that the governments themselves propagate.

There are three burning economic problems that the people of India are facing and these can most definitely be addressed through fiscal policy measures. In fact, addressing them would in effect be addressing all the other aspects of the economy. Let us have a look at each.

Jobs, Jobs, Jobs

For the past 41 months, the unemployment rate has been above 6%, in fact, mostly above 7%, according to data collected by regular surveys conducted by the CMIE. In particular, the joblessness rate stood at 8.3% in December 2022, higher than the pre-pandemic level of 7.2% in January 2020. In the same time period of two years, the number of employed persons has shrunk slightly – from 41.1 crore in January 2020 to about 41 crore in December 2022. (See chart below)

Meanwhile, labour participation rate – the proportion of persons working or seeking work to the whole working age population – has dipped from 42.9% to 40.5%, in the same period.

This deadly combination of falling labour participation rate, high unemployment and consequent falling or stagnant number of employed speaks of dire distress among people. Since jobs are not available, people may even opt out of the labour force, depending on families for survival.

Besides this shocking unemployment situation, there is under-employment or disguised unemployment. That happens when technically people may be counted as ‘employed’ but they are actually working for very low wages, seasonally and irregularly, just to survive. Also, remember that this is a situation when the number of people seeking work in the rural job guarantee scheme (MGNREGA) has zoomed up in the past few years.

In short, there is continued and persistent unemployment in India, its demographic dividend being criminally wasted. Shouldn’t the government pay attention to this directly, rather than hope (as it has been doing) that private capital will create job opportunities? This eventuality has not occurred – and the government’s blind faith in the private sector creating jobs has resulted in just exhortations which cannot work.

What can the government do? It can start with upping its public spending, not only through ameliorative schemes but also through massive investment in productive capacities in manufacturing, construction, infrastructure, and services. It can also stop selling off the precious public sector which was and remains a big source of employment. It can fill up lakhs of vacancies in both Union and state governments, with special attention to socially deprived sections as mandated.

The government can also stop allowing foreign capital to take over India’s natural resources and diverse industrial sectors. Cuts in import duties that have led to a flood of foreign goods swamping Indian markets and thus strangling the domestic sector need to be ended to protect local industry.

Clearly, there is much the government could have done but hasn’t. The upcoming Budget can be a beginning in this new direction.

Prices on Fire

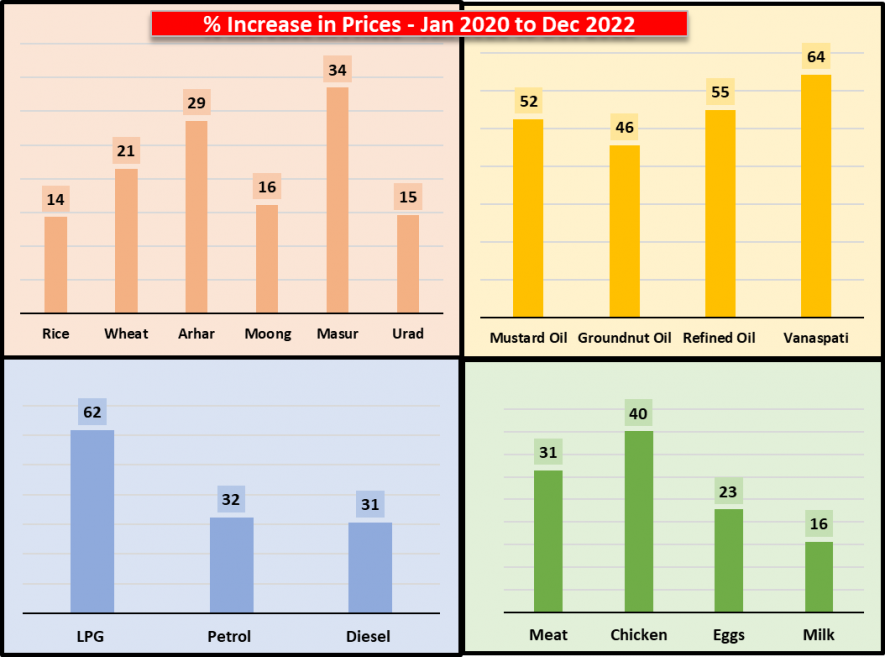

The second key issue is the price rise. Except for brief periods, consumer price inflation has been raging above 5-6% for the past nearly two years, with occasional spikes in prices of this or that essential items, as shown by consumer price index data made available by the Ministry of Statistics and Programme Implementation. In particular, cooking oils, cooking fuel (LPG) and now even a staple like wheat and atta (flour) have been on fire. Most of these can be attributed to faulty government policies. For instance, the government’s slackness in expanding oilseeds cultivation, or in the case of wheat, its policy fumbled last year, allowing procurement to fall drastically in the hope of exports that never happened, leaving enormous stores of wheat with private exporter-traders. The lack of wheat in the PDS system, combined with short supply in the open market due to holding back by these traders has led to this exorbitant rise of 21% in wheat prices over the Jan-2020 to Dec-2022 period. Various other essential food commodities and cooking fuels have also seen steep rise in prices as shown in the chart below.

Inflation, especially of food prices, is a direct robbery from the pockets of the poorer sections. As it is, these families have to spend the bulk of their income on purchasing food items. In times of low incomes and lack of well-paying jobs, the price rise is transferring more and more resources out of the families’ pockets to the rich traders and food corporates.

What can the government do to control prices? A lot. It can expand the public distribution system, bringing within its ambit other essential commodities like cooking oils, pulses, etc. It can expand it to cover more families, since it has been estimated that population growth has made about 10 crore more people eligible for being covered under the National Food Security Act (NFSA), 2013. Also, the government needs to strengthen the public procurement system and bring more produce under its ambit. The government can act strongly against hoarding and black-marketeering through existing enforcement mechanisms, although they would need strengthening too. In the longer range, it needs to invest more in expanding production, storage and processing of key food items that are perpetually on the brink of shortage. These include oilseeds, pulses, other cereals, vegetables and fruits, and marine produce. All this requires investment and spending by the government.

Lift Wages and Incomes

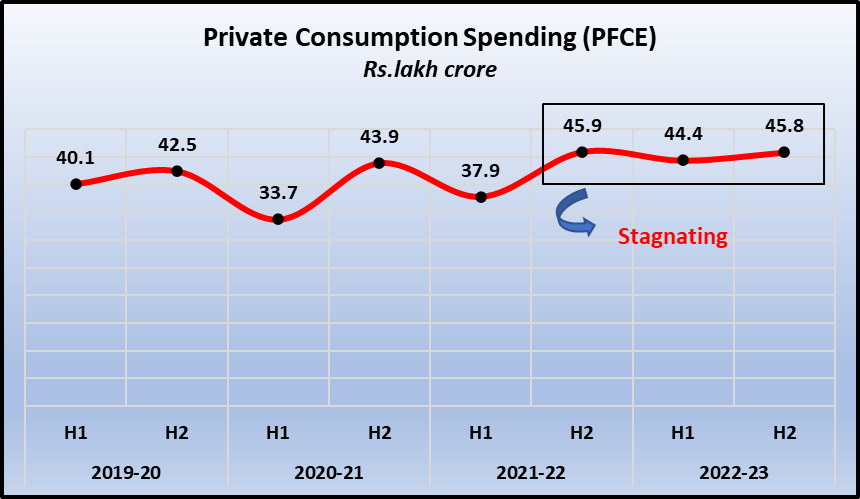

The third key issue is the extremely low incomes that Indians are being forced to accept. Although the Modi government has not allowed publication of the latest National Statistics Organisation (NSO) survey on consumer expenditure, but other sources indicate that household consumer spending – which is a proxy for household income – is stagnating, if not falling. People do not have requisite buying power in their hands. According to the latest available National Accounts data, released recently by the ministry of statistics, private final consumption expenditure has shown a slight fall in the second half of fiscal 2022-23 compared to 2021-22. (See chart below)

This is an unprecedented and worrisome situation because the pandemic blues are supposed to be over and done with and the economy was claimed to be on the recovery path. Remember that consumer spending is the cornerstone of the Indian economy, with over 50% of GDP arising from this only. If people do not have sufficient buying power in their hands, there will be less demand for goods and services. That means that all the gifts, tax cuts and exemptions given to the corporate sector in the hope of they increasing productive capacity would be in vain. If there is no demand why will anybody produce more?

As far as the people are concerned, pitiable wages are a fact of life, but now reaching intolerable limits. The last annual Periodic Labour Force Survey (PLFS) for 2020-21 revealed that the average monthly incomes of three types of employment in the country are abysmal: regular workers earn Rs.17,572 but they make up only 13% of rural households though 43% in urban areas; casual workers which make up 24% of all households in rural areas and 13% in urban areas, earn just Rs.8,281; and self-employed people’s earnings are Rs.10,563 only with 55% of all households in rural areas and 33% in urban areas falling in this category. This is a picture of a subsistence level economy. Calculations based on accepted norms of calorific intake and normal essential household spending indicate that Rs.26,000 is the minimum wage required for a family of four to survive in the country today, according to central trade unions. It is thus no surprise that consumer expenditures are so low.

What can the government do through fiscal measures in its Budget? By allocating more funds, the government can increase the Minimum Support Prices of produce to the level of 1.5 times the C2 cost of production. Coupled with a strengthened procurement system this single measure can transfer substantial resources into the hands of the peasantry which make up the bulk of India’s population. Passage of a law guaranteeing such MSP, along with enacting comprehensive legislation for the minimum wage to agricultural labour will ensure speedy and effective implementation of this, and help put money in the hands of the poorest and most downtrodden section, the agri labourers. Similar implementation of higher wages in the unorganised sector, creating a corpus to fund social security for all, including pensions and sickness benefits will also help save working class households from onerous medical expenditures, while providing a dignified life to the elderly. The MSME sector needs to be freed from the threat of imports and duty realignments with this key sector at the centre of focus needs to be done immediately. Remember that about two-thirds of employment in the manufacturing sector arises from MSMEs. Just providing cheap credit has already been done but it hasn’t worked.

Political Will Needed

Besides these key issues, there are a host of other measures involving government expenditure that can help the poor of the country and lift the whole economy. Resources can be mobilised by taxing the rich, which already own the bulk of the country’s wealth. The policies of raising money by selling off public sector enterprises or levying indirect taxes on the people like the cesses on petroleum products, need to be stopped and replaced by a progressive income tax, wealth tax and restoration of the corporate tax which was slashed by the present government in 2019.

The Budget can become an instrument for uplifting people out of poverty and building a more equitable society – provided there is a political will to do it. The people await this.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.