Aviva Insurance Allegedly Bribed Punjab & Sind Bank Officials to Sell Off Insurance Products

Representational image. | Image Courtesy: ftwonline

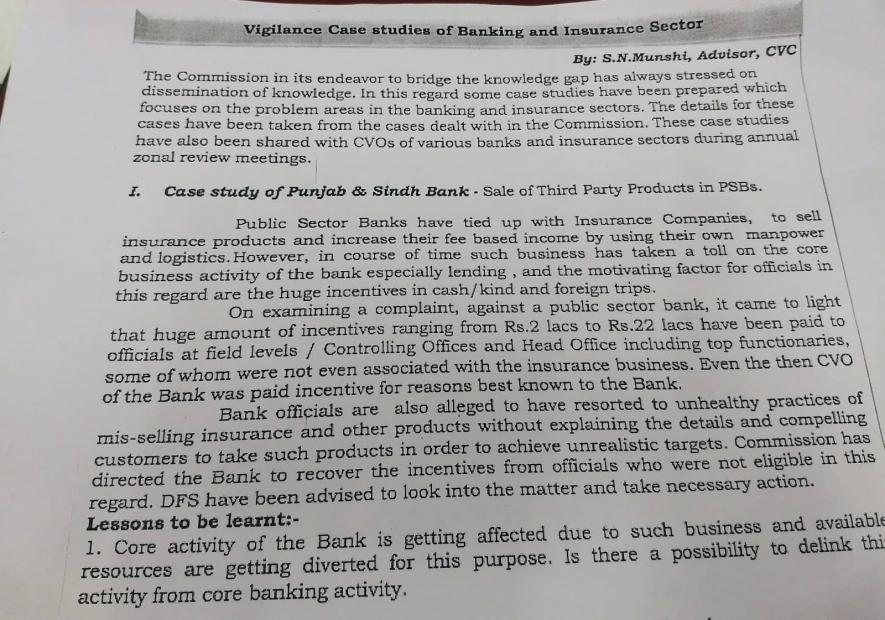

In 2000, the Government of India had introduced a scheme of Bancassurance, through the Banking Regulation Act. Under the scheme, insurance companies and banks had an agreement whereby banks were allowed to sell insurance products to its customers. The scope of the scheme was expanded in 2002, leading to gross violations of code of conduct of the banking sector. Documents accessed by NewsClick reveal how officials of the Punjab & Sind Bank were allegedly bribed by the privately owned Aviva Life Insurance to sell off its products, putting the sanctity of institutions such as the Insurance Regulatory and Development Authority (IRDA) and the Chief Vigilance Commission (CVC) under the scanner, exposing rampant corruption and lack of accountability in the sector through a PIL filed in the Delhi High Court.

Officers Bribed to Sell Insurance Products

Following the policy, the Punjab & Sind Bank allegedly became the corporate agent of Aviva for a fee or a commission which was supposed to be a part of the “non fund income” of the bank. The bank started selling its insurance projects to customers from 2005. However, as per this arrangement, the IRDA guidelines have ruled that “no payment other than the commission including administrative or servicing charges was to be paid to the bank”. Kulwinder Sethi, General Secretary of Punjab & Sind Bank Officers’ Union told NewsClick, “Aviva was transferring illegal money to the head office and to multiple officials as an incentive to ensure the selling of its products. The beneficiaries included zonal managers, assistant general managers, deputy general managers, and general managers, who were paid through the system of IBR banking.”

Also Read: Bank Fraud Investigation in India Extends to Leading Private Banks

Explaining how the products were sold to customers of the bank, he said, “Those who would come in to get smaller loans sanctioned were tricked into buying the products of the scheme. To get their work done, many fell for the promises of the bank officials. On failing to pay the premiums of the expensive policies, the policies of would lapse, meaning that the money collected initially could be used as a profit to the insurance firm, while a part of it was given to the official as a commission.”

Sanctity of Institutions Under Scanner

Sethi further alleged, “A bank account was opened, which was used to collect the commission by the bank, however, the incentives collected did not find a place in the balance sheets of the bank.” Following an exhaustive examination of the documents, Kulwinder Sethi filed a Public Interest Litigation in the Delhi High Court, putting institutions such as IRDA, CVC and Ministry of Finance in the dock. The PIL pressurised the bank to respond, triggering a discussion on the recovery of the commission collected by the bank. Following the petition in the court, the CVC highlighted, that amounts ranging between Rs. 2 lakh to Rs. 22 lakh were paid to bank officials, including top functionaries, even those who did not have anything to do with the insurance products. The officials were also involved in misselling of insurance products and compelling the customers to buy the products.

Documents accessed by NewsClick show that the bank officials were paid incentives, despite the bank admitting that it did not have an incentive scheme, establishing the fact that this was an attempt by the government to keep the ongoing corruption under the carpet. Multiple rules were brazenly flouted ensuring profits for the insurance firm. These include Section 7 of the Prevention of Corruption Act, 1986, according to which no public servant can take gratification other than legal remuneration. The foreign trips taken by bank officials are also contrary to the Officers’ Conduct Act.

Taking cognisance of the issue, the IRDA in 2010, had recognised that the corporate agents had resorted to the use of introducers or finders of sub-agents in the scheme. IRDA had issued many guidelines and had found that Rs 5.19 crore was paid by Aviva during the financial year 2011-2012, which was not accounted for in the balance sheet of the bank, and was misappropriated by officials. Accordingly, vide letter dated September 23, 2013, a fine of Rs 5 lakh was imposed on the bank, which it paid.

Also Read: Some Secrets of Private Banks

Sethi added, “IRDA did not take cognisance of similar irregularities committed by the bank during the previous five financial years.” Even the RBI was made a part of the case by the Delhi High Court as a respondent in the PIL. RBI finally submitted an affidavit in April 2015 to the effect that "payment of commission/ incentive directly to Bank Staff is prohibited". The RBI had also received complaints and during the scrutiny conducted by the bank, it was observed that employees of some of the banks apart from Punjab & Sind Bank were acting as corporate agents of the insurance companies.

Sethi through his PIL has highlighted that the process of recovery has been in a limbo, even after the Vigilance Commission sought that the recovery process be initiated. He said, “The Bank submitted a Board Resolution No. 21294 dated August 12, 2014, on February 18, 2015, during the court hearing on the PIL to the effect that "Recovery has been called for …". But the fact is, till now only Rs 8,000 has been recovered so far. Bank Management has refused to give the list of amount called for recovery, and no efforts have been made in spite of having had submitted the intent of the Board for effecting recovery.”

Talking about the inaction of the CVC and other such regulators, Sethi said, “Even though regulators such as CVC, RBI, IRDA and MOF were aware of the ongoing irregularities, yet none of them took substantive steps to punish the officials or to nip the practice in the bud. It is only after this PIL that they are facing a serious problem. Also, the Board of Directors who had resolved in 2014 to direct the Bank Management to recover the corruption money has not cared to evaluate whether the Bank Management has complied with its directives or not. The Delhi High Court should not delay any further in disposing off this Writ Petition on merit.”

On being asked to clarify the amount commissioned by the bank, it had shown the following figures denying the presence of any commission, washing its hands off of all accountability. Sethi said, “There is a clear case of the fudging of balance sheets that exposes the extent of corruption in the scheme, which includes the misappropriation of public funds and blatant violations of law, making this a serious scam of siphoning off public funds.

If the siphoned amount is calculated from the year 2005 onwards, the illegal amount could be over Rs 25 crore. However, the scam could be much bigger since the amount of incentives given to the bank officials were also through foreign trips which have not been fully accounted for yet.

Despite several attempts to reach the Bank for comments on the allegations, there was no response.

Watch More: Shakespearean Tragedy at Yes Bank

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.