People Face a Mountain of Debt in Himachal Pradesh

Image Courtesy: PTI

The people of the mountain state Himachal Pradesh, and future state governments, will look with despair at the works of the outgoing Bharatiya Janata Party (BJP) government. It is leaving behind a mountain of debt which was estimated at Rs.74,686 crore in the budget for the current financial year.

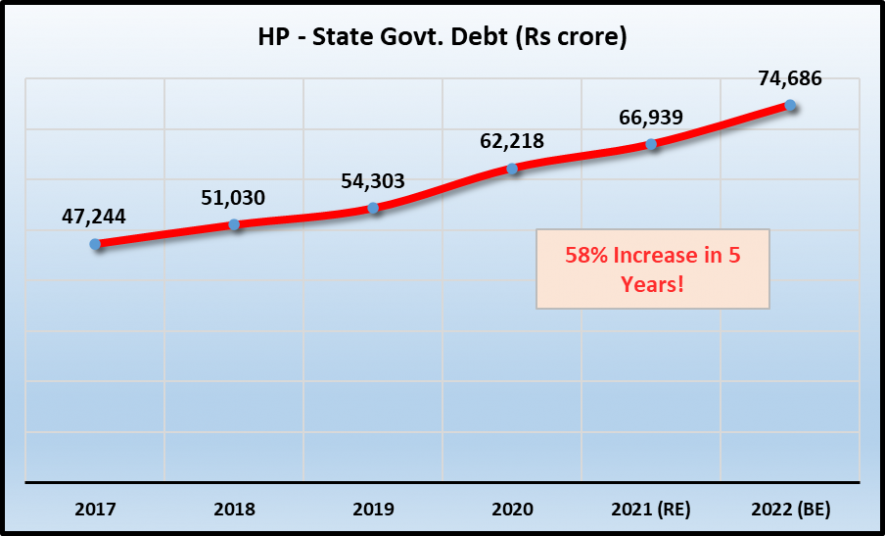

In the past five years of BJP rule under Chief Minister Jai Ram Thakur, state debt has zoomed up by an astonishing 58%. (see chart below) What this means is that each resident of Himachal Pradesh – from new-borns to senior citizens – now has a debt overhang of over Rs1 lakh on their heads.

Note that this is just the state government’s debt: the BJP-led Central government has on its part been following a similar policy of borrowing heavily, so much so that the total Central government debt as of June 2022 was estimated at just over Rs.141 lakh crore, according to a quarterly report by the Union finance ministry.

Note also that these are numbers for outstanding liabilities and these do not include state government guarantees. When state public sector enterprises borrow money from financial institutions, the state government stands guarantee that it will pay back the loans in case of any default contingency.

According to State Budget documents quoted by PRS India, a non-profit legislative research body, at the end of 2020-21, the outstanding guarantee of the Himachal Pradesh was estimated at 1.37% of GSDP (gross state domestic product), with increases in guarantee levels in the power sector and state electricity board.

The Future is Compromised

Currently, in financial year 2022-23, the total debt of the state government is about 40.49% of the GSDP. This is a record high. According to projections, the state debt will continue at a slightly lower level in the coming years with the debt in 2025-26 projected at 39.49% of GSDP, according to PRS.

What this means is that this debt is unlikely to go away soon. That is because borrowing has to be repaid over a certain period and, in the mean time, more borrowing may accumulate. So, future generations will continue to repay the debt incurred now.

Interest payments are, meanwhile, continuing every year. According to the budget documents, repayment of debt consumed Rs.4,387 crore in 2020-21 and is slated to eat up another Rs.5,342 crore in the current financial year.

Where is Borrowing Coming From?

It is instructive to see where the HP government has been borrowing all this money from. According to the break-up available with the Reserve Bank of India’s database, at the end of March 2020, the state’s debt was Rs.62,218.4 crore, out of which internal debt was Rs.39,527.8 crore. This internal debt mainly consists of market borrowings through State Development Loans (SDL,) which are bonds issued by State governments, under regulation of the Central government. HP’s SDL amounted to Rs.28,142.2 crore in the above example for 2019-20. That is, SDLs made up about 71% of the internal debt and about 45% of the total debt. These loans are thus determined by commercial rates of interest and come with strict repayment schedules.

Another major source of borrowing is provident fund from which the Himachal government had taken Rs.15,537 crore or nearly 25% of its borrowing. Loans were also taken from the National Small Savings Fund (NSSF), NABARD and various insurance companies.

Lack Lustre Fiscal Performance

Some may argue that there is no harm in taking loans if the money is used for the benefit of the people. In fact, market loans are often needed in order to expand productive capacities or finance infrastructure. But a look at the HP government’s performance shows that these loans are not really financing a booming economy. Rather, these are just being used to keep the state government afloat.

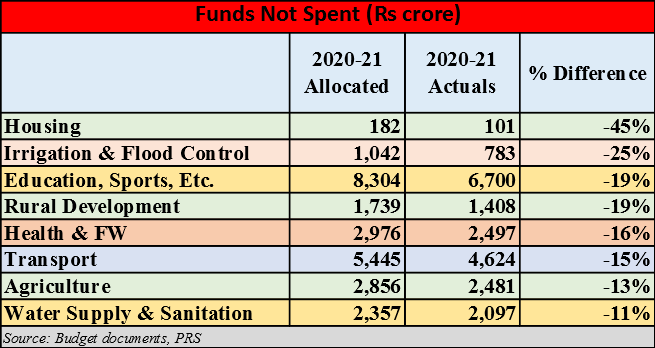

In fact, as the table below shows, the BJP government has been unable to spend even the funds that were allocated on several important heads of expenditure. The data is for 2020-21, the last year for which actual expenditure figures are available.

On several key sectors, such as education, rural development, health and agriculture and water supply – all burning issues in the state – the spending was short of the allocated amount. This was the pandemic year and focus should have been on providing maximum help to people struggling with the onslaught of the Covid pandemic. Even in the health sector, spending fell short by 16%!

Clearly, the BJP government has been borrowing heavily only in order to allow a low tax regime to continue and mismanaging the finances so drastically that it ends up not spending even allocated funds.

HP has one of the lowest tax-to-GSDP ratios and main sources of own tax revenue are SGST and excise. Here the ploy of the Central government to not make timely payments of the Goods and Services Tax (GST) compensation cess to states kicked in and forced the state (like many others) to go for commercial borrowing.

In sum, the performance of the BJP led state government leaves much to be desired and it is not surprising that in the ongoing election campaign for the state Assembly, it is facing severe discontent and anger from the electorate.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.