Modi Govt’s Disinvestment Targets Make LIC’s Health, Wealth Deteriorate

Image Courtesy: Business Today

Life Insurance Corporation of India (LIC) has been struggling with rising non-performing assets (NPAs) and downgraded investment portfolio of Rs 67,387 crore, reveals the insurer’s latest public disclosure figures. The biggest public insurer has been witnessing a deteriorating health since 2014, significantly due to massive investments in cash-strapped public and private entities pushed by Narendra Modi government, compounded by the economic crisis.

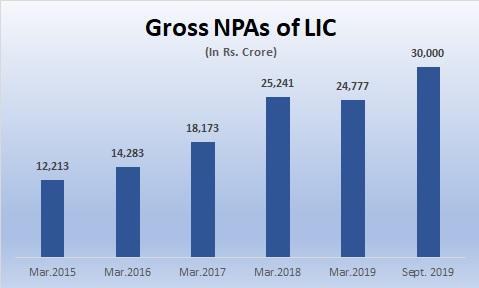

At the end of September quarter of 2019-2020 financial year, LIC has reported gross NPAs of Rs 30,000 crore. This is an increase of over Rs 5,000 crore or 21% in just a span of six months when the life insurer’s NPAs stood at Rs 24,777 crore as of March 31, 2019.

For the last five years, LIC’s NPAs have been mounting substantially. While the outstanding bad loans were recorded as Rs 12,213 crore in 2014-15, it increased by 17% to Rs 14,283 crore in 2015-16, and further spiked by 27% to Rs 18,173 in 2016-17 and the figure was Rs 25,241 in 2017-18. In other words, LIC’s bad loans bulged by 145% from March 2015 to September 2019.

What is more worrisome for the life insurer is its staggering downgraded investment towards cash-strapped entities. During the second quarter of 2019-20 financial year, investments worth Rs 23,126 crore were downgraded. Whereas, the total outstanding downgraded portfolio of LIC stood at Rs 67,387 crore, which has more than doubled compared to Rs 30,000 crore, five years ago.

The struggling companies where LIC made investments include Reliance Capital, Yes Bank, PNB Housing, Dewan Housing Finance Limited, Reliance Communications, Essar Power, Sterling Biotech, ABG Shipyard, Deccan Chronicle Holdings and Unitech among others.

Solvency Ratio

LIC has reported its solvency ratio of 1.55 at the end of September 2019 against 1.51 in September 2018. While the solvency ratio threshold fixed by sector regulator Insurance Regulator and Development Authority of India (IRDAI) is 1.50, LIC’s solvency ratio has hovered around 1.5 in the last 11 years, reportedly the lowest in the industry.

Solvency ratio is the ratio of net assets to net liabilities of insurance companies. It is the indicator that is significant in understanding the health of insurance companies. That is, although the net assets of LIC available in policyholders’ fund and shareholder’s funds are reported as Rs 1.44 lakh crore as of September 2019, of this, it had maintained only Rs 0.93 lakh crore to maintain the solvency margin. This is the amount that LIC has provisioned to cover liabilities in cases of natural calamities.

LIC Investments

One obvious reason for the crisis at LIC has been prompted by its massive investments essentially after pressurised by the central government. According to the Reserve Bank of India data, LIC’s investments increased by a whopping 76% between 2014 and 2019.

As of March 2019, LIC made investments worth Rs 26,61,564 crore, against total investment in 2014, which was Rs 15,11,133 crore.

As the Modi government began its divestments, in 2014, LIC bought 5.94% stake in Bharat Heavy Electricals Ltd (BHEL) for Rs 2,685 crore, increasing its stake in BHEL to 14.99%. In 2015, the insurer rescued the government in the disinvestment of Coal India by buying shares worth Rs 7,000 crore, picking up one-third of the public offer.

In 2017, LIC had put in over Rs 15000 crore to get stakes after government initiated the disinvestment of General Insurance Corporation of India and New India Assurance Company.

In June last year, the government made it buy sinking IDBI at a cost of nearly Rs 13,000 crore. That year, while the government asked the insurer to even bail out the Infrastructure Leasing and Financial Services (IL&FS) group, but the insurer had to back out after the fraudulent affairs inside IL&FS began to emerge.

Also watch: ‘We Won't Allow Privatisation of LIC, It’s People's Asset'

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.