Gautam Thapar: Victim Or Villain?

File Image/ Source: NDTV

In the first part of this investigation for NewsClick, the events that led to Thapar’s removal as chairman, CG, Power, were outlined. In the second and final article in the series, the role of the persons and corporate entities supposedly responsible for getting him removed are examined.

Gurugram: In a regulatory filing for the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE) on November 26, CG Power and Industrial Solutions Limited (earlier Crompton Greaves Limited) announced that all its existing directors––Ashish Guha, Sudhir Mathur, Ramni Nirula, Jitender Balakrishnan, Narayan Seshadri, Pradeep Mathur, Aditi Raja and Rathin Roy––had resigned from the company and its subsidiaries.

In their place, six new directors were appointed, signalling the change in ownership of CG Power to Tube Investments of India (TII) Limited, which is part of the Chennai-headquartered Murugappa Group. The new appointments include those of Vellayan Subbiah as a non-executive, non-independent director and chairman of the board, M.A.M. Arunachalam as a non-executive non-independent director, and N. Srinivasan as managing director. Shailendra Narayan Roy, Sasikala Varadachari and P.S. Jayakumar were appointed as independent non-executive directors.

CG Power stated: “The Independent Non-Executive Directors have been appointed for a term of five years and the Managing Director designated as (among the)… Key Managerial Personnel of the Company has been appointed for a period of three years, subject to the approval of the shareholders.”

In another filing the same day, the company said that shares worth Rs 550 crore were issued and allotted to TII by CG Power. The former was also issued and allotted 1.52 crore warrants, each carrying a right exercisable within 18 months, for an aggregate consideration of Rs 150 crore.

It was finally official: TII had taken took over CG Power, once headed by Gautam Thapar, by infusing Rs 700 crore in the company.

Meanwhile, government investigative agencies such as the Enforcement Directorate and the Serious Fraud Investigation Office in the Union Ministry of Corporate Affairs (MCA) as well as the regulator of the country’s financial markets, the Securities and Exchange Board of India (SEBI), continue to probe the allegedly fraudulent transactions that took place in CG Power and try to figure out whether or not the company’s former board members are guilty of illegalities or financial misdemeanours.

HOW GOOD WAS GOVERNANCE IN AVANTHA GROUP?

To continue where we left off at the conclusion of the first part of this article, according to a source close to Thapar who did not wish to be identified, the nine questionable transactions which resulted in CG Power losing money, were not a series of “frauds”, but a consequence of circumstances that rose out of the Reserve Bank of India’s (RBI) master circular issued on July 1, 2015, which consolidated instructions/guidelines issued to banks on prudential norms on income recognition, asset clarification and provisioning pertaining to advances.

The source further claimed that Avantha Group companies had a “clean record” till the financial year (FY) that ended on March 31, 2016, and had one of the highest credit ratings for group companies.

He said: “Till 2016, both CG Power and the Avantha Holdings Limited (AHL)–– the investment holding company of the group––experienced no problems related to bank loans, dues, defaults. Mr Thapar and the group had an impeccable reputation. The group attracted the best of banks to loan money, the best private equity investors for financial support and professional talent. The group made many acquisitions. Between 2008 and 2014, the Avantha Group (including Ballarpur Industries Limited or BILT) raised roughly US$ 2 billion (or around Rs 14,000 crore), of which around three-fourths was in the form of debt and the rest in form of equity or equity-related securities.”

Not everyone is in agreement with this version of corporate governance practices in the Avantha group. In a detailed profile of Thapar published by Outlook Business in October 2019, Krishna Gopalan wrote: “…in 2011, a red flag was raised on corporate governance at Crompton Greaves. It was to do with the purchase of a private jet, when the company was not posting good numbers. Reportedly, institutional investors pressurised the management to sell the aircraft.”

The magazine further reported: “Initial symptoms that all was not well was evident in FY12 when the company’s net profit crashed by almost 60%,” and quoted Sameer Kalra, founder, Target Investing, saying that CG’s acquisitions were in sectors with high working capital requirements. “All the major acquisitions were done before the global financial crisis, which meant they were bought at the highest revenue and profitability level,” he said.

“The overseas business had become the biggest drag. Competition was cutting prices and customers were not taking delivery. Smaller businesses such as the one in Canada were quickly sold, though the larger piece that was in parts of the US, Indonesia and slowdown facing Europe continue to struggle.”

Financial troubles in BILT and Avantha Power and Infrastructure added to pressure on CG Power. In 2006, BILT bought Sabah Forest Industries, Malaysia’s largest pulp and paper company, catapulting to the league of top ten paper companies in Asia, excluding Japan. A major reason for the failing finances of the Avantha group was the crash in paper price three-four years after BILT’s acquisition of Sabah Forest. Transporting pulp was no longer an economically viable option.

In late-2009, plans to list Avantha Power––that had thermal power projects in Jhabua, Madhya Pradesh and Korba, Chhattisgarh––failed to materialise. The group had investment, the equivalent of around one billion USD (Rs 7,000 crore) in the two power projects, largely by leveraging the assets of Avantha Holdings Limited that were secured by pledging the shares of CG Power and BILT and Thapar’s private real estate. The Korba plant is currently owned by Adani Power Limited from the Adani Group after undergoing an insolvency process, while the one in Jhabua is still with the Avantha Group.

BILT Graphic Paper Products, a subsidiary of BILT, reportedly owed around Rs 218 crore to Kotak Mahindra Bank and was on a list of defaulters of the RBI. The bank filed an insolvency plea against the company in April 2019. BILT currently owes around Rs 6,000 crore to its lenders.

IMPACT OF NEW RBI RULES

The debt-funded strategy of the Avantha Group and CG Power was seriously challenged in 2016 in the wake of the RBI changing its norms for banks on refinancing of debts and the tightening of rules relating to classification of assets (or loans of banks). The source close to Thapar said: “CG Power and the Avantha group had a large number of lending banks in common. Under the new RBI rules, if the assets of any entity in a group are considered non-performing, banks are supposed to not only not extend new loans to any other entity in the group, but also recover loans made to these other group entities.”

A portion of the RBI’s “master circular on exposure norms” dated July 1, 2015, read: “The concept of ‘Group’ and the task of identification of the borrowers belonging to (a) specific industrial group is left to the perception of banks/financial institution(s). The group to which a particular borrowing unit belongs, may, therefore, be decided by them on the basis of the relevant information available with them, the guiding principle being commonality of the management and effective control.”

The source close to Thapar said the Avantha Group was under a lot of pressure between 2014 and 2016 because the international businesses of CG Power were faring badly. Notable among the lenders were KKR India and AION Capital Partners, a joint venture between the US private equity firm that specialises in stressed assets – Apollo Global Management – and ICICI Ventures, the private equity arm of ICICI Bank. (Incidentally, in June 2020, the joint venture reportedly came apart.)

There was intense pressure on the Avantha group to hive off CG Power’s consumer products business. As stated in the first article, in 2015-16, the Avantha Group demerged and then sold all its shares in Crompton Greaves Consumer Electricals Limited to US-based private equity firm Advent International and the Singapore government-owned Temasek Holdings for Rs 2,000 crore. Crompton Greaves, arguably the best-known venture of the Avantha group, produces and sells a host of household electrical goods, such as light bulbs, fans, kitchen appliances and water pumps.

The source close to Thapar said: “The demerger created value for public shareholders but the Avantha Group did not benefit from the higher valuation––currently around Rs 6,200 crore. The consumer business was a cash cow earlier, generating profits of around Rs 400 crore a year before it was hived off.”

In order to overcome its liquidity constraints after the demerger, CG Power approached the consortium of banks led by the State Bank of India for additional loan limits. This was refused by the banks and the source quoted earlier claimed that CG Power was left with “no option” but to approach the Avantha Group to “use” its relationships with certain banks and financial institutions for the additional funds. These included IndusInd Bank, Standard Chartered Bank, YES Bank, Axis Bank and Aditya Birla Finance.

SEVERE LIQUIDITY CRUNCH

By then, over and above CG Power, the entire Avantha Group faced severe challenges in raising loans with companies such as BILT, its subsidiaries, Avantha Power and Avantha Holdings defaulting on servicing their debts and the banks declaring their assets as “stressed” ones.

“When CG Power approached the above-mentioned banks and non-banking finance companies for additional funding, they said they would agree only if CG Power agreed to clear the dues of other Avantha Group companies and prevent these loans from becoming non-performing assets in their books,” the source close to Thapar claimed.

He further contended that at a meeting of the risk and audit committee (RAC) of CG Power and its board of directors, that was held on August 30, 2016, in which Thapar was not present, what came to be known as “related party transactions” worth Rs 1,000 crore were approved. “If this had not been done, CG Power would have become a defaulting company, shareholder value would have been destroyed, thousands of employees would have lost their jobs and the livelihoods of many vendors would have been adversely impacted,” the source claimed.

Not everybody is convinced by these arguments. Whatever be the claims and counter-claims of the contending parties, one thing is crystal clear: this was the beginning of the problems of CG Power and the beginning of the end of Thapar’s stewardship of the company he headed that would eventually take place three years down the line. Could he have anticipated his ouster as chairman of board? Certainly not.

DID KKR INDIA AND SESHADRI STAGE A ‘COUP’?

The InGovern report quoted in the first article in this series, dealt with the role that the private equity firm KKR India may have played in the troubles that arose in CG Power. Sometime in 2017, it appears that Avantha Holdings, headed by Thapar, was unable to pay a part of the loan to KKR India and had asked for an additional loan from the private equity firm.

The following year, in 2018, Thapar asked KKR India to roll over the outstanding debt or convert it into equity, after which KKR India asked for the appointment of Narayan K. Seshadri, chief executive officer of (CEO) of Tranzmute Capital and Management Private Limited, as a consultant in the company. Soon thereafter, KKR India changed its demand and asked that Seshadri be made an “independent” director of CG Power.

In February, Sanjay Omprakash Nayar, the current partner and CEO of KKR India was made a partner of Tranzmute. The InGovern report asked: “What is the relationship between Mr. Narayan Seshadri, Tranzmute and KKR India?”

Apart from Tranzmute, there are other firms in which there are close links between KKR India, its CEO Nayar, and Seshadri. KKR India has invested in Ramky Enviro Engineers Limited, a company which provides environment management services. Seshadri is currently an independent director in the company and Nayar a non-executive director. In February 2019, KKR had invested around $510 million and acquired 60% stake in the company. The Economic Times reported in April that KKR was looking to sell its controlling stake in Ramky. Nayar resigned from the company’s board in September this year.

In October 2016, Nayar, Seshadri and Vikram Sud started Epimoney Private Limited, a non-banking finance company (NBFC). Nayar and Seshadri are designated partners in EPI Venture Partners LLP (limited liability partnership) from the time the entity was incorporated in June 2015.

Earlier, in May 2011, KKR invested Rs 236.31 crore to own a stake of 14.95% in Magma Fincorp Limited, another NBFC, based out of Kolkata. KKR sold all its shares in Magma during April-May 2018 in the open market with “double returns.” Seshadri used to be the chairman and an independent non-executive director of Magma and resigned from his position on August 31 this year. Nayar was also on the company’s board between July 2011 and April 2018.

According to an Economic Times report from May, India Grid Trust, an infrastructure investment trust backed by KKR, acquired a power transmission asset at Jhajjar, Haryana from Kalpatru Power Transmission and Techno Electric and Engineering Company for Rs 310 crore. Interestingly, Seshadri is currently an independent director in Kalpatru Power Transmission.

Nayar and Seshadri are also board members in Radiant Life Care Private Limited, which acquired 49.7% in the Max Group, one of India’s largest private hospital chains, in June 2019. Two years earlier, in July 2017, KKR invested $200 million to pick up a 49% in Radiant Life Care. Former CG Power director Omkar Goswami was on the board of directors of Max Heathcare Institute Limited till June 21, 2019 and was replaced the same day by Nayar.

Nayar and Sesahdri became directors in Seynse Technologies Private Limited in July 2015; the latter resigned in May 2017.

Seshadri is evidently an influential member in many of the companies in which KKR India has invested, and is closely associated with the Indian affiliate of the international private equity group. Sources close to Gautam Thapar alleged that he was instrumental in staging the “coup” that led to Thapar’s ouster as chairman of CG Power on August 19, 2019, and that KKR India earned an overall annual return of between 18% and 20 % in all its deals with CG Power as well as the Avantha group.

In a guarded response to a detailed questionnaire emailed by the writers of this article, Narayan Seshadri denied the allegations against him. He first praised one of the writers of this article and then stated:

“To answer your question directly and unequivocally, I am independent. I was invited by Mr. Thapar to join the board as independent director only after full disclosure to, and diligence by, the NRC (nominations and remuneration committee) and the Board of CG Power approved the nomination. This position has been reviewed by lawyers at the behest of the CG Board, and they have completely endorsed the fact that I am independent.

As a director of any company, I strive to improve governance, enable better decision making by challenging proposals and working to take care of the interests of minority shareholders. Any allegations by any person either questioning my independence or making any allegation of mismanagement or otherwise against me is incorrect, baseless, frivolous, misleading and motivated. The same is clearly being done with the intention of deflecting attention from the real issues that are facing the Company and are being investigated by due process of law.”

CIRCUMSTANTIAL EVIDENCE

A former member of the board of directors of CG Power, who spoke to one of the writers of this article on condition of anonymity, said that he did “suspect” that Narayan was “fronting” for KKR. He said: “When it became apparent that KKR India wanted to take control of the company, I asked him, ‘Narayan, are you an independent director or are you fronting for KKR?’ He kept quiet.”

An “operations committee” was constituted in CG Power after Seshadri was made a board member. The committee soon hired Vaish Associates to investigate certain transactions in the company. SEBI then barred Thapar and others from participating in securities transactions. Interestingly, this committee was wound up in September 2019 after Thapar was ousted on August 29 that year.

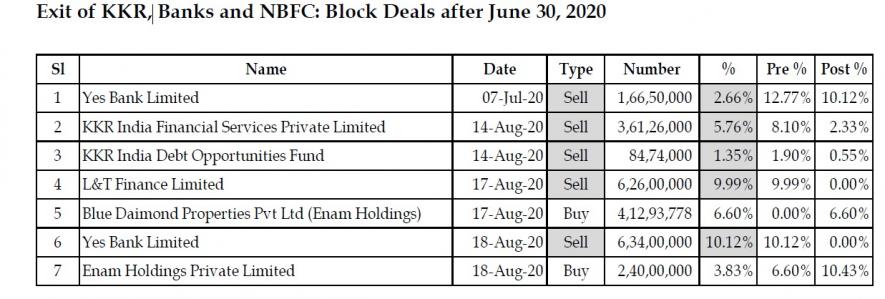

The circumstantial evidence is there for all to see. KKR India held around 10% of the equity capital of CG Power after invoking the shares pledged by Thapar and the firms controlled by him. On August 14, 2020, KKR India Financial Services Private Limited and KKR India Debt Opportunities Fund, subsidiaries of KKR India, sold 5.76% and 1.35% of their shares respectively, in CG Power. The two KKR subsidiaries were left with shares of just 2.33% and 0.55% respectively in CG Power while KKR India held less than 3% shares in the company.

The InGovern report noted: “During the investigations by SEBI, (the) SFIO and restatement of accounts, KKR was exiting its holdings in the company. So, it is not clear as to why KKR, which triggered in 2019 the entire change of Board and ouster of Mr Gautam Thapar and some key management personnel and converted its debt in the holding company to equity of CG Power, is exiting even before the new imminent promoter steps-in.”

The report raised a question: “Is KKR selling out its holdings as SEBI, in the confirmatory order, has mentioned about complaints and investigation into the role of KKR and Narayan Seshadri for their alleged involvement in market manipulation and insider trading, based on material made available to them by the Noticees?”

KKR India has stated that as a shareholder, it is in its interest to engage

constructively with CG Power through its board of directors as well its shareholders, in order to “preserve and enhance the value of the company.” The InGovern report asked why was KKR India was exiting the company at a time when its valuation was very low?

People aware of the goings-on in CG Power told the writers of this article that officials in SEBI had made enquiries about the alleged role of KKR India in the ouster of Thapar and claims about Seshadri acting as “front” for KKR India in CG Power.

In December 2019, the MCA had ordered the SFIO to investigate the affairs of CG Power and 15 related/group companies. It was reported in The Hindu Business Line in September that the forensic audit report initiated by the BSE “makes no mention of wrongful diversions, siphoning of funds or account manipulation by Gautam Thapar.”

NCLT ENTERS PICTURE

As mentioned in the first article in the series, the Mumbai bench of the National Company Law Tribunal (NCLT) had in January termed the report by Vaish Associates as “bogus” and said that it will only accept a report on CG if it is conducted independently or by a government agency. The NCLT also added in the order that Vaish Associates’ report could not be the “sole basis for concluding that fraud unless, corroborated with the inspection / investigation report of an independent government agency on the facts and circumstances of the case.”

In 2019, the MCA had filed a petition in the NCLT seeking re-opening of the books of account of CG Power and the recasting of the company’s financial statements. The respondents in the petition included CG Power, V.R. Venkatesh, Gautam Thapar, Omkar Goswami, Ashish Kumar Guha (former chairman who replaced Thapar), Ramni Narula, Jitender Balakrishnan, Narayan K. Seshadri, Sudhir Mathur, Madhav Acharya and B. Hariharan.

In its March 2020 order, the NCLT allowed the reopening of the books of account and recasting of financial statements of the company for a five-year period between 2015 and 2020. The order stated:

“From the beginning whenever this matter was posted before this Bench we were not very much impressed by the submissions made by the present and past management of the company. In order to bring out the truth whether any irregularities are committed or not, whether the Respondent No. 1 (CG Power) Company’s self-declaration on the alleged irregularities are correct or not, can be ascertained only when the entire affairs of the Company are investigated by the Government or its agencies.”

INVOLVEMENT OF SUNIL MITTAL AND LARSEN & TOUBRO FINANCE

The InGovern report highlighted that YES Bank and Larsen & Toubro Finance Limited also sold their shareholdings in CG Power. In July and August 2019, YES Bank cumulatively offloaded its entire share of 12.77% in CG Power. And L&T Finance offloaded all its 9.99% shares in the company during the month of August.

The report questions whether KKR India acted as “persons-acting-in-concert” with other shareholders like the Sunil Bharti Mittal-owned Bharti (SBM) Holdings Private Limited and L&T Finance, thereby “precipitating” the changes in the board of directors and top management in CG Power changes, including the sacking of Thapar.

Bharti (SBM) Holdings Private Limited, which is a part of the multinational conglomerate Bharti Enterprises, had shares of 8.30% as on September 30, 2019. Interestingly, Bharti Infratel, the tower unit of Bharti Airtel sold 10.3% of its stake to KKR and Canada Pension Plan Investment Board in March 2017.

However, Bharti Enterprises denied any wrongdoing on its part in a response sent by a group spokesperson on October 30 to an emailed questionnaire sent by the writers two days earlier. The spokesperson stated: “We would like to state that Bharti (SBM) Holdings Pvt. Ltd (Bharti) while acquiring the aforesaid stake did not act in concert with any other entity(ies). The shares were acquired in a normal course (market transactions) in full compliance of all regulatory guidelines and it is evident from the disclosures submitted to the Stock Exchanges under SEBI. We had no interest in effecting any change in the board etc. and Bharti continues to hold the shares till date.”

SEEKING RESPONSES FROM KEY PLAYERS

We sent a questionnaire to the email address of the media contact of L&T Finance on October 28 and repeated it on November 24. We also attached the InGovern report with our e-mail. One of the writers of this report also spoke to this person over the phone, but we received no response to our email. We emailed a questionnaire to the official email address of KKR India and again, received no reply.

We emailed questionnaires and/or a draft of this article to Gautam Thapar twice using WhatsApp on October 28 and November 23 and also emailed the secretary, Avantha Holdings Limited. On November 23, we set similar emails to the then CG Power chairman Ashish Guha, the company’s then whole-time director Sudhir Mathur, Sanjay Nayar, CEO of KKR India and to B. Hariharan, former CEO, CG Power, who is currently director, Avantha Holdings Limited.

Nayar did not respond to our email, while Guha, Mathur and Hariharan said over the phone that they would not like to comment as investigations were on by SEBI and the SFIO.

VICTIM OR VILLAIN?

A person who is familiar with the goings-on in CG Power told one of the writers of this article on condition of anonymity that while Thapar was in private painting himself to be a victim of circumstances, he was not exactly innocent. He said: “After the Vaish report came out, the board of directors took a call to oust him because he was hurting the credibility of the company.”

Another knowledgeable source who also spoke on condition that he not be named, claimed: “Thapar had pledged 12% of CG Power’s shares to YES Bank and the balance to KKR India and L&T Finance. So, nearly all his shares were pledged except for 8,750 shares. The amount these shares were pledged for is not known but when Thapar was not able to repay his dues, KKR invoked its guarantees. This was what happened.”

A source close to Thapar alleged: “Till the involvement of Narayan Seshadri, who was clearly associated with KKR India’s CEO, CG Power and the Avantha group never faced any allegations against them. Nor was there any litigation against any bank or financial institution. Mr Thapar was stripped off control of the company and its chairmanship with mala fide intentions by certain individuals with vested interests for personal gains. The allegations need serious investigation.”

Indeed, that is precisely what SEBI and the SFIO is currently supposed to be doing.

As already stated, Seshadri claimed he was “independent” as a director of CG Power.

Another source close to Thapar questioned the role of the regulator: “Look at the interim order of SEBI. In it, CG Power has been directed to ‘file for recovery of money’ from various group companies, which presupposes that there has been a fraud and that the former chairman and others are guilty. Is SEBI a regulator or a court? The order tied Mr Thapar’s hands behind his back completely. We wonder who benefited from the order since the forensic audit has raised serious doubts about the accusations against Mr Thapar and others.”

This argument is refuted by another person aware of what had taken place in CG Power. He remarked: “I am of the view that there was nothing unusual about the interim order of SEBI. As a regulator it can ask for recovery of funds from group companies since public money is involved.”

We were told by another reliable source that the banks conducted a forensic audit which was completed in April 2020. “Only thereafter has fraud and siphoning of public money been alleged,” the source claimed.

On September 18, 2019, Business Standard had reported that a “look-out” circular had been issued against Thapar by the MCA on the recommendation of the SFIO as a result of which he is unable to leave India to meet his family members, some of whom are based in London. The source close to Thapar suggested that this is not such a “big deal” as his family members have visited him in India.

Others whose names figure in the MCA circular are former CEO of CG Power K.N. Neelkant, former director B. Hariharan, current whole-time director Sudhir Mathur, and former top officials of the company Madhav Acharya, V.R. Venkatesh and Shikha Kapadia (who was company secretary).

The travails of CG Power’s former chairman Gautam Thapar seem far from over. The ongoing and ensuing legal tussles are likely to be protracted.

The writers are two independent journalists based in Gurgaon. Research assistance was provided by Ravi Nair.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.