Air India: Family Silver Sold for a Song

Corporate chieftains and the media have gleefully welcomed the sale of Air India. The sale of the Maharaja of Indian aviation marks the first big ticket privatisation by the Narendra Modi government since it assumed office in 2014. The sale, ominously the first in a series of planned sales of public enterprises, could well mark the Modi regime’s ‘Balco moment’, the point at which an earlier National Democratic Alliance dispensation, headed by Atal Bihari Vajpayee, embarked on an aggressive — and controversial — adventure of selling profitable Indian PSUs (public sector undertakings) in 2001.

On October 8, the government announced that Talace Pvt. Ltd, a fully owned entity of the holding company of the Tata empire, Tata Sons, is to take over India’s oldest airline, Air India. The deal includes the sale of Air India, Air India Express, the low-cost international carrier of the company, and Air India’s holding in AISATS, the ground handling company in which Air India is an equal partner along with Singapore Airlines.

The Tatas are to pay Rs. 18,000 crore for taking complete control of Air India. Of this, Rs. 15,300 crore is to go toward a partial settlement of total debts amounting to Rs. 61,562 crore. In effect, the government is receiving only Rs. 2,700 crore as cash from the sale. The uncovered debt, amounting to Rs. 46,252 crore, is to be transferred to Air India Assets Holding Ltd (AIAHL), a special purpose vehicle. Non-core assets, including land and building, reportedly valued at Rs 14,718 crore, would also be transferred to AIAHL. It is by no means clear whether this value would be realised eventually. Curiously, although the Cabinet Committee on Economic Affairs (CCEA) approved the bid on October 4, it was only announced four days later.

Although the government announced cryptically that the interests of employees would “be taken care of,” there is little clarity about the fate of more than 14,000 employees in Air India and Air India Express. In any case, the terms of agreement provide a minimum level of protection for only one year, after which a VRS (voluntary retirement scheme) will come into operation. Most importantly, it is very likely that the terms of employment of what is regarded in the industry as an extremely well-trained workforce, are likely to turn significantly adverse for the employees.

Tuhin Kanta Pandey, Secretary, Department of Investment and Public Asset Management (DIPAM), has said the government will also fund the airline’s daily operational cost of Rs. 20 crore that will keep Air India afloat till the deal is finalised in December. Pandey also clarified that any additional liabilities that arise between now and December would be moved over to the special purpose vehicle. Simply put, this means that the losses would be the responsibility of the exchequer, or even more simply, the public at large. The Letter of Intent (LoI) was issued on October 12, which confirmed the government’s commitment to sell 100% of its stake to the Tatas.

A Debt-Driven Takeover

The takeover of Air India’s debt is quite significant, a fact played down in most media narratives since the sale announcement last Friday. First, although the transfer of Rs. 15,300 crore of debt would result in revocation of the sovereign guarantee, the Tatas would still benefit significantly from it, especially because interest payments on the debt would give the group significant tax advantages. It is by no means clear whether the Tatas will actually incur an outgo of Rs. 15,300 crore as payment for the debt that it has taken on as part of its bid for Air India. Very soon, the Tatas will have to renegotiate the debt with the banks concerned. In fact, it is quite possible that a portion of it may be written off by the public sector banks.

Thus, the Tatas would not only be acquiring control of an airline that significantly expands its market share in civil aviation, but the deal is significantly sweeter because 85% of the payment would be on terms that offer it tax concessions. Needless to say, since the corollary of any tax “concession” is a corresponding loss to the public exchequer, it is obvious who suffers from the extra sweetness of the deal. For instance, if the Tatas incur interest payment of Rs. 1,570 crore on the debt (at the rate of 10% on the loan), they would be able to offset Rs. 471 crore as tax breaks, assuming an average corporate tax rate of 30%. Seen from this perspective, tilting the structure of the privatisation deal in favour of debt has adverse revenue consequences for a government whose sole justification for the Air India sale is that it is a ‘burden’ on the exchequer.

Air India’s Crushing Burden — Four Factors

The triumphant narrative about the Air India sale in the media is based on the portrayal of the airline as a basket case whose sale was inevitable because of its bleeding balance sheet. This, coupled with the commentary that the airline is a slothful player unworthy of rescue, is what explains the shrill whoops of joy that have welcomed the sale. However, this ahistorical approach -- one that refuses to locate Air India’s longstanding travails in the context of the actions and policies implemented deliberately by its owner (read successive governments) in the past two decades -- is obviously biased. In doing so, such an approach blatantly and egregiously favours powerful private interests, at the expense of wider public interests.

The historical context of Air India’s massive and crushing debt burden arises from four specific sets of policies adopted by the Indian government. The first was the decision in 2005-2006 to place a massive order — in one shot — for the purchase of 111 aircraft by Air India and Indian Airlines. The only conceivable trigger for the massive purchase order — described by one airline pilot to this correspondent at that time as akin to a buyer ordering sacks of potatoes or onions at a mandi — was that it was to be a quid quo pro for the India-US nuclear deal that would be signed later, in 2009.

Air India placed an order for 50 Boeing aircraft (with GE engines), including a 27 medium-capacity long-range Dreamliners. Air India Charters, its subsidiary, signed a deal with Boeing for 18 aircraft fitted with CFM engines (CFM is a joint venture between GE and the French company, Safran). The combined value of the two orders was Rs.38,149 crore (at the then prevailing exchange rate of Rs.44 to the US dollar). The deal was signed on December 30, 2005. In February 2006, Indian Airlines ordered 43 Airbus aircraft in a deal that was valued at Rs. 8,400 crore. Both airlines thus placed orders worth Rs.46,549 crore.

Subsequently, the Comptroller and Auditor General (CAG) and parliamentary committees documented the egregious neglect of the two airline companies. Between 1996 and 2002, when the Indian civil aviation market was expanding rapidly, and when private airlines had already made inroads, successive governments dithered in allowing the two public sector airlines to expand their fleet. Instead, when the orders were placed later, they were so huge that they broke the backs of the airlines.

Significantly, the CAG concluded that the Ministry of Civil Aviation (MoCA) applied heavy pressure on Air India to inflate the scale of its acquisition. In particular, the increase in the order for long-range aircraft, from 10 initially to 50 finally, resulted in the acquisition budget increasing from $1.10 billion to $6.15 billion. It also pointed out the “risky” acquisition of long-haul aircraft for deployment on routes that had been traditionally loss-making (non-stop flights to destinations in the US, for instance).

The national auditor also found serious deviations in the process adopted to finalise the deal. The case of the domestic carrier Indian Airlines’ attempts to increase its fleet strength during a phase when the market was growing, was a little different. Between 1996 and 1999, it initiated a programme to acquire 15 Boeing and Airbus aircraft, but this was shot down by the NDA Government headed by Vajpayee because it had already decided to sell the airline. Eventually, when the airline ordered 43 aircraft, the CAG found that a smaller order, with an option to order more later, would have been more beneficial for the airline. In four years, between March 2005 and March 2009, although Indian Airlines’ fleet strength increased from 67 to 97, its market share fell from 37% to 17%. Clearly, the scale of the acquisition was imposing a catastrophic burden on the two airlines.

And, if this was not bad enough, a year later, the government forced Air India and Indian Airlines into a shotgun marriage, without a care for their synergies. Even more incredibly, the MoCA, which had egged the two airlines to aggressively acquire aircraft, was plotting the merger of the two airlines; common sense would have dictated that any acquisition be made after the merger, depending on the needs of the combined entity. In fact, later, the CAG did not detect any evidence that the MoCA had provided any “detailed justification” for approving the merger. Although the merger was hurried through and became effective in August 2007, shockingly, it took four more years for the merged airlines to incorporate a common ticketing system! As a result, Air India’s entry into the Star Alliance was delayed significantly. Meanwhile, it kept losing market shares.

The Undermining of National Carriers

The third element of this sordid story pertains to the aggressive pursuit of an “Open Skies” policy in India by successive governments, even when these have not been reciprocated by other countries. For instance, until 2003-04, foreign carriers were only allowed to operate from major airports in India. Since then, they have been allowed to directly serve locations in the interiors. Liberalised bilateral agreements also allowed foreign carriers to significantly enhance capacities.

For instance, on the lucrative routes to West Asia, seat capacities for airlines from Dubai increased almost fivefold between 2003-04 and 2008-09. While foreign carriers were operating at almost 99% capacity in 2008-09, Indian carriers were operating at less than 50%. It was obvious that foreign carriers were able to ramp up capacity utilisation not merely by carrying point-to-point traffic, but by carrying traffic from their home hubs, using their so-called 6th Freedom advantage to carry traffic to and from their hubs to destinations beyond. The 6th Freedom for airlines, which has become important in the past two decades, allows airlines carrying traffic between two foreign locations to stop within their own country, usually their home hub. Etihad/Abu Dhabi, Emirates/Dubai, Qatar Airways/Qatar, Cathay Pacific/Hong Kong and Singapore Airlines/Singapore are some examples of these partnerships in which the state, airport authorities and airlines promote and nurture national hubs. Alas, Indian aviation policy, driven by a neoliberal fixation, has refused to consider such a role for the state.

While Air India’s operations, were hampered by an inadequate fleet, Indian Airlines was hit hard by the fact that foreign carriers such as Emirates were allowed to operate even from smaller towns such as Kozhikode. In fact, an analysis of air traffic to and from India for 2009-10 by the CAG (2011) revealed 6th Freedom traffic of Qatar Airways, Gulf Air (Bahrain) and Etihad was more than 75 per cent of their overall traffic to/from India. In the same year, Lufthansa’s 6th Freedom traffic was 87 per cent, British Airways 61 per cent and Air France 73 per cent (the overall proportion for European carriers was 74 per cent). More than half the traffic to and from South-East Asia carried by foreign airlines was 6th Freedom traffic, especially in the case of Cathay Pacific.

The fourth dimension of the longstanding and systematic neglect of Indian public sector airline companies has been the manner in which the interests of the two companies were blatantly surrendered to please private players. A former Chennai-based pilot employed with Indian Airlines, who used to fly regularly on the Chennai-Kuala Lumpur route, told this writer that Jet Airways, now defunct, was allowed to take off a few minutes before Indian Airlines on both legs of the journey. “This is unthinkable anywhere in the world, but this is what happened on many, many routes.”

It is also very well known that private airlines occupied the prime slots for ticketing counters, lounges and other facilities that enhanced passenger comfort inside Indian airports, often at the cost of the two national carriers. Indeed, although India’s bilateral Air Service Agreements with other countries had the provision for two national carriers, the slots were vacated and handed over to private carriers, such as Jet and Kingfisher, flying international routes.

The twin burden imposed by the indiscriminate purchase of aircraft and the shotgun marriage forced on Air India and Indian Airlines, without considering their different aircraft requirements, resulted in a massive build-up of Air India’s debt between 2011 and 2020. The overall losses of the airline surged to almost Rs. 65,000 crore. Incidentally, the crushing burden of the debt meant that the cumulative interest payments over this 10-year period amounted to almost Rs. 35,000 crore; depreciation accounted for an additional Rs. 21,000 crore.

Strikingly, over the same period, the cumulative operational losses — that is, losses arising from the operations of the airline — were a mere Rs. 917 crore. This meant that less than 1.5% of the overall losses came from operations; instead, 87% of the cumulative losses arose from the crushing financial burden imposed on the airline by the twin sins committed by its custodian, the Ministry of Civil Aviation. In fact, as recently as 2019-20, after the decision to sell it was made by the Modi government, although Air India made an operating profit of Rs. 1,787 crore, its overall balance sheet reflected a loss of Rs. 7,427 crore because of the heavy burden of interest payments (Rs. 4,419 crore) and deprecation (Rs. 4,795.30 crore).

Privatisation facilitates an Oligopoly

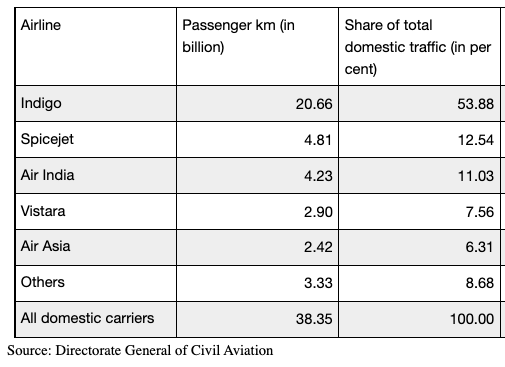

The combined revenues of the three airlines — Air India, Vistara and Air Asia — amounted to Rs. 40,500 crore in 2020, out of the total revenues of the entire industry amounting to Rs. 95,700 crore. This implies that the combined share of these three companies was 42.32%. Indigo, which has a much bigger market share in the domestic traffic market, earned revenues amounting to Rs. 35,800 crore, implying a market share of 37.41%. Indigo’s lower market share of revenues is explained by the fact that it is a low-cost carrier, unlike Air India and Vistara, which generally charge higher ticket prices because of their full service operations. The combined market shares in terms of revenues of the top two entities would thus almost be four-fifths of the Indian market. By any account, this would mean that privatisation of Air India has resulted in one of the most concentrated markets in India. In terms of domestic passenger market shares, Indigo and the Tata-controlled airlines would now have a market share of almost 80% (see chart).

Domestic Air traffic shares of select Indian carriers (Jan-July 2021)

The question whether Rs. 18,000 crore is a fair price, is a tricky one. The price of an enterprise, especially when it is on the block, is a hazardous guess for several reasons, primarily because the value of an enterprise in a market economy hinges crucially on what its earning potential is over the long run. But one thing is clear: the fact that the acquisition gives the Tatas a higher market share obviously means that it gives the group enough leverage to engage in cartel-like behaviour, especially in the domestic market. In fact, if the Tatas and Indigo arrive at some understanding on pricing, there is very little that other players can do.

Of course, the dynamics of the international travel market are different, and the Tatas may not be big enough to control them, but even here their access to Air India’s existing clientele and infrastructure, such as slots in overseas airports, will give it enough clout. Along with Vistara and its Air Asia operations, the use of services of the profitable low-cost carrier Air India Express’ give the Tatas enough reach across multiple market segments, ranging from low-cost to full-service operations.

The timing of Air India’s sale could not have been more wrong. Who sells an airline company in the middle of the biggest global slump ever in the history of aviation? The decision can only be termed reckless. The facts speak for themselves: there was no response to the initial decision in 2017 to sell the airline. The process was re-started in January 2020, just as the pandemic snuffed out all activity across the world. In October 2020, the terms were revised to make them significantly sweeter, especially what quantum of the debt would be assumed by the bidder. Although the Ministry of Finance has claimed that the “transaction saw keen competition”, the facts do not reflect this. There were only seven responses, of which five were disqualified because they did not meet the specified criteria. Of the two remaining bids, one was by a consortium led by Ajay Singh, Chairman and Managing Director of SpiceJet, which incidentally, not long ago, was on the throes of a meltdown; his bid valued the enterprise at Rs. 15,100 crore. Incidentally, the minimum price set by the government was Rs. 12,906 crore.

It is obvious that Air India has been sold for a song. This is not merely because its sale offers the new owner greater avenues for profitability, but also because of the assets it owns. Air India currently owns 141 aircraft, of which 118 are in airworthy condition. Moreover, a significant proportion of its airbuses, as well as Boeing 737s flown by Air India Express, are relatively new. The Tatas, therefore, are acquiring an airline, its fleet, its well-trained workforce as well as 4,400 domestic and 1,800 international slots at Indian airports as well as 900 overseas. Clearly, this is a sweetheart deal for India’s oldest large conglomerate.

The writer is former Associate Editor, Frontline, and has worked for The Hindu Group for over three decades. The views are personal.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.