Under Modi, Tax Burden has Shifted from Corporates to People

Representational Image. Image Courtesy: IndiaToday

It was once famously said that the executive (government) is nothing but a committee to manage the affairs of the ruling class in any society. The Narendra Modi-led Bharatiya Janata Party government is a fine example of this truth. The open and brazen way in which it has worked to the advantage of India’s powerful corporate sector has few parallels in the world.

Take the example of taxation, which is the sovereign right only of governments. In the name of spurring ‘growth’ and ‘employment’ the Modi government has decisively reduced taxes levied on big business while increasing the burden on common people through direct and indirect taxation. It has also reduced customs duties (tax on imports) to encourage entry of foreign products into the country, thus damaging domestic industry, especially the medium and small-scale sectors.

Corporate Tax Cuts

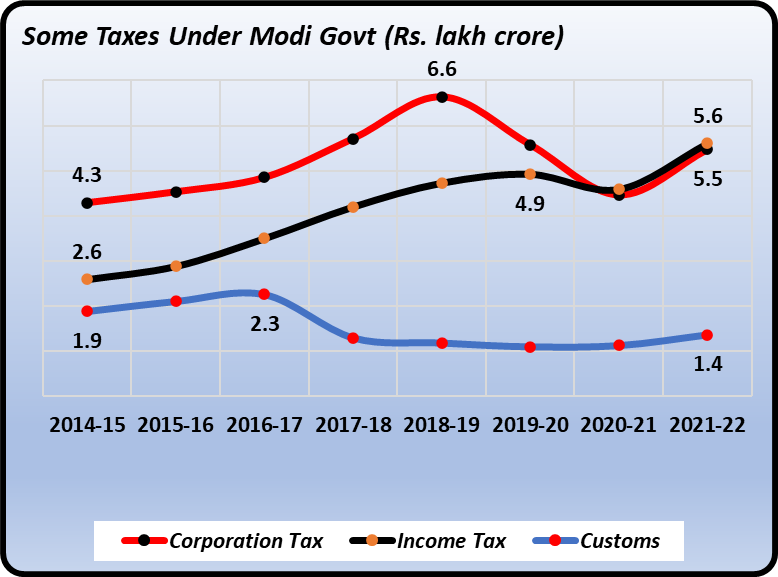

As the chart below shows, income tax collections increased from Rs.2.6 lakh crore in 2014-2015 when Modi came to power, to Rs.5.6 lakh crore – a rise of 117%. In the same period, corporation tax levied on corporates increased only by 28%, from Rs.4.3 lakh crore to Rs.5.5 lakh crore.

In the same period, gross tax revenue increased by 78%, clearly bringing out the high degree of skew in corporate tax and income tax growth rates.

The chart above also shows the fate of customs duty collections. These have suffered an absolute decline of about 28%, from Rs.1.9 lakh crore in 2014-15 to Rs.1.4 lakh crore in 2021-22. In fact, the decline is more precipitous than this. By 2016-17, customs revenue had increased to Rs.2.3 lakh crore but then it slid down to its present level, which marks a nearly 40% decline.

All this data is from the Union Budget documents of various years, available at the finance ministry’s site dedicated to Budgets. Figures for 2021-22 are Budget Estimates, those for 2020-21 are Revised Estimates and all others are actuals.

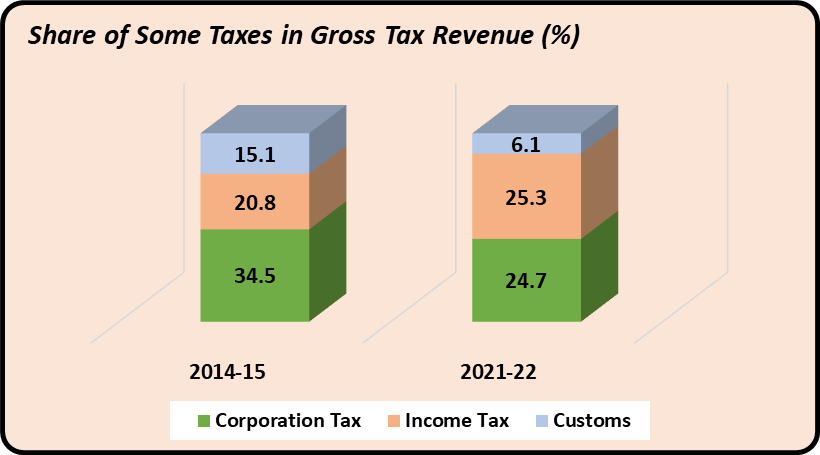

All this can be viewed in another way, as shown in the chart below:

The share of corporate tax in gross tax revenue has shrunk from 34.5% in 2014-15 to 24.7% in 2021-22. Customs revenue has shrunk even more drastically, from 15% to just 6%, over the same period. But income tax revenue has increased from 20.8% to 25.3%.

Bonanza for Corporates

As can be observed in the first chart, the decline in corporate tax collections started from 2019 when the finance minister announced an unprecedented cut in corporate tax rates from the prevailing basic rate of 30% to 22%. Various other incentives were also announced.

Ironically, the government sought to portray this as some kind of employment boosting step. Their bizarre reasoning was that tax concessions would lead to increased investment by corporates and that, in turn, would lead to more jobs. As developments have shown, nothing of the sort has happened. There was no job growth in 2019, and then, in 2020, the pandemic hit India, which was met by an ill-conceived lockdown that lasted in various forms for several months, destroying the economy further.

Strangely, the corporate sector has emerged all the better from the devastation of the pandemic and lockdowns! As discussed earlier in NewsClick, profits of listed companies soared to record highs by the end of 2020, undoubtedly helped by not just the massive cuts in corporate tax rates but also by the free hand given to industry to retrench or dismiss workers to save labour costs during the pandemic.

Besides the tax cuts, the corporate sector has also benefitted from a slew of other executive measures, which include concessions and rebates of various types that add up to over Rs.6 lakh crore for just the recent few years (data available in the Budget papers), loan write-offs from banks, gobbling up of smaller industry by larger ones through the operation of the Insolvency and Bankruptcy Code (IBC) at basement prices, relaxation in company law to ease penalties for various defaults, etc.

In addition, the Modi government has also shown extreme alacrity in the sale of public sector units (for much reduced costs) again to the same corporate sector. The recent sale of Air India to the Tata group is a case in point where all the debt (Rs.46,000 crore) is left behind for the government to settle, while the Tatas walk off by paying just Rs.27,500 crore for the airline.

Burden on Working People

The Modi government is financing this largesse by transferring resources from the poor to itself, either by spending cuts or through various types of taxation. Spending cuts can be seen in almost all the ministries, but especially in those that manage programmes for spending money on welfare of the people.

In order to save money, crucial spending needed for, say, foodgrain distribution or cooking gas subsidy has been curtailed. Government warehouses are full of record grain stocks yet the government is unwilling to distribute it beyond its legal commitment – just to save money.

The case of ever increasing petro product prices is a clear example of obstinate indirect taxation. As pointed out in NewsClick earlier, the Modi government has raised excise duties on petrol, diesel and cooking gas so much that its revenue from this has sky-rocketed from about Rs.99,000 crore in 2014-15 to Rs.3.73 lakh crore in 2020-21 – an increase of nearly 277% in seven years! As a result, petrol prices have increased by 79% while diesel prices have jumped up by as much as 101% in the same period. Cooking gas prices have risen by over Rs.300 in just the past one year, even as the subsidy given by the government was stopped in 2019.

Besides the injustice of this economic policy of giving concessions to the rich and squeezing the not so rich, it is also short sighted and self-defeating. No number of concessions to the rich will boost the economy because what is needed is buying power in the hands of the people, not in the hands of the rich. This can be done only by increasing government spending, and raising taxes on the rich. But the Modi government continues blindly in the opposite direction – causing immense and continued suffering to the people of India.

Get the latest reports & analysis with people's perspective on Protests, movements & deep analytical videos, discussions of the current affairs in your Telegram app. Subscribe to NewsClick's Telegram channel & get Real-Time updates on stories, as they get published on our website.