Modi’s Return Bolsters Plan to Privatise PSUs to Meet Disinvestment Targets

In it's previous term, the Modi government was able to raise Rs 2.09 lakh crore through disinvestments, however, the government primarily relied on buyback of shares and the exchange-traded funds (ETF) route for meeting its disinvestment targets. In fact, the only time the Narendra Modi-led NDA government has met and exceeded its target in its tenure was in the financial year 2017-18, when it managed to raise Rs 1 lakh crore as against the budgeted expectation of Rs 72,500 crore. This was achieved by listing insurance companies, mergers of public sector companies, Central Public Sector Enterprises (CPSE) exchange traded funds and numerous buybacks.

However, it has failed to sell any CPSE to the private sector, despite having approval to do so for 24 firms including Air India. The government as a result may now look to privatise profit-making state-run companies, marking a sharp shift from its earlier policy. The list, which includes land and industrial plants of state-owned enterprises National Thermal Power Corporation, Cement Corporation of India, Bharat Earth Movers Ltd. and Steel Authority of India Ltd., has been passed on to the Department of Investment and Public Asset Management (DIPAM).

Ever since the Modi government came to power, the bid to privatise PSUs, and dismantle what is left of the public sector has been followed through with unseen aggression. However, their success or failure on the same, is a different question.

Also read: Modi Government Continues Sucking Out Cash from Profitable PSUs through Share Buybacks

The economic reforms helmed by Modi and his think tank seem to be in line with the dictates of the Washington consensus.

The theoretical foundations of these reforms are the usual analysis promoted by neo-liberal economic theory. The arguments are as follows, economies are in crisis due to the existence of barriers to the free play of market forces, the obstacles come from the bloated interventionist state and its expansionist and redistributive policies that distort the information and market signals. The solution, according to neo-liberal order, would be the withdrawal of state from the economy and restoring the unimpeded functioning of the market.

Fiscal discipline is to be enforced on the activities of government and a return to balanced budgets (as opposed to the Keynesian deficits and expansionary budget). Limited public spending should now be directed towards areas that would cover the costs (perhaps through the imposition of compensatory payments) and to support entrepreneurship in the private sector, rather than being used to pay for public works and redistributive policies. Then, the tax system is to be reformed so as not to hit hard corporate profits and incomes of the upper layers, which are considered to be the engine of the economy. Finally, the limited public expenditure could be met with fewer taxes. The withdrawal of the state of the economy also requires the privatisation of all activities and businesses run and owned by the state, reducing to a minimum all state regulations and provide adequate assurance that there will be no violations of any property rights (as had happened previously with the nationalisations).

The solution to this, as is outlined by the Washington consensus, is to cut state expenditure. This was achieved by primarily cutting food subsidies – while people suffer from hunger, the government was more bothered about their accounts.

Also read: Modi Govt. Claims it is Set to Cross Disinvestment Target, But It’s Not Good News

Therefore, as the revenues of the central government as share of gross domestic product (GDP) fell from a height of 9.4% in 2016-17 to 8.8% in 2018-19, according to the Controller General of Accounts (CGA), state expenditure also shrank as a share of GDP simultaneously. It was seen that, in 2014-15, when Modi took over as Prime Minister, central government expenditure shrank from 13.9% of GDP to 13.2%. Since then, it has dropped to just 12.2% in 2018-19, as per CGA data.

In a desperate attempt to balance their books and cover deficits, and raising revenue, the Modi government in its previous term made desperate attempts to privatise the public sector enterprises.

PRIVATE SECTOR IN PERIL

However, the growth of the private sector itself is facing stagnation, as is evident from the falling investments and a stagnating bank credit. Credit to industry had recovered strongly after the shock of 2008-09, such that it was growing at annual rates of 20-30% in the period 2010-12. Annual growth rates of less than 15% were first evident in November 2013, but thereafter, the decline was marked and even precipitous. By mid 2016, credit to industry was flat or slightly negative, and the decline became more pronounced with demonetisation, with declines of more than 5% year-on-year in the first two months of 2017, and absolute annual declines in every month since then.

Measures such as demonetisation are infact huge factors for this situation. Plant and machinery assets of the private corporate sector grew by 5.7% in 2016-17 and 7.1% in 2017-18, according to Centre for Monitoring Indian Economy (CMIE). During the first four years of the Modi government, the average annual growth of plant and machinery of the private sector was 9.2% in contrast with 13% under UPA-II and under UPA-I , 19.5%. This implies that the private sector is not investing in productive capacities.

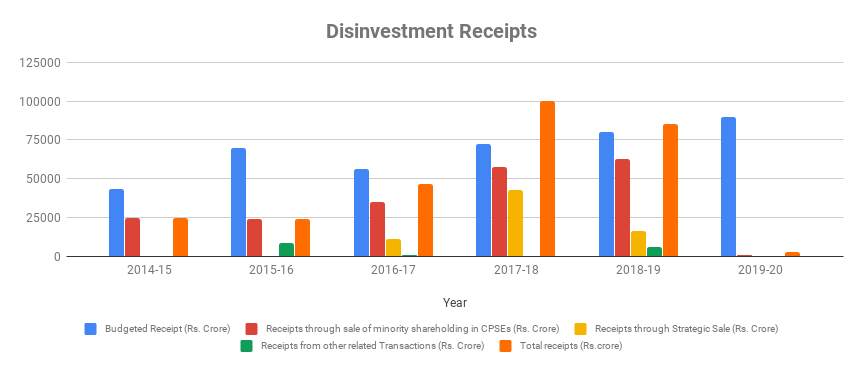

Routes followed to meet the disinvestment target

Money drawn from buybacks and inter-CPSE sales might look good on paper, however, it doesn't really affect the agenda of privatisation, as this does not reduce the government shareholding in those CPSEs – it transfers money from the CPSE to government coffers.

The above graph highlights the various routes taken by the government to meet disinvestment targets, however, a closer look at the DIPAM data would shed light on the fact that a substantial chunk of the accruals came from stake sale between CPSEs and buybacks — for example, the government-owned Oil and Natural Gas Corporation (ONGC) bought out the central government’s entire 51% stake in the Hindustan Petroleum Corporation (HPCL) for Rs 36,915 crore. A study by Prime Database, a source for capital market information, revealed that 36.62% of the disinvestment target last year came from CPSE-to-CPSE sales.

Also read: Ultra-Nationalist Modi Govt Emerges a Champion in Sale of Public Sector Assets

Despite all maneouvers and manipulations the government did in it's previous term, the economy was left in a sorry state, GDP in decline and a record high unemployment. The neo-liberal messiahs of the Bharatiya Janata Party could hardly do much to save a sinking ship.

The writer is a student in Shiv Nadar University, Uttar Pradesh, and is interning with Newsclick. The views are personal.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.