Under Modi, Total Government Debt Rose By 54% In Five Years

Image Courtesy: Live Mint

The total debt of the Modi-led central government has increased by 54% to Rs 84 lakh crore between April-June 2014 and March 2019, as per the quarter ending March 2019, as per data published on June 12 by the Department of Economic Affairs, Ministry of Finance.

As of March 2019, the total debt of the central government stood at Rs. 84,68,086 crore. As of June 2014, the debt stood at 54,90,763 crore.

The Ministry of Finance data on government borrowings also shows that the total debt currently accounts for 44.55% of the country’s GDP, while till June 2014 it had accounted for 44.03% of the GDP.

The huge growth in central government’s borrowings has been prompted by 57% growth in public debt, from Rs 48 lakh crore to Rs 75 lakh crore during the first Modi government,

This rise in public debt is driven by a 60% rise in internal debt, which took it to about Rs 70 lakh crore as of March 2019. The internal debt stood at Rs 44 lakh crore in June 2014.

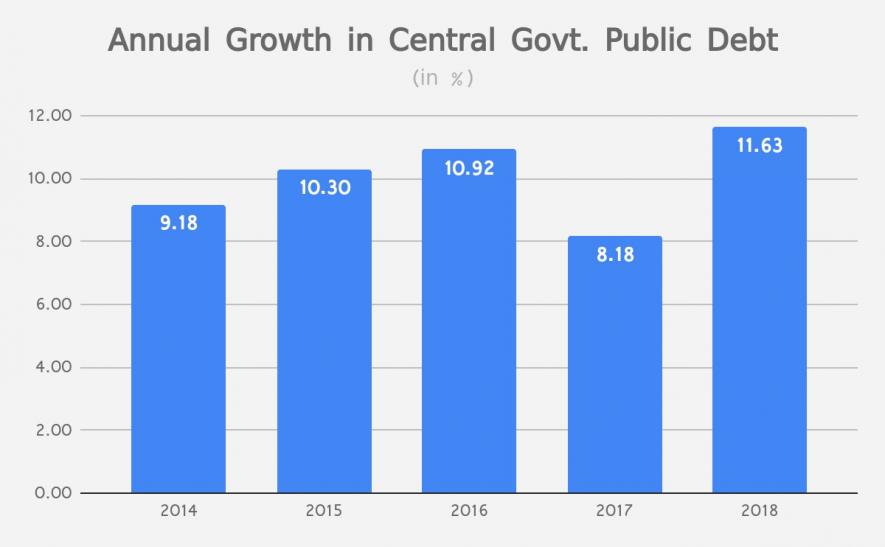

The annual growth rate in public debt, which includes both internal and external debts, is increasing continually. In December 2014, growth in public debt was 9.18%, which increased to 11.63% in December 2018, the highest in the past five years. And from December 2018 to March 2019, the growth rate in public debt was 1.5%.

Source: DEA, Ministry of Finance, Government of India

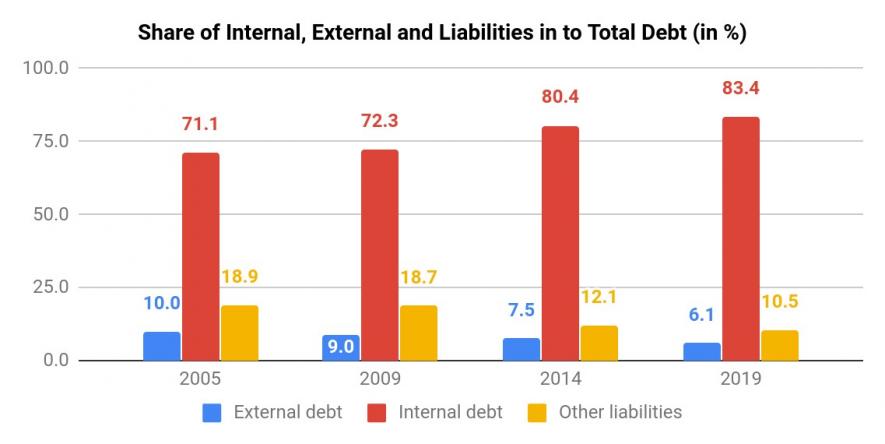

The central government is highly dependent on internal debt. Share of internal debt in total debt is around 83% in 2019, while it was 80% in 2014 and 72% in 2009. While the share of internal debt is increasing, the share of external debts and liabilities has declined.

Source: DEA, Ministry of Finance, Government of India

Internal debt is highly dependent on market loans. The share of market loans is around 65% as of March 2019, while there has been 54% growth in market loans from June 2014 up to now. Market loans account for 55 lakh crore in the latest data, which was 35 lakh crore in June 2014.

The Department of Economic Affairs provides the government debt status quarterly, and this quarterly document provides the detailed analysis of the overall debt position of the Government of India.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.