Revealed by RTI: PM Jeevan Jyoti Bima Yojana Not Working Even in COVID Crisis

During the COVID-19 pandemic crisis, we have lost more than 3.5 lakh people across the country, out of which a large number of deceased were sole breadwinners. As a result, many families are facing a deep financial crisis.

Since the COVID-19 crisis began, followed by the sudden countrywide lockdown taking away livelihoods, many people have lost their earning members to the infection and have been demanding compensation. Along with this, the families of the deceased who had opted for the government’s insurance policy – Pradhan Mantri Jeevan Jyoti Beema Yojana or PMJJBY – are getting claims that are negligible, with most of them still running from pillar to post.

Responding to an RTI (right to information) query by NewsClick, the Insurance Regulatory and Development Authority of India (IRDAI) has said that till March 30, 2021, only 1,163 persons had received claims on death related to coronavirus, under which Rs 23.26 crore had been paid.

This number is miniscule compared with the number of deceased persons covered under the policy.

As per the RTI response by IRDAI, till March 31, 2021, the total number of persons covered under PMJJBY was 4.94 crore. At the same time, the Department of Financial Services, under the Ministry of Finance, says that over 10 crore persons are covered under the ambit of the insurance scheme.

The wide difference between the figures of IRDAI and the Ministry of Finance is because the Central government has not removed the names of those who have not renewed the insurance policy from the total number of nominations to gain accolades. Hence, hence Finance Ministry’s figures appear to be much higher than the actual numbers, as given by IRDAI.

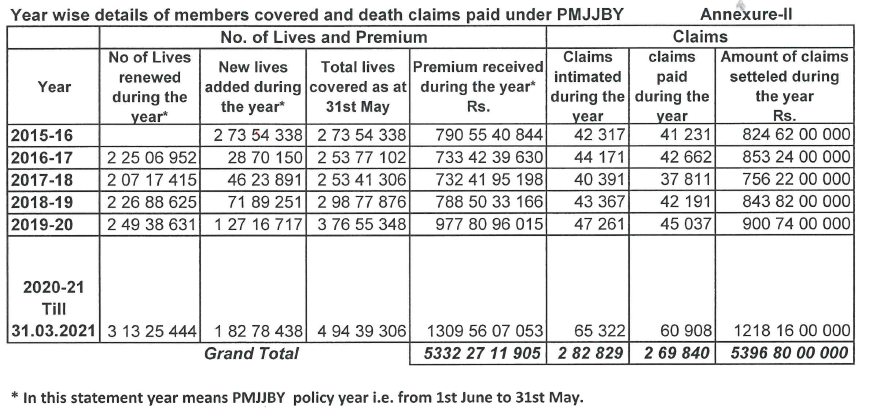

In the data obtained through the RTI (see table below, we can see that 2015-16, when PMJJBY was launched, a total of 2.73 crore persons had taken the insurance policy. But, out of these 2.25 crore persons renewed the policy in 2016-17, while 48.5 lakh persons did not get it renewed.

However, in 2016-17, a total of 28.7 lakh new insurance policies were bought, due to which the total number of enrolled people in the year has come down to 2.53 crore, as compared to the previous year. Due to this process, the total enrollment in 2017-18 also remained at 2.53 crore. The total number of enrollment increased to 2.98 crore in 2018-19, 3.76 crore in 2019-20 and 4.94 crore in 2020-21, as per IRDAI.

In any case, a total of about 5 crore people enrolled in PMJJBY in 2020-21 is a miniscule proportion of the current population of India at close to 1.4 billion.

This shows that the so-called 'development' being claimed in the past seven years, aimed at creating a universal social security system for the common people of the country, especially the poor and the underprivileged, has failed to be effective.

The table shows that since the beginning of the scheme till now, in 2020-21, the maximum number of persons, at 1.83 crore, decided to join PMJJBY due to the raging pandemic, for which the highest ever amount of Rs 1,309 crore has been paid as premium.

The fact that such a large number of people joined the scheme in 2020-21 shows the crying need of the people for protection against future risks.

It may be noted that the maximum number of 65,322 people applied for insurance claims in 2020-21 alone, during which Rs 1,218 crore was disbursed to 60,908 persons as claims.

While COVID-19 could possibly be the main reason for the increase in claims cases this year, but the RTI reply says that out of the total claims, only 1,163 were for deaths due to corona, for which claims worth Rs 23.26 crore had been received.

Also, it may be noted that since the beginning of PMJJBY till March 31, 2021, a total of 2.83 lakh people had applied for insurance claims, out of which 2.70 lakh have been disbursed Rs 5,396 crore, and 13,000 persons who have applied are yet to receive the claim amount. Out of these, 4,414 persons applied for claims during the pandemic period in 2020-21.

What is PMJJBY?

PMJJBY was launched by Prime Minister Narendra Modi on May 9, 2015. It is a term insurance plan, the benefit of which accrues to the nominee after the death of the insured.

It is a one-year life insurance plan, and can be renewed every year. Under this insurance scheme, a cover of Rs 2 lakh is available. The minimum eligibility for PMJJBY is 18 years and maximum is 50 years. The annual premium for this insurance plan is Rs 330, which is deducted directly from the bank account.

The scheme was started with the objective of creating a universal social security net for the common man, especially the poor and the underprivileged. But, the scope of this insurance scheme is reaching the common man at a very slow pace, as revealed by the RTI reply.

As per an RTI response by the Department of Financial Services, the enrollment in the country as on March 331, 2021 was 10.27 crore, which is only about 8% of the current estimated population of the country. The limited reach of the scheme goes to show that the Central government’s promise of creating a universal social security net for the poor remains more of a ‘jumla’ (hollow statement).

To top it, the data is being presented in such a way that it seems that a large number of people are covered under this insurance scheme, while the reality is quite the opposite.

Also, the Central government should give details of the total beneficiaries as well as those who have not renewed the policy, instead of manipulating the total enrollment figures. The effort should be to get more and more people to renew their policies and ensure that new people join, so that a large part of the population can draw benefits of the scheme.

Different Figures by Finance Ministry and Minister Sitharaman

On June 5, Finance Minister Nirmala Sitharaman, at a meeting with officials of various insurance companies, asked them to expedite the claim process under PMJJBY and also said that a total of 4.65 lakh claims had been disbursed since the scheme’s inception. She said a total of Rs 9,307 crore had been paid. On the contrary, according to the weekly data given on the official portal of PMJJBY -https://jansuraksha.gov.in/Performance.aspx - a total of 2.60 lakh people applied for claims till May 26, 2021, out of which 2.44 lakh people have been given the amount.

Sitharaman also stated that during the pandemic period, from April 1, 2020 to June 05, 2021, a total of 1.2 lakh claims worth Rs 2,403 crore were settled, while IRDAI’s response shows till March 31, 2021, 60,908 claims worth Rs 1,218.16 crore were settled.

According to a Press Information Bureau release: “The Finance Minister further observed that under PMJJBY, a total of 4.65 lakh claims have been paid of value Rs. 9,307 crore and since the beginning of the pandemic i.e., 1st April 2020 onwards till date, 1.2 lakh claims have been paid amounting to Rs. 2,403 crore, at a disposal rate of 99%.”

Apart from this, the IRDAI response says that from 2015-16 to March 31, 2021, a total of 2.82 lakh people applied, of which 2.69 people received the claims.

While the claim figures of the Department of Financial Services (DFS) are different from IRDAI, the weekly performance report of the scheme on IRDAI’s portal and the DFS does not show much of a difference in the claim figures, which could be the time lag in getting the figures from banks. But, the figures cited by Sitharaman are twice the actual figures. So, is there some data juggling going on? Only the Finance Minister or Finance Ministry can tell.

The number of claims of corona is very low

The fact that out of the enrollment of about 5 crore persons in PMJJBY, only 1,163 people applied for claims for deaths due to COVID-19, shows that the total number of such claims is much lower than the total number of corona-related deaths this year. However, it is possible that several claims may also be related to corona but because the documents submitted and even death certificates have not recorded COVID-19 as the cause of death, these have not been categorised that way.

Rajasthan-based social worker, Dapinder Singh, who is helping people in getting insurance claims under this scheme, says the publicity during the launch of the scheme is missing during the pandemic, when it is most needed. Had this been done, more people could have got benefits.

Singh says a large number of nominees and family members of the deceased who had taken the PMJJBY policy are not aware of it as also whether the premium was paid or not.

Nesar Ahmed, economist and director of Centre for Budget Studies and Research, says no policy document or any other document is given under PMJJBY, which is why families do not even know that there is such a policy under which they can claim insurance, which is one reason why they are deprived of the scheme’s benefits.

There is not much awareness about the fact that nominees of the deceased can find out by looking at his/her bank statement of the whole year. The main implementing agency of PMJJBY is a bank because the premium money is deducted from the account by the bank. But, banks have their own priorities and there is no monitoring system specifically for PMJJBY. Therefore, it is necessary the Central government should set in motion a monitoring system that is simple to navigate by the family of the deceased.

Claim Settlements Proving to be Difficult

PMJJBY's claim procedure states that it would be better if it is applied for within 30 days of the death of the policy holder. Singh says citing this rule, some banks are not accepting claim applications. He says, along with two colleagues Ravindra Sharma and Sanjeev Vikal, has also written to the President and the Prime Minister in this regard, but there is no response yet.

He says they also contacted DFS on this issue and got a reply that the word "preferably" is attached to the rule. The departmental officials also said that banks cannot stop accepting applications if claims are made after 30 days.

Sanjeev Vikal, a Chandigarh-based legal social worker, says the ground reality is that banks are refusing to give claims on the basis of this rule itself. The Central government should clearly write in its manual that there is no deadline for application within 30 days and the applicant should claim as soon as possible, he adds.

Describing the process, Vikal says it is not easy for a village to get work done easily. How can we expect them to get death proof, discharge slip from hospital, premium statement from bank within 30 days? He adds. These things take a long time in the hinterland.

Apart from this, there are a large number of accounts in which the nominee is not linked. In such a situation, the family has to go through a lengthy legal process separately, which takes ages. Therefore, it is necessary to simplify the claim process and increase the claim amount so that the nominee and the family can get some immediate help out of the deep financial crisis, he says.

Vikal also feels that the insurance amount of Rs 2 lakh is very low for the family of a deceased sole bread-winner. He says the family of a person who has died should get at least four times his annual income or minimum salary as a claim.

Advocate Gaurav Bansal, who has filed a petition in the Supreme Court for the deaths due to corona, says that if the death occurs under a ‘notified disaster’, then according to the law passed in Parliament, the ex-gratia amount was Rs 4 lakh before June 14 2020. This policy has been changed by the Central government and now no ex-gratia amount is to be made available.

During the pandemic, especially in the second wave, a large section of the poor and deprived, which includes a large number of workers in the unorganised sector, died. They should have got ex-gratia. But the change in the Centre’s policy is depriving them of this help, Bansal says.

During a hearing in the Supreme Court regarding compensation for deaths due to COVID-19, the apex court questioned the government why there was no mention of COVID on several death certificates. In such a situation, how will you identify which family gets compensation? On many such questions, the Central government has been asked to present its side. The matter was heard on June 11, in which the government sought time from the court for its reply. The next hearing is on June 21.

(Translated and edited from the original Hindi

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.